Kenya and the International Monetary Fund (IMF) have reached an agreement to cancel the ninth review of the loan program under the Extended Fund Facility (EFF) and Extended Credit Facility (ECF).

This decision marks a significant shift in Kenya’s economic engagement with the IMF as the country navigates fiscal and economic challenges while exploring new financial arrangements.

A team from the IMF, led by Haimanot Teferra, visited Nairobi from March 6 to 14, 2025, to assess the country’s recent economic developments and discuss macroeconomic strategies with Kenyan authorities. At the conclusion of the mission, the IMF announced that both parties had agreed to forego the ninth review of the existing EFF/ECF programs.

“The mission team engaged with the Kenyan authorities on recent developments and the macroeconomic outlook. The Kenyan authorities and IMF staff have reached an understanding that the ninth review under the current Extended Fund Facility and Extended Credit Facility programs will not proceed. The IMF has received a formal request for a new program from the Kenyan authorities and will engage with them going forward.”

Haimanot Teferra

Why Did Kenya Cancel the Ninth Review?

The IMF’s statement did not provide specific reasons for the decision to discontinue the current review. However, the move reflects ongoing discussions about Kenya’s fiscal and economic challenges, including debt sustainability, revenue mobilization, and external financing pressures.

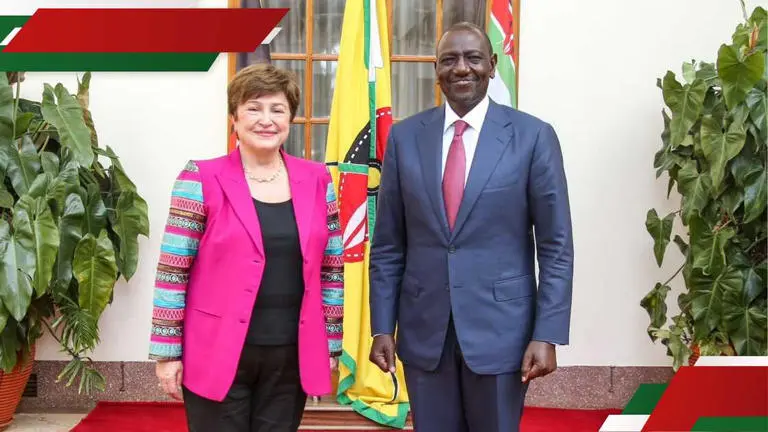

During the IMF mission, high-level meetings were held with key figures, including President William Ruto, Cabinet Secretary for the National Treasury Mbadi Ng’ongo, and Central Bank of Kenya Governor Kamau Thugge. These discussions centered on Kenya’s economic outlook and the need for a financial framework that aligns with the country’s evolving fiscal and development priorities.

The decision to pivot away from the ninth review suggests that Kenya and the IMF are seeking to establish a more tailored financial arrangement that better addresses Kenya’s pressing economic needs. The request for a new IMF program signals the government’s commitment to continued economic reforms while exploring alternative financing mechanisms.

Kenya’s IMF Loan History and Commitments

Kenya has been a beneficiary of the IMF’s EFF and ECF programs since April 2021, when the IMF Executive Board approved financial support amounting to Special Drawing Rights (SDR) 1.655 billion, equivalent to approximately US$2.34 billion at the time of approval. These funds were aimed at supporting Kenya’s economic reforms, stabilizing public debt, and fostering sustainable growth.

In previous reviews under the EFF/ECF framework, the IMF approved additional loan disbursements. Most recently, the combined seventh and eighth review led to the approval of a KSh 78 billion loan for Kenya. Overall, the IMF’s financial commitment to Kenya under the EFF and ECF arrangements has reached SDR 2.714 billion (approximately KSh 465.76 billion), of which SDR 2.343 billion (about KSh 402.54 billion) has already been approved for disbursement since 2021.

Beyond the EFF and ECF programs, Kenya has also benefited from the IMF’s Resilience and Sustainability Facility (RSF) arrangement. Since 2023, the IMF has approved SDR 407.1 million (about KSh 69.8 billion) and SDR 135.70 million (about KSh 23.3 billion) under this facility to support Kenya’s sustainability and economic resilience initiatives.

What’s Next for Kenya?

The cancellation of the ninth review does not mean the end of Kenya’s collaboration with the IMF. Instead, it signals a transition to a new program, which could provide fresh financial assistance tailored to the country’s current economic landscape.

Kenya faces critical fiscal challenges, including high public debt, rising inflation, and the need to mobilize domestic revenue. The country’s decision to seek a new arrangement with the IMF suggests a strategic realignment of its economic policies and financial commitments.

Going forward, discussions between the IMF and Kenyan authorities will likely focus on designing a new financial support package that aligns with Kenya’s long-term economic goals. This could involve new conditions and policy adjustments to enhance economic stability and growth.

READ ALSO: Minority Challenges 2025 Budget, Accuses Government of Manipulating Data