MTN Mobile Money Ltd (MoMo) has marked a significant milestone, celebrating 15 years of revolutionizing Ghana’s financial landscape with a grand awards ceremony honoring its esteemed partners.

The event, a culmination of the anniversary activities, brought together stakeholders from across the country to commemorate a shared vision that began with the launch of the innovative mobile money service. From its humble beginnings with the catchy phrase “minsaka oo,” MTN MoMo has evolved into a financial powerhouse, championing financial inclusion and redefining the way Ghanaians transact.

The evening was dedicated to recognizing the immense contributions of partners who have played a pivotal role in building the MoMo brand and driving the vision of a cashless society forward.

Reflections on 15 Years of Progress

Mr. Haruna Shaibu, CEO of Mobile Money Limited, reflected on the transformative 15-year journey of mobile money in Ghana, highlighting the presence of key stakeholders such as representatives from the Bank of Ghana, the FinTech and Innovation Office, the Ghana Revenue Authority, and other state institutions.

He expressed gratitude on behalf of the board and management of Mobile Money Limited and MTN Ghana, acknowledging the pivotal role of regulators, especially the Bank of Ghana, whose progressive policies enabled the exponential growth of financial and digital inclusion. Mr. Shaibu also praised the millions of Ghanaians who use the service daily, underscoring their importance to the success of the platform.

In celebrating the achievements, Mr. Shaibu recognized the invaluable contributions of Mobile Money’s partners, from the initial nine partner banks to the current collaboration with almost all banks in Ghana. He commended the vibrant FinTech community for driving innovation and the agents and merchants for their resilience and support, even during challenging times.

Special appreciation was extended to the staff, whose dedication and passion have been instrumental in building the MoMo brand. He also honored the pioneering team, particularly Mr. Bruno Akapa, the first General Manager, who championed the idea of mobile money despite its abstract concept at inception, paving the way for what has now become a cornerstone of Ghana’s financial ecosystem.

“Let me share a very small story about our mobile money journey in MTN. As you know, 15 years ago, we embarked on a journey. We were unsure about the destination. However, we had envisioned a future where every Ghanaian across the length and breadth of our country could access financial services with ease and convenience through the power of the mobile phone. This was at a time where mobile penetration was still brewing with limited penetration of smartphones.

“Ladies and gentlemen, after much deliberation with technology expert then and of course, industry regulators and very critical stakeholders of our business, we launched mobile money service in 2009. We took a lot of inspiration from the experiences in other deployments in East Africa, specifically in Safaricom. But before then, we had to test the system and as captured in our records, the very first successful mobile money transaction was done by a staff of MTN then on the 25th of September, 2008, at 3:51pm. This was the very first mobile money transaction. We, of course, officially launched the service on July 21 2009 by the governor of Bank of Ghana at the time, Dr Paul Akon.”

Mr. Haruna Shaibu

Mr. Haruna Shaibu highlighted the introduction of a pioneering multi-bank partnership model under the leadership of Bruno Akapa, the first General Manager of Mobile Money Ltd., unlike most African deployments that relied on single-bank collaborations.

Mr. Shaibu emphasized that building sustainable, long-term relationships remains central to the company’s strategy for business evolution and growth. “We hit the ground running with a catchy commercial, and it caught the attention of most Ghanaians with a phrase minsaka oo. And in the spirit of our partnership, we also have our lovely mother whose baby mobile money is 15 years old here today with us as well,” he said.

Challenges and Early Adoption

Mr. Haruna Shaibu acknowledged the challenging early years of Mobile Money’s introduction, describing it as a slow and difficult journey that required a shift from traditional methods of handling money. The service represented not just a technological breakthrough but a disruption of conventional financial practices, leading to initial customer unfamiliarity.

“To overcome this, we had to use different methods of engaging customers and convincing them to try and begin to use these services. What was to become a service for everyday use had to be nurtured gradually, and we want to also appreciate the leadership of MTN for supporting us through that journey. The first six years was about investment and about seeing the vision of inclusion and keeping that investment until it matures, the resilience of this business is incredible. Thank you very much. MTN, a story today is different.”

Mr. Haruna Shaibu

Mr. Haruna Shaibu credited the customers for their trust and loyalty, acknowledging them as central to the company’s success. As part of the anniversary celebration, Mobile Money Ltd engaged in various customer outreach activities, including market and neighborhood engagements, and organized promotions to reward customers. He also highlighted the importance of educating users about fraud prevention to enhance their experience in the growing ecosystem.

Looking ahead, Mr. Shaibu noted that the FinTech industry in Ghana is poised for substantial growth, supported by a solid infrastructure and progressive policies. He expressed optimism about the next phase of Mobile Money’s evolution, envisioning even stronger partnerships and a broader customer base. Despite the milestones achieved, he acknowledged that financial service penetration remains low in some critical areas, indicating significant opportunities for further expansion and impact in the sector.

“We continue to see significant opportunity, and some would choose to call it gaps in the area of digital payments, cross border payments, insurance, investment and wealth management and E commerce, these are opportunities that we can co create and develop into the future. The key to unlocking this piece is around how we collaborate and focus and skill. Our ambition for the next decade is to provide financial freedom for every Ghanaian and by empowering them to be able to do every service.

“My mission is to see a taxi driver with a smartphone being able to trade in shares and to do other advanced financial services in Ghana in the next five to 10 years, and I’m sure that our partners here would be able to collaborate with us to enable such innovation and make this service available to every single Ghanaian.”

