The Vice President of IMANI Africa, Bright Simons has revealed that the new proposal by the finance minister in relation to the debt exchange program still falls short of creditors’ demands.

Mr. Simons expressed his concerns in a write-up about government’s refusal to engage a formal advisory committee representing the bulk of outstanding debt as part of negotiations in the implementation of the Domestic Debt Exchange Program indicated in the 2023 budget.

According to Mr. Simons, even though the new proposal issued by the Finance Ministry contained in the current Press Statement was laudable and worthy, the amended terms still fall short of the needed collaboration with creditors to guide the process.

“The new proposal, whilst showing capacity for flexibility, still falls short of the co-creation demands being made by creditors. It is not clear why the government prefers to engage with creditors without a coordinating mechanism such as a formal advisory committee representing the bulk of outstanding debt.

“Perhaps it fears that such a process might undermine its negotiation position by removing the ‘divide and conquer’ option. The danger with the attempt to preserve the fragmentation of the creditor community is the likelihood of inertia being traded for lack of organized resistance.”

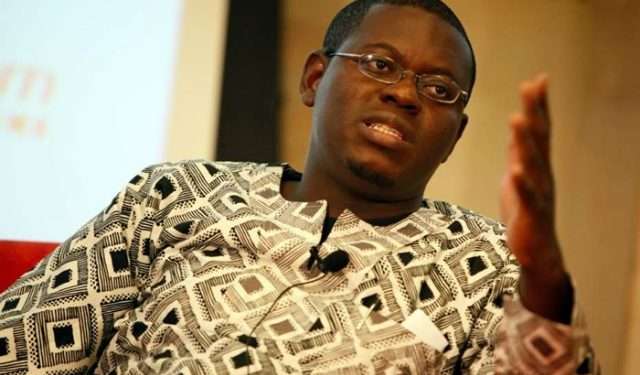

Bright Simons

Mr. Simons further disputed that, the Finance Ministry’s apparent efforts to harden its resolve and efforts to hold the line without further concessions will have very little influence to deter holdouts.

“The leaked attorney general report has revealed major chinks in the government’s legal armor: there is very limited prospect that holdouts will get a worse deal from the Ghanaian courts.

“And given the one-year moratorium on interest payments affecting all creditors, the time delay penalty stemming from litigation is less onerous for holdouts if government chooses to outrightly default on their bonds.”

Bright Simons

Publication Of Amended Domestic Bond Exchange Program

A statement issued by the Finance Ministry indicated that, the amended GH¢137.3 billion domestic bond exchange program is expected to be published this week. The amended terms would be set forth fully in an Amended and Restated Exchange Memorandum.

As part of efforts by the government to make an amendment to the debt exchange program, individual investors who were initially excluded from the debt exchange program have now been included.

“Individual bondholders were originally exempted from the domestic debt exchange, however, after government excluded pension funds following pressure from organized labor, the program is expanded to cover individual investments.”

Finance Ministry

Furthermore, in addition to the modifications of the debt exchange program, the finance ministry revealed there would be eight new instruments to the composition of the new bonds, for a total of 12 new bonds, one maturing each year starting January 2027 and ending January 2038.

The government is also setting a non-binding target minimum level of overall participation of 80 per cent of aggregate principal amount outstanding of eligible bonds among others, Ministry of Finance stated.

Read More : The Cedi Is Prepared For Another Significant Accomplishment – Annoh-Dompreh