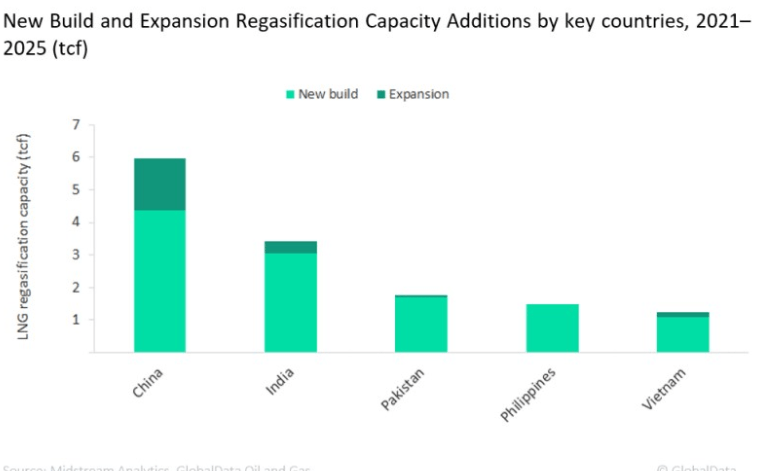

GlobalData forecasts show that china will lead Asia’s LNG regasification capacity additions, contributing 36 per cent of the total LNG regasification capacity additions between 2021 and 2025.

The capacity additions are based on two pointers: outlined projects with identified development plans; early stage announced projects undergoing conceptual studies and expected to get approved for development.

China is expected to add about 4,380 billion cubic feet (bcf) of new build LNG regasification capacity additions by 2025 while expansion projects account for the rest of the capacity additions with 1,576bcf.

Bhargavi Gandham, Oil and Gas Analyst at GlobalData, commented: “Among the new build and expansion projects that are likely to start operations in China during the forecast period, Tangshan II is the largest upcoming project with a capacity of 584.4 bcf. Yantai I and Zhoushan III are the other major projects with capacities of 487 bcf and 340.9 bcf, respectively.”

India Records Second Highest LNG Regasification Capacity Additions

India registers the second highest LNG regasification capacity additions in Asia during the period under review. Projections show that India will contribute about 21 percent of the region’s total capacity additions by 2025.

According to GlobalData, India will add LNG regasification capacity additions of 3,062 bcf by 2025. Expansion projects account for the rest of the capacity additions with 365 bcf by 2025. Kakinada GBS Floating leads LNG regasification capacity additions in the country with a capacity of 350.6 bcf by 2025.

GlobalData revealed that India is likely to witness a total LNG regasification capacity additions of 3,428 billion cubic feet (bcf) by 2025. Of this, 3,062 bcf of capacity would be from the new-build terminals while the rest of the capacity is from the expansion of the existing regasification terminals.

Teja Pappoppula, Oil and Gas Analyst at GlobalData, commented: “Most of the capacity additions in India are through the new build projects with the announced Kakinada GBS Floating terminal being the largest with a capacity of 351 bcf. The Crown LNG India-operated terminal is expected to become operational in 2024.”

Among the expansion projects, the Hazira Expansion regasification terminal accounts for most of the expansion capacity additions in India with 244 bcf of capacity expected to be added by 2025.

The third highest contributor in the country is the planned Jaigarh Port Floating terminal which is likely to add a capacity of 274 bcf in 2021. H-Energy Gateway Pvt Ltd will be the operator of this regasification terminal.

The third largest contributor is Pakistan, which is expected to increase LNG regasification capacity additions by 1,752 bcf. Of these, new build capacity additions account for 1,697 bcf. Among the new build projects in the country, Port Qasim is the largest upcoming project with a capacity of 438 bcf and is expected to start operations in 2023.

On the whole, Asia’s Liquefied Natural Gas is expected to grow from 26.5 trillion cubic feet (tcf) in 2021 to 42.1 tcf in 2025 from new build and expansion projects.

READ ALSO: Ghana’s LNG Project Holds Potential to Reduce Energy Poverty- AEC