Mr. Haruna Shaibu

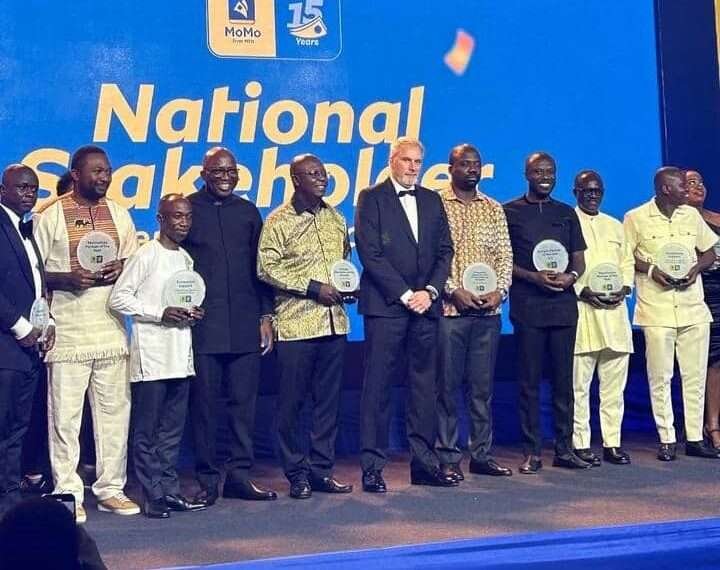

MTN MoMo Awards 2024

The first category of awards focused on FinTech companies that have made notable contributions to the MoMo ecosystem:

- FinTech Partner of the Year (B2B): The prestigious award was presented to Insano, a first-time recipient recognized for its outstanding business-to-business collaborations.

- Most Innovative FinTech Partner: The award was given to appsNmobile for their cutting-edge solutions that have significantly enhanced mobile money services.

- Government FinTech Partner of the Year: Hubtel received this accolade for its exceptional partnership with government entities, driving financial inclusion through digital payment solutions.

- Merchant FinTech Partner of the Year: The award went to BluPenguin, a key player in integrating seamless payment solutions for merchants across the country.

- Overall Best FinTech Company: The top award in the FinTech category was clinched by Hubtel, reaffirming its dominance and commitment to the mobile money industry in Ghana.

Product Awards: Recognizing Innovative Solutions

In the Product Awards category, the focus was on acknowledging pioneering products that have transformed the digital financial landscape:

- Bank Partner of the Year (Lending Sub-Category): The award was presented to Letshego Savings and Loans for their significant role in providing accessible lending solutions.

- FinTech Partner of the Year: Jumo was recognized for its outstanding implementation of MTN’s Quick Loan product, a service that has revolutionized access to credit for millions of Ghanaians.

- Remittance Partner of the Year: IT Consortium received the award for its impactful role in facilitating seamless remittance services.

- Most Innovative Product of the Year: This honor went to Agent Flex by Tyra and FAB, a product praised for its creativity and impact on mobile money agents.

Special Recognition Awards

The ceremony included special recognition awards to honor individuals who have made significant contributions to the mobile money industry:

- Original MoMo Icon: Madam Rita Tetteh, celebrated as the first MoMo icon in Ghana, received a cash award of GHS 30,000 for her role in creating widespread awareness of mobile money services through the first MoMo commercial.

- FinTech Champion of the Decade: Mr. Archie Hesse, CEO of the Ghana Interbank Payment and Settlement Systems (GhIPSS), was honored for his pivotal role in advancing mobile money operations in Ghana. In an emotional speech, Mr. Hesse reflected on the early challenges of integrating mobile money into the financial sector and expressed gratitude for his contribution to its success.

Best Performing Partners

The awards ceremony also recognized outstanding partners whose collaborations have propelled the growth of mobile money services:

- Government Partner of the Year: The Electricity Company of Ghana (ECG) was acknowledged for its effective use of mobile money in facilitating bill payments.

- Corporate Partner of the Year: Keith Ghana Limited was recognized for its strong corporate partnership.

- Technology Partner of the Year: The award went to Ericsson Technology for its exceptional support in enhancing the technology infrastructure of mobile money services.

- Overall Best Financial Service Provider: The highest honor in this category was awarded to First Atlantic Bank (FAB) for its exemplary financial services.

Industry Category Awards

The Industry Category Awards celebrated efforts in expanding and supporting the FinTech ecosystem:

- FinTech Ecosystem Expansion Award: Ghana International Payment and Settlement Systems (GhIPSS) was recognized for its role in expanding the FinTech landscape.

- FinTech Ecosystem Support Award: Both the Mobile Money Agents Association of Ghana (MOMAG) and the Money Agents Association of Ghana (MoMA) were jointly honored for their support in driving the mobile money agenda.

- Progressive Regulation and Financial Inclusion Award: The Bank of Ghana was celebrated for its leadership in implementing progressive regulations that have driven financial inclusion.

Agent and Merchant Awards

The final category focused on recognizing the efforts of mobile money agents and merchants who have excelled in their operations:

- Overall Best Mobile Agent of 2024: The award went to Ike Bediako, who also received a motorbike as part of his prize.

- Overall Best Merchant: China Mall was awarded for its outstanding performance, receiving a plaque and a cash prize of GHS 15,000.

The MTN MoMo Awards 2024 was not just a celebration of achievements but also a reflection on the journey of mobile money in Ghana. Over the past 15 years, mobile money has transformed from a novel concept into a vital part of everyday life, driving financial inclusion and economic empowerment. The event highlighted the collaborative spirit that has propelled the industry forward and set the stage for even greater innovation in the future. As the mobile money ecosystem continues to evolve, the collective efforts of FinTech companies, financial institutions, technology partners, and regulatory bodies promise to shape a brighter, more inclusive financial landscape for all.

READ ALSO: Fitch Predicts Slower Growth for Ghana in 2025 Amid Post-Election Austerity Measures