Oil prices rose to new highs today, as China eased zero covid policy lockdowns and the EU worked on a plan to ban imports from Russian crude.

Brent crude price jumped above US$120 a barrel, before shedding off some gains, after the benchmark price jumped more than 6 per cent last week to post the highest price in two months.

This is against the backdrop that the key hub of Shanghai, has recently allowed all manufacturers to resume operations from June, 2022 while officials said Beijing’s coronavirus outbreak is under control.

Meanwhile EU nations failed to agree on a deal on Sunday, May 29, 2022, on a revised sanctions package that would include a Russian crude ban to trigger a rescission of Moscow’s invasion of Ukraine, however talks will continue during the week.

Hungary is also refusing to back a compromise despite proposals aimed at ensuring its oil supplies. Reports indicate that a deal is still possible in the coming days as leaders meet, an EU official is cited to have said.

Brent crude is on course to realize a sixth straight monthly climb that would be the longest run in more than a decade. The rise has been driven by the fallout from war in Europe, as well as increased demand as more economies return from COVID-related restrictions. In the US, the summer driving season kicked off at the weekend with retail gasoline prices at a record.

“It’s tight supply– China demand and beginning of US driving season in focus,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S. At the same time OPEC+ has fallen behind production targets and is struggling to meet quotas.

China’s Zero Covid Policy

According to available data, Brent for July settlement rose as much as 0.9 per cent to US$120.50 a barrel on the ICE Futures Europe exchange, before trading at US$119.95 earlier in the morning, according to Bloomberg.

The August contract, which has more volume and open interest, added 0.6 per cent to US$116.19 a barrel. West Texas Intermediate for July delivery gained 0.5 per cent to US$115.63 a barrel on the New York Mercantile Exchange, according to Bloomberg.

China’s persistent adherence to its COVID Zero policy at all costs— epitomized by Shanghai’s lockdown that began in late March 2022 and restrictions elsewhere— have reduced energy demand, and an easing would help to support global consumption. Administration officials have both warned of the economic damage stemming from the curbs, and pledged support to offset the impact.

With a meeting pending this week of the Organization of Petroleum Exporting Countries (OPEC) and allies on supply policy, leading member Saudi Arabia is expected to boost its official July prices. Saudi Aramco may raise Arab Light for sales to Asia next month by US$1.50 a barrel, according to a Bloomberg survey .

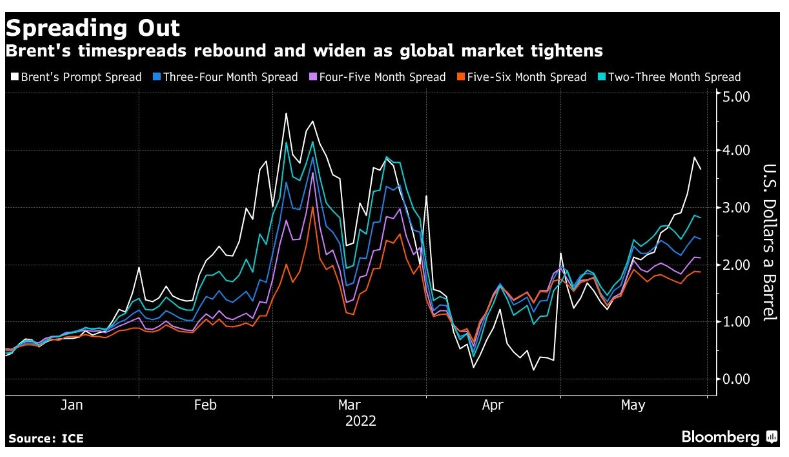

The oil market is steeply backwardated, showing a bullish pattern marked by near-term prices, trading at a premium to longer-dated ones. Brent’s prompt spread, which is the difference between its two nearest contracts— was US$3.73 a barrel on Monday, up from US$1.34 a barrel some three weeks ago.