The central Bank of Ghana (BoG) has indicated its commitment to preserving the safety and integrity of the payment and financial ecosystem amidst the economic turbulence in Ghana.

According to Kwame Oppong, Head of Fintech and Innovation at BoG, the Bank has put in place a number measures to safeguard the burgeoning payments space against possible shocks, so as to consolidate the gains made so far. The bank is constantly exploring innovations to maintain soundness of the financial sector, particularly in technology-driven financial solutions, he added.

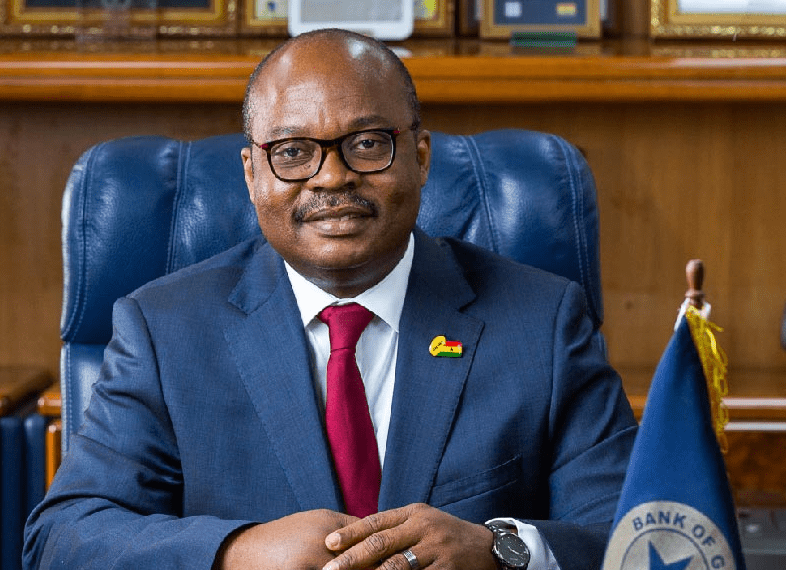

“Good governance arrangement has been a priority for the bank as it sets the tone, culture and manner in which we expect regulated payment service providers to operate. The BoG will continue to evolve its regulatory environment to preserve the safety, soundness and integrity of the payment and financial ecosystem.”

Kwame Oppong

This, Mr. Oppong iterated in a speech delivered on his behalf at the just-ended Mobile Technology for Development Conference (MT4D2023) in Accra.

Mr. Oppong stated that the BoG remains resolute in ensuring a sound and robust payments market through the introduction of the regulatory sandbox in 2019, as well as the establishment of the FinTech and Innovation Office (FIO) in 2019. The FIO provides a platform for collaboration between the central bank, FinTech companies, and other stakeholders in the ecosystem.

The Fintech and Innovation Head of the central bank again noted the introduction of the Payment Systems and Services Act, 2019 (Act 987) to provide a legal framework for the regulation and oversight of payment systems and services in Ghana. This Act aims at promoting innovation, competition, and consumer protection in the payment services industry.

Attending the conference were experts from the digital finance, agritech, digitised payments and academia spaces, who together explored the challenges and solutions as well as the impact of digital finance in the financial sector since its introduction.

Scaling up merchant acceptance with the introduction of innovative financial technological solutions

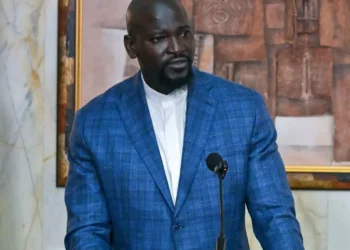

Clarissa Kudowor, the central bank Deputy Director of Payment Systems Department, on her part, called for innovative financial technological solutions to help scale-up merchant acceptance.

Despite the successes within the domestic fintech industry which boasts of about 43 registered companies, she said there is still more work to be done to maximize the gains of digital financial inclusion. While speaking on the topic: ‘Driving Digital and Financial Inclusion In Our Financial Ecosystem’, Madam Kudowor noted that:

“Digital technology is enhancing easy access to credit in novel ways. But, there is the need to further scale-up merchant acceptance through digital payments; this calls for innovative fintech solutions sensitive to the peculiar needs of diverse businesses.”

Clarissa Kudowor

Meanwhile, per the Digital 2023 Global Overview Report, Ghana’s internet penetration rate stood at 53 percent of the total population, beginning last year, 2022. The remaining percentage remained offline at the beginning of this year, 2023.

Stakeholders in the digital spaced urged to collaborate to provide cheaper services

Against this backdrop, Ama Pomaa Boateng, Deputy Minister for Communications and Digitalization, encouraged all the key stakeholders within the industry to collaborate in ensuring that cheaper technological devices and internet services are provided for the informal sector.

“Our drive towards universal access to technology and digital inclusion is meaningless if we do not look at access and usage, especially, for the majority of our people who are unable to afford it. In doing this, we must look at pricing to make sure it is affordable.

“Even though we are doing remarkably well by making data affordable, I still think there is some work to be done that will require a multi-stakeholder approach to drive our prices down.”

Ama Boateng

READ ALSO: Appiatse Support Fund Bags GHC62 Million As Goil Donates GHC200,000