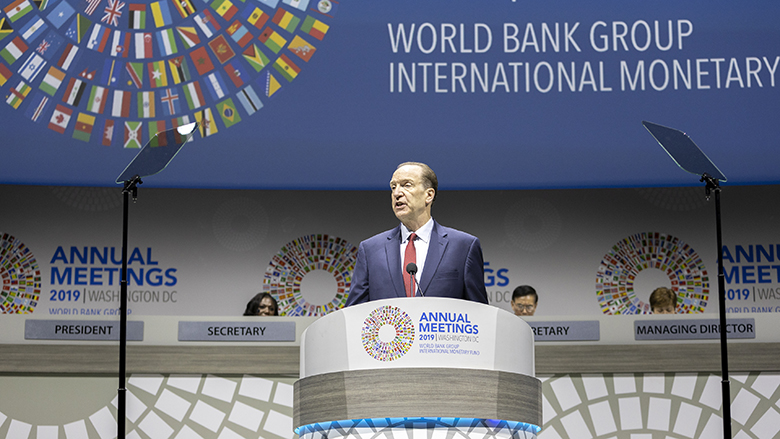

World Bank President, David Malpass has called for investors to grant some form of relief that could also include debt cancellation in poor countries as the coronavirus pandemic could trigger a debt crisis in these nations.

“It is evident that some countries are unable to repay the debt they have taken on. We must, therefore, also reduce the debt level. This can be called debt relief or cancellation,” Malpass told Handelsblatt business daily in an interview.

“It is important that the amount of debt is reduced by restructuring,” Malpass added.

He pointed to similar steps in previous financial crises, such as in Latin America and the so-called “Highly Indebted Poor Countries” initiative for countries with unsustainable debts in the 1990s.

Rich countries backed an extension last month of the G20’s Debt Service Suspension Initiative, approved in April to help developing nations survive the coronavirus pandemic, which has seen 43 of a potential 73 eligible countries defer $5bn in debt payments.

Malpass warned in August that the pandemic could push 100 million people into extreme poverty. In his latest comments, he renewed his call for private banks and investment funds to get involved, too.

“These investors are not doing enough and I am disappointed with them. Also, some of the major Chinese lenders did not get enough involved. The effect of the aid measures is, therefore, less than it could be,” the World Bank head said.

Malpass also said that the pandemic could trigger another debt crisis, as some developing countries had already entered a downward spiral of weaker growth and financial trouble.

“The enormous budget deficits and debt payments are overwhelming these economies. In addition, the banks there are getting into difficulties due to bad loans,” Malpass added.

The World Bank President first made this call in April stating that the pandemic will force people back into extreme poverty.

“This is worse than the financial crisis of 2008 and for Latin America worse than the debt crisis of the 1980s.

“The immediate problem is one of poverty. There are people on the brink. We have made progress in the last 20 years. Whole populations have come out of extreme poverty. The risk as the economic crisis takes hold is that people fall back into extreme poverty.

“As the crisis hit, inequality has become very distinct. The stimulus in advanced countries has been targeted on advanced countries, to the extent that a major inequality problem has gotten worse. The recessions are even worse in the developing world than they are in advanced economies.”

Malpass is pleased to see the G7 industrialised nations have extended repayment holidays due to end this year into 2021 but said a more radical approach was needed.

“Even before the pandemic we had noted debt distress in many countries. There has been a huge rise in the amount of debt in poor countries and across the developing world, in part caused by the hunt for yield.

“For countries that are heavily indebted we need to be looking at the stock of debt”, Malpass said. “Up until now we have been providing relief for debt service payments but then adding what hasn’t been paid on at the end.”