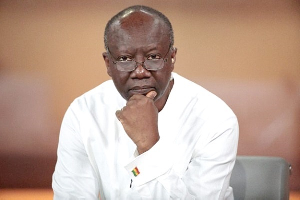

Dr. Ernest Addison, Governor of the Central Bank, during the 115th Monetary Policy Meeting on Monday, November 2023 disclosed that Ghana’s banking sector maintains a steadfast stance, characterized by stability, soundness, liquidity, and profitability.

In a testament to its robustness, Dr Addison noted that the total assets value of Ghana’s banking industry registered a commendable annual growth of 3.2%, reaching GHS 257.9 billion by the end of October 2023.

Deposits within the banking sector surged to GHS 199.9 billion, marking an impressive annual growth of 16.2%, underlining the sector’s attractiveness to depositors.

Despite an increase in the Non-Performing Loan (NPL) ratio to 18.3%, the banking sector maintains a robust position with a capital adequacy level of 13.4%, surpassing the BoG’s regulatory minimum.

According to the Governor, profitability in the sector continues to ascend as banks strategically invest in high-yielding short-dated instruments issued by the Bank of Ghana (BOG) and Government of Ghana (GOG) with the sector’s proactive measures contributing to its resilience in the face of economic challenges.

Credit to the private sector contracted during the review period. Banks continue to deploy their resources towards short-term investments as opposed to extension of credit, in response to the increased risks associated with lending following the deteriorating macroeconomic conditions and the impact of the Domestic Debt Exchange Programme (DDEP). Private sector credit contracted by 7.5 percent in October 2023, compared with a 57.3 percent growth recorded in October 2022.

Private Sector Contracts Significantly

In real terms, credit to the private sector contracted significantly by 31.6 percent relative to a growth of 3.0 percent recorded over the same comparative period. On the money market, interest rates broadly tightened at the short end of the yield curve. The 91-day and 182-day Treasury bill rates fell marginally to 29.40 percent and 31.37 percent respectively, in October 2023, from 31.53 percent and 32.61 percent respectively, in October 2022.

The rate on the 364-day instrument, however, increased to 33.16 percent from 32.32 percent over the same comparative period. The interbank weighted average rate, the rate at which banks lend among themselves, increased to align with the policy corridor. The weighted average rate increased to 28.49 percent in October 2023 from 23.98 percent in October 2022, in line with movements in the monetary policy rate and an increase in the Cash Reserve Ratio.

This led to an improvement in the policy transmission as the average lending rate of banks increased to 32.69 percent in October 2023, from 31.40 percent recorded in the corresponding period of 2022. The banking sector remained stable, sound, liquid and profitable, even as banks continue to adjust to the impact of the DDEP.

The sector’s capital adequacy levels remained above the minimum regulatory level with regulatory reliefs, with most banks carrying excess liquidity. The industry’s NPL ratio increased to 18.3 percent in October 2023, from 14.0 percent in October 2022 – and 15.7 percent in January 2023 – reflecting elevated credit risk associated with the lagged effects of the macroeconomic crisis of 2022.

Profitability continues to improve as banks continue to invest in high yielding short-dated BOG and GOG instruments. The banking sector showed some resilience as the various stress tests on banks’ capital, following adverse macroeconomic shocks, pointed to stability.