Mr Rexford Addi-Kissiedu, the Resources Portfolio Manager of First National Bank Corporate and Investment Banking division, in a statement issued by the Bank disclosed that, to improve the capacity situation, there was the need to get experienced infrastructure experts who will assist with project preparation, prioritization and funding solutions.

According to Mr. Addi, First National Bank’s corporate and investment portfolio for the energy sector has the capacity to support the upstream value chain activities carried out in Ghana.

Mr. Addi revealed the fact, the bank continues to offer funding solutions to a wide array of players in the infrastructure space from debt to equity.

“We are also able to play a financial advisory role in these projects which is evidenced by the recent Beitbridge border project in Zimbabwe, where our team from the Rand Merchant Bank did not only act as a lead arranger but financial advisors as well.”

Mr. Rexford Addi-Kissiedu

Mr Addi-Kissiedu advised that, capacity limitation on the side of government could be remedied by skills sharing and more collaboration between the private and public sectors

“If we are able to actively broker relationships with key players and formulate consortia that hold the skills to bid, we can definitely deliver exceptional financial solutions to support the sector. To move forward as a nation, we need to champion partnership and innovation.

“We believe that partnership is the way to go. While there may be risks involved in infrastructure investment, and often a steep learning curve, the rewards for the country are exponential.”

Mr. Rexford Addi-Kissiedu

According to Addi-Kissiedu, First National Bank has shown the need for continuous investment in projects that have strong environmental, social and governance considerations, particularly in this century of energy transitioning.

Mr. Addi-Kissiedu concluded by saying, investments in the hydrocarbon sector need to be supported with environmentally friendly technology to enable Ghana and Africa maximise value whilst critical attention is paid to transition from fossil fuel usage to cleaner options of energy.

PURPOSE OF THE CONFERENCE

First National Bank, one of the leading commercial banks in Ghana, participated in a discussion hosted by the Petroleum Commission on enhancing local content for upstream petroleum.

This event was held in the Western part of Ghana, Takoradi on the theme “Sustaining local content development through enhanced exploration and production activities in the era of energy transition”.

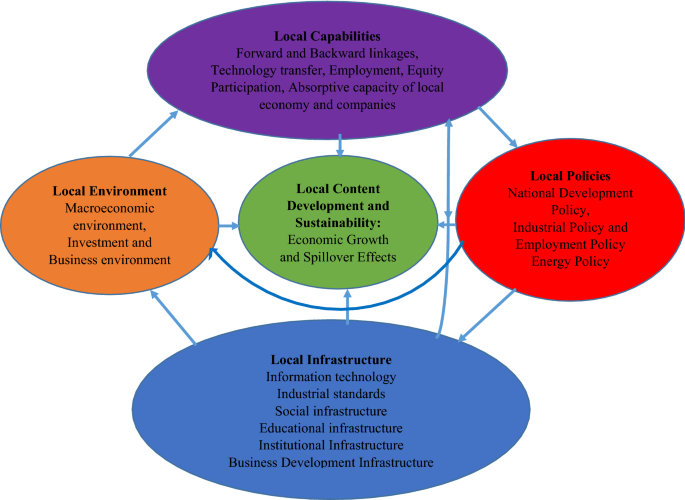

The objective of the event was to encourage individual suggestions on enhancing exploration and production activities and the development of marginal fields to sustain local content development in the preparation towards the energy transition.

The conference and exhibition was hosted by the Petroleum Commission to as well provide a platform for stakeholders and players in the upstream oil and gas industry to deliberate on critical issues affecting the industry.

Not limited to that, it was also organized to provide opportunity for stakeholders and players to explore investment opportunities, build business networks and deepen local content development.

Currently over 300 indigenous companies have been registered under the local content policy and legislation. Out of this number, less than five per cent (5%) possess the financial wherewithal or have built the requisite capacity to contribute at least five per cent capital and other technology requirements for exploration and production (E&P) which ranges between US$100-150 million.

READ ALSO : Call For Review Of Free SHS Policy