Angola may soon be forced to seek assistance from the International Monetary Fund (IMF), as a sharp decline in crude oil prices strains the country’s public finances. Finance Minister Vera Daves de Sousa confirmed that the government is conducting stress tests to understand the full extent of the impact.

As sub-Saharan Africa’s second-largest crude oil producer, Angola’s 2025 budget was based on an oil price of $70 per barrel. However, after U.S. President Donald Trump announced sweeping tariffs on April 2, Brent oil futures dipped below $60 before settling at $66.91 last Friday.

“We are rolling out stress test scenarios,” Daves de Sousa revealed during an interview held on the sidelines of the International Monetary Fund and World Bank spring meetings in Washington.

According to the finance minister, if oil prices experience only a moderate decline, the government could freeze certain spending. However, a more severe drop to $45 per barrel would likely necessitate the creation of a supplementary budget to address revenue shortfalls.

Daves de Sousa also emphasized that the government is actively pursuing measures to offset lower oil revenues. These include enhancing tax administration efficiency and stepping up enforcement of property taxes to bolster non-oil income.

Bond Market Reflects Growing Pressure on Angola

Beyond the oil price crash, Angola is also feeling the sting of volatility in global bond markets, particularly within the U.S. Treasury sector. Smaller, riskier emerging economies like Angola have witnessed sharp declines in their international bonds amid investor flight from risky assets after Trump’s tariff announcements.

Angola’s 2049 dollar bond saw its yield climb to 13%, up from 12% before the tariffs, as bond yields move inversely to bond prices. However, on Monday, April 28, the bond staged a modest recovery, gaining nearly 1 cent to trade at 71.38 cents on the dollar.

Typically, when bond prices dip below 70 cents on the dollar, it signals potential borrowing difficulties for a nation. Though Angola’s bonds briefly rallied last week on market optimism over a potential resolution to the tariff dispute, concerns remain high.

Earlier this month, Angola had to post $200 million in margin to JPMorgan on a $1 billion total return swap backed by its dollar bonds. Daves de Sousa noted that discussions with JPMorgan are underway to explore ways to avoid another margin call.

She also highlighted that neither ratings agencies nor investors had expressed alarm over the rapid payment. “They were positive, surprised that we were able to mobilize such an amount of money so fast,” she said.

Nevertheless, Daves de Sousa acknowledged that Angola is actively considering the option of applying for an IMF financing program.

When asked about Angola’s oil-backed Chinese loans, Daves de Sousa confirmed that $8 billion remains outstanding, but she is confident the debt will be repaid by 2028, sooner than the initially projected 2030–2031 timeframe.

At the same time, Angola continues to secure additional loans from China, mainly through concessional lending by China’s EXIM Bank. Unlike previous agreements, these new loans are not backed by oil but are allocated to specific development projects such as expanding internet access in rural areas and improving education systems.

Despite the financial turbulence, Daves de Sousa expressed Angola’s long-term intent to re-enter the international capital markets. However, she noted that current market conditions are unfavorable.

“We want to go to the market, but the way they are performing now, this is not the moment. We will continue to look at it and make sure that we are ready if the moment comes.”

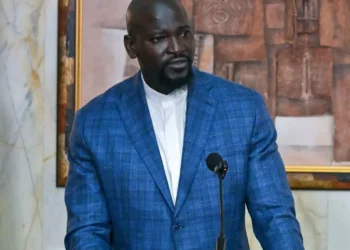

Vera Daves de Sousa

Daves de Sousa revealed that Trump administration officials reiterated their support for financing the Lobito rail corridor, an infrastructure project designed to move critical minerals from the central African copperbelt to the Atlantic coast, although specific funding amounts were not disclosed.

READ ALSO: Parks and Gardens Vital for Revenue, Not Resource Consumption – Edem Kojo