The passage of Nigeria’s proposed Petroleum Industry Bill (PIB) is likely to have positive long-term effects on its public finance and oil and gas production, Fitch Ratings, an international credit ratings agency suggests.

This notwithstanding, the success or impact of the bill depends on the details of implementation. Aside that, the bill is unlikely to have a significant near-to-medium term impact on Nigeria’s creditworthiness.

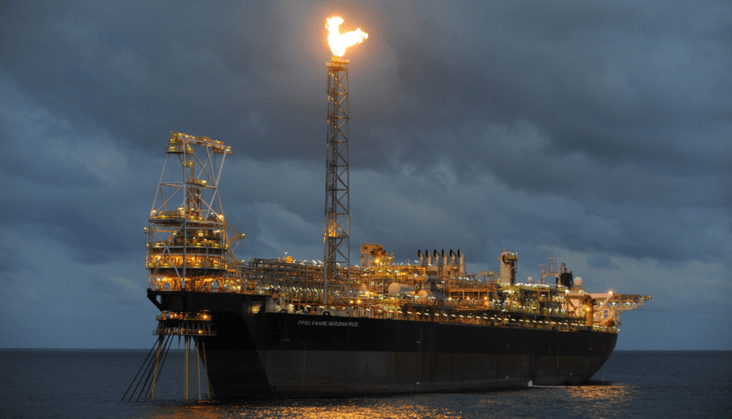

“A harmonised version of the long-deliberated PIB completed its passage through both houses of parliament on 16 July. If signed into law by the president, as we expect, the PIB could boost oil-sector investment, helping to stabilise the sector, which has long suffered from underinvestment, and potentially reverse the downward trend in oil production.

“This would also be positive for fiscal revenues; fossil fuel tax receipts accounted for 41 per cent of general government revenue in 2019. The new legislation would come after a decade in which oil output has trended lower.”

Fitch Ratings

Per the law, 30 per cent of the Nigerian National Petroleum Corporation’s (NNPC) profit from petroleum sharing contracts will be sent on frontier exploration. Meanwhile, Fitch indicates that the near term effects of this on revenues remitted by the NNPC to the government are uncertain, however it could help raise production in the longer term.

Furthermore, the full impact will also depend on the details and implementation of the fiscal regime for international oil companies, as joint ventures between the NNPC and international oil companies account for the bulk of new exploration and production activity.

Fitch contends that if remitted revenues tend to be lower, this would be credit negative for Nigeria in the near term. Nonetheless, Fitch believes this would be unlikely to drive rating adjustments, all else being equal. The reason is that Nigeria is hugely benefiting from the significant rise in international oil prices.

Merits and Demerits of the Petroleum Industry Bill

According to Fitch Ratings, the provisions in the Petroleum Industry Bill could also improve transparency in the petroleum sector. This could occur as it potentially lowers revenue losses due to inefficiencies and corruption. Nonetheless, there remains a risk that they may not be fully implemented, which would blunt this effect, Fitch asserts.

Furthermore, Nigeria’s structurally low government revenue, as well as its heavy reliance on volatile oil revenue, is an important constraint on its rating, Fitch argues. As such, Fitch affirmed the sovereign’s rating at ‘B’ with a Stable Outlook in March 2021. Also, the sovereign’s general government debt/revenue ratio is high relative to peers, as is its interest expense/revenue ratio.

With investment available for hydrocarbon sectors fast declining, “those countries with the highest extraction costs and least favourable investment climates will be the first to suffer a pullback in investment.

“It is still uncertain whether the PIB will be enough to make the country internationally competitive for energy-sector investments against such a background. Moreover, there is a risk in the long term that some existing production facilities in the oil sector could become stranded.”

Fitch Ratings

There is brewing contention around the share of oil revenue to be distributed to oil-producing communities. The PIB mandates the formation of Host Community Development Trust Funds, aimed at ensuring the funding is used to address the communities’ concerns. However, there is danger that conflicts over the proportion of shares or beneficiary communities may spark regional resentments.

READ ALSO: Rise in Public Sector Base Pay to cost Gov’t GHc1,177 million in 2021