Activities in the stock market have been identified as no different from what is happening in the business environment following the advent of the novel coronavirus.

According to a survey conducted by Mr. Evans Asare, a senior manager at Deal Advisory of KPMG, there has been a fall in percentage in the stock market as well.

“Same story can be said about the stock market, that is, the Ghana stock exchange year-to-date have a fall of 16% or a return of -16%. Our cedi to dollar rate has remained relatively within reasonable range. Year-to-date depreciation of 2.5% is a much better performance than the same period last year when year-to-date as at June 2019, was about -18.5%. Therefore, comparing -2.5%, the cedi seems to have gained a little bit resilience from the pandemic.”

He said this while speaking as a guest speaker at a webinar hosted by the UK Ghana Chamber of Commerce on the theme “Planning for Post-COVID-19 Era in Ghana: Investment Opportunities and Key Risks”.

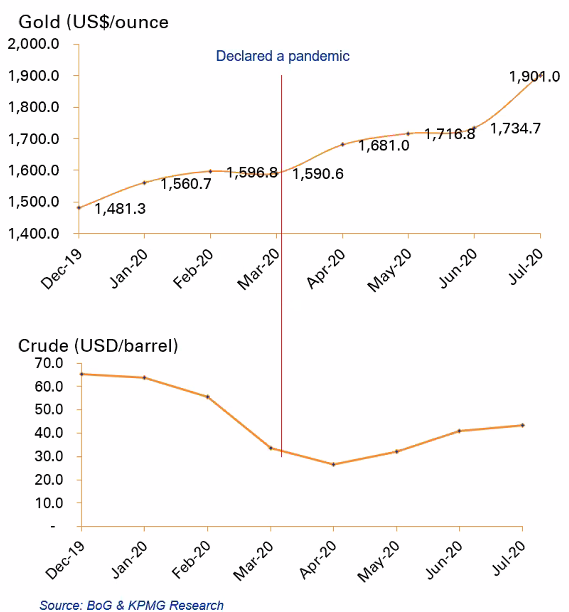

He went on to highlight the changes in commodity prices and financial market as well as trends in business activities. Touching on commodity prices specifically gold and oil, he indicated both commodities are interlinked and activities with one affect the other.

“We saw gold prices surging right from March when the virus was declared as a pandemic and that showed how investors were moving liquid funds into some kind of assets aside the stock market. For crude oil prices, they were already on a downward spiral from the beginning of the year and the virus also had its own effect. And so, we say that it dropped to below $30 per barrel somewhere in April but we’ve since seen some kind of recovery though that is still below the level before the pandemic.”

Moreover, the Ghanaian business environment has seen some recovery since June but the uncertainty of how long the virus will linger makes it difficult to determine the stability of the economy.

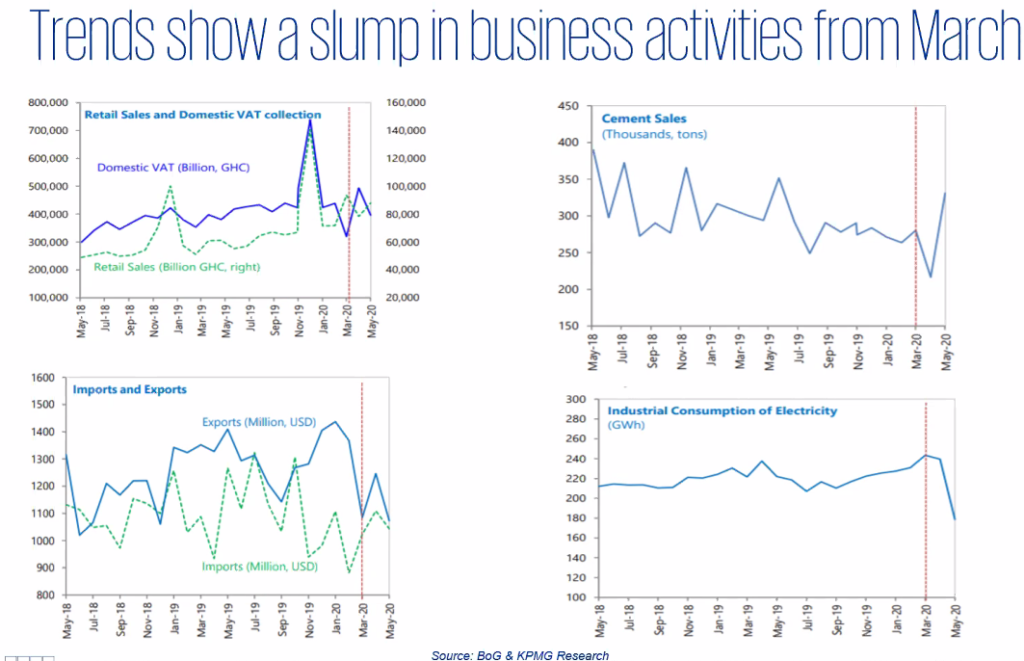

“These economic activities are represented by the various sales. We have retail sales, cement sales that is showing the directions of construction activities, imports and exports and then industrial consumption of electricity. Since the pandemic is showing some kind of slump, we see retail sales slumping in March but we saw a pick up somewhere in April and this is as a result of the panic buying ahead of the lockdown that people went into somewhere in April but have since slumped further in May.”

He further gave a breakdown of the performance of some sectors in the business environment after COVID-19 was declared a pandemic in March.

“Cement sales showing construction activities have also slopped since March but we have also seen some kind of an upward trend in May. Import and export, of course, with the closure of borders, activities have become difficult to go through therefore, we only have probably vessels operating, no flights at this stage. Therefore, we expect that some kind of a slump in import and export will upgrade activities obviously heavily impacted. Finally, we look at the manufacturing sector mainly based on the consumption of electricity. We also see a slump since March that the virus was declared as a pandemic.”

Talking about the confidence level for both consumers and businesses, he indicated that, there has been a decline in the index, however, there is a steady recovery.

“If we look at the confidence level, that is from the perspective of consumers and that of businesses, it sort of depicts how the pandemic has had effects on business activities and consumer confidence in the market. We saw that before the pandemic, the index was almost over 100 but it dropped further to 84 which showed that consumer confidence in the system can drop. Since April, we have seen it curving upwards so I could say that, confidence in the business environment seems to have bent the curve upwards.”