Output growth continued to rise in the final month of the second quarter of 2021 together with new orders and employment in Ghana, albeit marked increase in prices presented some headwinds to the rate of expansion, IHS Markit survey results show.

That said, inflationary pressures also led to the decline in business sentiment regarding the 12-month outlook, IHS Markit indicates.

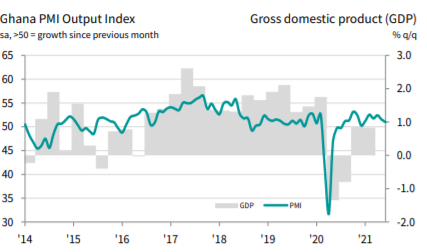

Following this, the headline seasonally adjusted Ghana Purchasing Managers’ Index (PMI) inched down to 51.0 in June 2021 from 51.5 in May 2021. According to IHS Markit, the latest reading signaled a slight improvement in business conditions but the weakest in the year-to-date. For the past 11 months, the health of the private sector has been strengthening, and this is a good sign, IHS Markit economists noted.

Based on the survey results, customer demand continued to see some improvements as that resulted in ongoing increases in both business activity and new orders at Ghanaian companies during June 2021. That notwithstanding, there were some reports from respondents that price rises had made securing new work more difficult. As a result, output and new business rose only modestly, and in both cases at the slowest rates in six months.

In making adjustments to cover costs associated with price rise, firms raised their selling prices quite significantly, and one that was the joint-fastest in just over two-and-a-half years. Consequently, where charges increased, this was mainly due to the passing on of higher input costs to customers.

Furthermore, purchase costs continued to increase sharply, although the rate of inflation softened slightly from that seen in May. Meanwhile respondents attributed these inflationary pressures from a range of sources. Higher fuel costs were widely mentioned, while rises in freight and other transportation costs also featured. Also, raw material shortages also contributed to higher prices.

Firm’s costs behaviour in June 2021

Alongside rising purchase prices, staff costs also increased in June as firms helped their employees with higher living costs. Wages also increased modestly, albeit the fastest in three months.

Moreover, concerns about cost pressures dampened optimism in the 12-month outlook for business activity, as sentiment dropped to a 14-month low. Nonetheless, firms remained optimistic overall amid hopes of improving economic conditions.

Considering the trajectory of demand for workers in each of the past 11 months, companies in Ghana took on extra staff during June 2021 in response to higher workloads. As such, the rate of job creation was modest but the slowest since January 2021. Delays in firms’ receipt of raw materials and production materials further accumulated workloads.

Suppliers’ delivery times lengthened marginally, with delays caused by material shortages. The rate of deterioration in vendor performance was the least marked in 2021 so far. Higher new orders encouraged firms to expand their purchasing activity, which increased for the eleventh month running. Despite increased purchasing, stocks of inputs decreased amid difficulties sourcing materials.

Andrew Harker, Economics Director at IHS Markit in commenting on the survey results remarked:

“Whilst the latest Ghana PMI seems to paint a positive picture of the performance of the private sector midway through the year, delving into the details suggests some developing headwinds. Sustained price rises have begun to test the strength of customer demand as increases in costs for fuel, materials and transportation are passed on to clients.

“There are also growing concerns among companies that price rises are going to restrict growth over the year ahead. Firms will therefore be hoping that price pressures start to ease so that the current sequence of growth can be sustained.”

Andrew Harker, Economics Director, IHS Markit

READ ALSO: Ghana targets 28% tax-to-GDP ratio in next 3 years