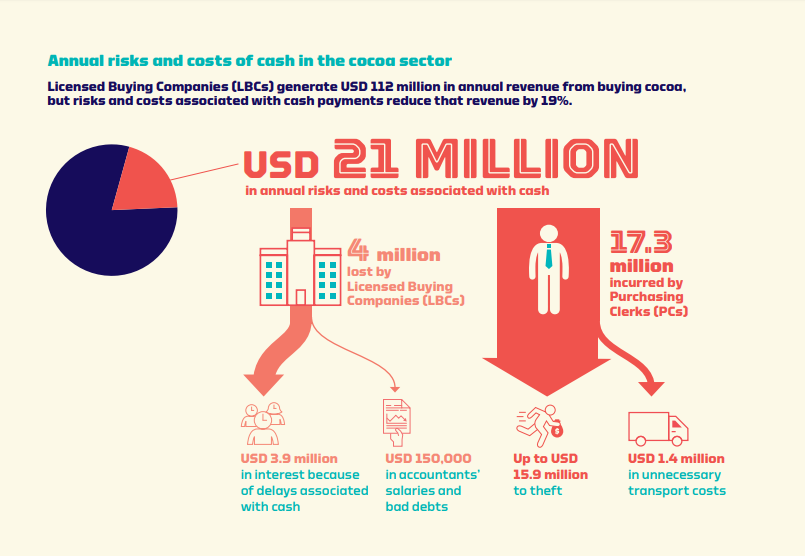

A research conducted by the Better Than Cash Alliance in collaboration with the World Cocoa Foundation has shown that the continuous use of cash in Ghana’s cocoa sector costs stakeholders approximately $21.5 million annually.

According to the study, the estimated loss is equivalent to 19 percent of licensed buying companies (LBCs) revenues gained per year.

The research is based on the premise that the number of days in the operating cycle greatly affect expenses. This is because some LBCs borrow from Ghana Cocoa Board (COCOBOD) while others get their purchasing funds from local banks in the form of overdrafts to purchase cocoa from farmers, using a network of local purchasing clerks (PCs).

“As working capital sits as cash in PCs’ houses or in bags of cocoa waiting to be paid for at the port, LBCs must borrow heavily to make more cocoa purchases and generate their margin revenue. Some LBCs borrow from COCOBOD at concessionary rates, but most purchasing funds are sourced from local banks in the form of overdrafts.”

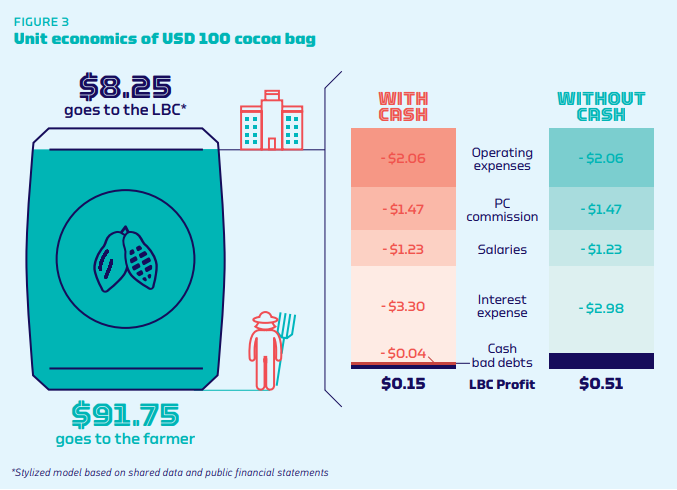

The study reveals that the interest accrued on these loans are more than the profit gained by LBCs as interest rate ranges between 22 and 30 percent.

“According to LBC executives, interest rates from banks are between 22% and 30% compared with an average commercial bank lending rate of 23.7% (Bank of Ghana, 2020). Interest accrues daily from the moment the funds leave the LBC bank account and only stops accruing when the LBC is paid on delivery of the cocoa, typically some 40 to 60 days later.”

The LBCs which were used as a sample for the study lamented about the toll interest costs take on their operations. The research also disclosed that even the state-owned LBC faced similar challenges and further predicted an increase in interest cost over the season based on government’s projection of the quantity of ton to be purchased.

“LBCs interviewed for this report indicated that between 42 and 59 percent of their margin revenue is lost to interest costs before paying commissions, salaries, or operating expenses. In its last published quarterly financial statement, PBC Limited – the state-owned LBC – paid 52% of its margin revenue in interest, turning an operating profit into a significant pre-tax loss. Using 40% of margin revenue as a conservative estimate, and with the government’s projections of 850,000 tons to be purchased in the 2019/20 season, LBCs will pay GHC 251 million (USD 45 million) in interest over the season.”

Another challenge the report noted Ghana’s Cocoa sector faced was write-offs related to theft of cash bills and bank notes.

“In addition to interest costs, write-offs suffered by the LBCs related to theft of cash bills and bank notes are between 0.1 and 0.5% of revenue, or USD 110,000–550,000. Further, LBCs’ accounts departments must spend around 10% of their working hours issuing checks and reconciling cash payments, costing LBCs around USD 40,000 a year.”

According to the report, stakeholders in this sector are at risk both physically and financially therefore the only way to address this is by digitization of payments.

“This is threatening the financial viability of key players in the value chain, and causing serious risks to people’s physical safety. There is an urgent need for greater collaboration and action to tackle these serious challenges. Many of these threats, risks, and costs can be lowered significantly, if not removed entirely, by digitization of payments.”

Meanwhile, Ghana’s cocoa value chain has begun its transition away from the use of cash as cocoa-buying companies are searching for new ways to deliver greater benefits to farmers while improving efficiency, sustainability, and transparency in their cocoa procurement.