World merchandise trade volume growth remained strong in the fourth quarter of 2020 after trade rebounded in the third quarter from a deep COVID-19 induced slump. However, the pace of expansion in the fourth quarter is unlikely to be sustained in the first half of 2021 since key leading indicators appear to have already peaked, according to the WTO’s latest Goods Trade Barometer reading on 18th February 2021.

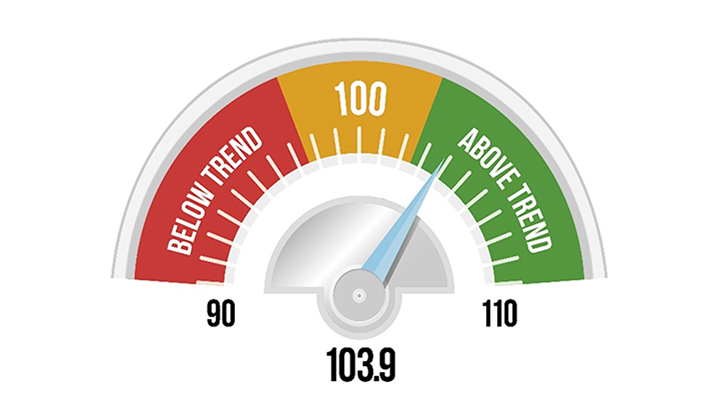

The barometer’s current reading of 103.9 is above both the baseline value of 100 for the index and the previous reading of 100.7 from last November, signaling a marked improvement in merchandise trade since it dropped sharply in the first half of last year.

All component indices are either above trend or on-trend, but some already show signs of deceleration while others could turn down soon. The WTO said the indicator may not fully reflect the resurgence of COVID-19 and the appearance of new variants of the disease, which will undoubtedly weigh on goods trade in the first quarter of 2021.

Indices for export orders (103.4) and automotive products (99.8), which are among the most reliable leading indicators for world trade, have both peaked recently and started to lose momentum. In contrast, the container shipping (107.3) and air freight (99.4) indices are both still rising, although higher-frequency data suggest that container shipping has dipped since the start of the year.

While the indices for electronic components (105.1) and raw materials (106.9) are firmly above trend, this could reflect temporary stockpiling of inventories. Taken together, these trends suggest that trade’s upward momentum may be about to peak if it has not already done so.

In the third quarter of 2020, the seasonally-adjusted volume of world merchandise trade bounced back from a deep second-quarter slump, boosted by rising exports in Asia and increasing imports in North America and Europe. Goods trade in the third quarter, nevertheless, was still down 5.6% compared to the same period in 2019 after having to fall 15.6% in the second quarter. These declines, while still very large, are less severe than many analysts feared at the start of the pandemic.

The WTO’s most recent trade forecast of 6 October 2020 predicted a 9.2% drop in the volume of world merchandise trade in 2020, but the actual decline may be slightly less severe.

“Prospects for 2021 and beyond, moreover, are increasingly uncertain due to the rising incidence of COVID-19 worldwide and the emergence of new variants of the disease. Recovery will depend to a large extent on the effectiveness of vaccination efforts”.

According to the WTO, total flights rose towards the end of last year due to holiday travel but have since fallen around 22% and currently stand at around 15% below their level in mid-August. Much of this fluctuation, the WTO said was due to intra-EU flights, which have fallen more than 50% since mid-August, in part due to the resurgence of COVID-19 and tighter restrictions on travel within Europe. Excluding intra-EU, international flights are only down around 5% since last summer.

Port calls in January 2021 were down around 7% compared to December 2020 and 6% compared to the average of July-September of last year. This, according to the WTO, suggests that the second wave of COVID-19 will have an appreciable impact on shipments of goods by sea, which is not yet fully reflected in the Goods Trade Barometer.

The volume index has continued to decline while the tone index has remained relatively positive since last November, both reflecting lesser concern about the economic outlook than 6 to 9 months ago.

“This suggests that positive sentiment about medium-term economic conditions, driven also by the arrival of vaccines against COVID-19, may outweigh the negative impact of the still high number of COVID-19 cases worldwide”.