Controversies surrounding Italy’s oil major, Eni and Ghana’s Springfield’s proposed unitization do not look likely to settle anytime soon, as the former has proceeded to a Tribunal in London to annul the directives for the unitization.

With the current move by Eni, this rekindles fears for the high likelihood of a potential loss of investor confidence in Ghana’s upstream sector, which may further stall investment in the upstream sector.

This is at a time when the country is in a dire state to maximize profits or benefits from its oil reserves due to the transition towards renewable energies.

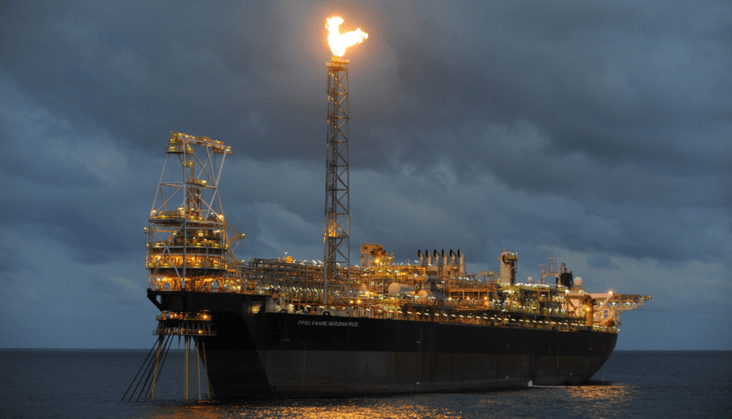

At worst, should this prolong to such an extent that will see ENI exit the operation of the Sankofa field, this would mean that Ghana’s only major player in the upstream sector will be Tullow Oil. And this is a situation, the government would not want to end up with.

Meanwhile, without the unitization coming through, an IES research estimates the country to lose approximately US$8 billion in revenues. But, time and again, Ghana has looked to maximize its benefits, a move which Eni believes it may not benefit from, thus the disinterest in the unitization.

Events preceding Eni’s current court action

Although this was expected, industry experts and some sections of the public have expressed worries over the trajectory of events, calling on the government to ensure that the issue is settled amicably— a possible out of court settlement— without ending up in international arbitration.

Prior to this development, a Commercial High Court sitting in Accra ruled in favour of Springfield’s application to freeze 30% of revenues received by Eni and Vitol from the sale of crude oil from the Sankofa field. The payment which was to be stashed in an escrow account, amounts to approximately US$40 million monthly.

Following this, Italy’s Eni went ahead to appeal the court order for the escrow account, which was subsequently dismissed. However, the government’s lustre-role as an arbiter seems to have run out, as Eni continues its demands asking for reliefs from a London Tribunal.

Eni’s court action against the government

Among the requests for relief sought by Eni include a declaration that the proposed directives by the then Minister of Energy, John Peter Amewu, and any other steps taken to implement those directives represent a breach of contract under the Petroleum Agreement (PA).

Eni is also seeking for a declaration that the respondents take no further action to implement the purported unitization of the Sankofa Field and Afina discovery on the terms of the proposed directive.

Furthermore, Eni requests from the court an order that the government pays damages in an amount to be quantified for the losses suffered by ENI arising out of the respondent’s breaches of the petroleum agreement, Ghanaian law and International law on a joint and several bases.

Also, ENI is seeking an order that the respondent pays all of the costs and expenses of the arbitration including the fees and expenses of the claimant counsel.

In addition, it requests for the payment of fees for any witnesses and/or experts in the arbitration, the fees and expenses of the Tribunal and other fees the tribunal may in its discretion consider appropriate.

READ ALSO: IMF urges Gov’t to leverage underutilized tax handles