FirstRand Ltd. plans to replicate its South African business, where it is a leader in car and home finance, in Ghana following the takeover of the West African nation’s biggest mortgage provider.

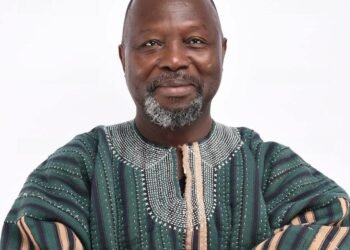

First National Bank Ghana Ltd. will also expand GHL Bank Ltd.’s offerings to include insurance, personal loans and investment products, said Dominic Adu, the chief executive officer of the combined entity. Until the deal in May, FirstRand was mainly focused on corporate and investment banking after getting a license to operate in Ghana in 2014.

“We’re a growing bank — we’re mobilizing a lot of deposits,” he said in an interview in Ghana’s capital, Accra. “Therefore, as our cost of funding comes down, we will have to pass that on to borrowers. I see a trend toward lower interest rates. Once that’s addressed people will then have the confidence to borrow.”

FirstRand, Africa’s biggest bank by market value, builds its strategy around offering its customers as many services as possible, from within the group, to boost revenue and protect profit margins.

To be updated ……