- Banks should employ tried and tested robust control/electrical systems

- Banks should administer IT and Cyber training

- “Fraud Triangle Theory: Perceived Pressure, Perceived Opportunity and Rationalization” underlines fraudulent employee behaviour.

- Banks should look out for sudden changes in employee’s lifestyle

- Fraud investigation should be swift and perpetrators should be banned for life

- Amendment of criminal code to accommodate emerging activities like cyber-crimes.

- Outsourced cash mobilization agencies should remunerate their staff properly

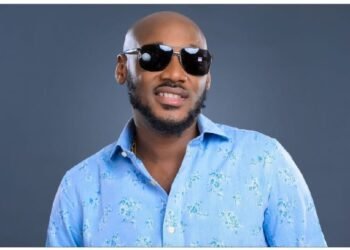

Banking Consultant, Dr Richmond Atuahene is advocating for perpetrators of banking fraud schemes in the banking sector to be ”banned for life” amid a warning that, the banking sector should expect an increase in online fraud especially as lots of transactions by staff and customers have been moved online due to the Covid-19 pandemic.

He said, “It’s going up because the more you open up to IT, the more you make yourself vulnerable. People were working from home recently and I can assure you next year, we are going to see online fraud upped.”

Dr Atuahene encouraged banks to “employ robust control or electronic systems like the Device Recognition Software and Geo-location Software system” which will guarantee additional security from online fraudulent activities.

“If you don’t have robust control systems or electronic systems, people can intercept your data and use your data to penetrate into your systems.”

He further explained the role systems like the Device Recognition Software and Geo-location Software system could play in ensuring safety of online transactions;

“The Device Recognition System seeks to recognize the device being used to conduct an online transaction to ensure it is the customer’s device before permitting transactions whiles Geo-location allows the bank to know where a customer’s device is physically, allowing them to create a restricted access areas. Therefore banking operations can only be performed if the mobile device is within an area known and approved by the user, and would be cancelled if they are made from a suspicious area.“

He therefore admonished banks to make sure their “up and robust systems” are also “tried and tested” to ensure “outsiders have no chance of colluding with some of the staff to dupe the system.”

Dr Atuahene iterated that, “Banks have not trained themselves as far as IT and cyber activities are concerned. Once risk management, fraud management and internal control systems are not up to the standard, then you can see that the staff will begin to commit this fraud.”

Cash mobilization has continually been part of the primary and important components of banking. Dr Atuahene disclosed that banks have “hived off cash mobilization to third party institutions” who might not have “quality staff”, a factor in the suppression of cash and deposits which accounted for the largest portion of the total number of fraud cases reported to the Bank of Ghana.

“Once upon a time, we had cashiers employed by the banks and somewhere along the line we decide to diverse to make ourselves efficient so we called the third party to do the job. But the third party is not up to, because you won’t get quality staff and if you even get quality staff, they won’t be trained. So, the banks are supposed to ensure the services they are providing internally, which they have hived-off, are of the highest standard as the bank was doing. They should do it before they pay them.

“They provide mediocrity standards by employing people who are not up to; these are people who will commit fraud.”

Dr Richmond Atuahene also called on third party cash mobilization institutions to pay their employees fairly to prevent employee fraud, using the “Fraud Triangle Theory: Perceived Pressure, Perceived Opportunity and Rationalization” to reinforce his point.

He cautioned banks to ensure continuous due diligence by “keeping an eye” on staff “until they retire” and watch out for sudden changes in the lifestyle of their employees “which does not reflect their standing.”

“It must be a continuous system which must be done by internal audit and fraud management department. We need to have people who will be quietly, subtly monitoring one another. Everyone becomes each other’s brother’s keeper. Everybody including the CEO should be checked and the internal control system should keep an eye on everyone including the MD.

“Someone should keep an eye on the MD. The banking crises was caused by people at the top, not the down.

“When the people at the top are rot …when the people at the top are making bad loans, people think that, what can we do? …if we also stay down, let us do certain things and make ourselves happy. Because the up is bad, the down will be bad.”

Dr Richmond Atuahene advocated for investigations into employee fraud in the banking sectors to be “swift and punishment should come early as prosecution takes such a long time.”

“How many people were prosecuted as numbers are reported to have been increased?” He quizzed.

He suggested that “anybody found culpable as part of a fraud scheme in the banking sector should be banned from working in any financial institution for life. “

Dr. Atuahene also recommended the amendment of the criminal code 1960, to accommodate “emerging fraudulent activities like cyber –crimes” as there was no internet when the law was passedthereby entreating financial institutions to advocate for new financial laws to keep them abreast with times.