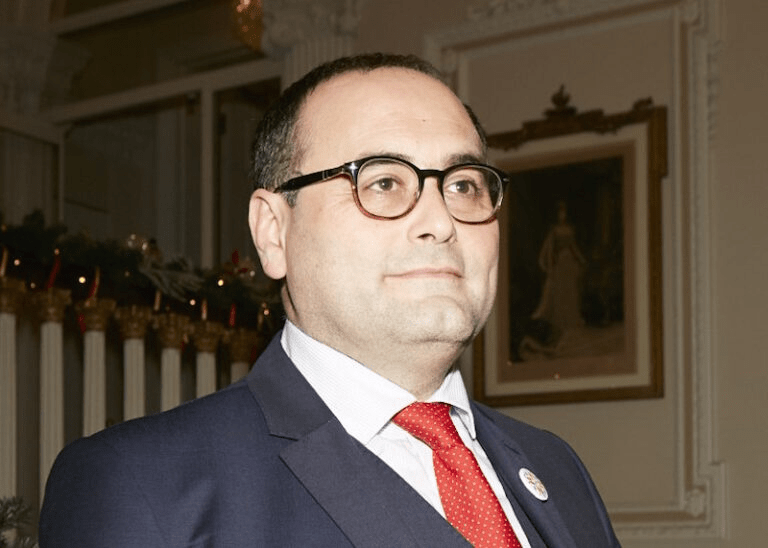

According to leaked information, the UK and San Marino signed a “double taxation” agreement in May of this year, under the supervision of a San Marino business mogul, Maurizio Bragagni. The deal was assented by the Chancellor Jeremy Hunt.

Sources revealed that the deal was frontiered by an important Conservative financier, who has contributed enormously to the party and made other relevant donations.

Treasury Secretary for Finance, Victoria Atkins supervised the entire procedure and signed the contract with the San Marino businessman, the report stated.

Protocol demands that, the selection of countries to have such business with, are solely the role of the Treasury department and the HM Revenue and Customs.

Sources further revealed that, for over two years, the government of San Marino has been lobbying with the Foreign Office for a compromise on the said tax deal.

Moreover, the San Marino consulate in the UK expressed their delight to the All-Party parliamentary committee of MPs and Peers for their “continuous lobbying support.”

According to the statement, Jeremy Hunt was honoured by San Marino for his “merits in promoting San Marino’s best interests in the UK, and for his valuable support during the emergency situation created in the republic during the pandemic.”

On the other hand, the Treasury Department revealed that, the maiden demand for such pact was initiated by the Foreign Office in 2022, six months prior to the appointment of Jeremy Hunt. This is to make the argument that, Chancellor Jeremy Hunt played no cogent role in the negotiation of the treaty.

Explanations from the Treasury Department noted that, the deal was intended to “eliminate the double taxation of income and gains arising in one country and paid to residents of the other country.”

The department further said that, there were “specific measures which combat discriminatory tax treatment and provide for assistance in international tax enforcement.”

Moreover, a spokesperson for the Treasury Department debunked any act of conflict of interest in the action of Chancellor Jeremy Hunt.

“We reject these claims as negotiations on this agreement were conducted by HMRC officials and began in April 2022 long before Jeremy Hunt became chancellor following a request from the Foreign Office.”

“The UK, under successive administrations, has signed over 130 double tax treaties, including with the United States, China, Japan, India, Germany and smaller countries. They are designed to prevent tax evasion in the UK and excessive foreign taxation and other forms of discrimination against UK business interests abroad.”

Treasury Department Spokesperson.

Tax expert, Richard Murphy susgested that the pact may lead to the transfer of tax revenue from the UK to San Marino.

“There will be no financial flows from San Marino to the UK of any consequence. Why are we allowing for the potential of flows from us to them? I think there could be the opportunity for someone to exploit this by ‘treaty shopping’, to set up the opportunity to create a financial services hub in San Marino that could be used for funds to flow out of the UK.

“For me, any such possible opportunity is naive at best and totally unnecessary, why do it? You have to question the political judgment of any politician who would want to do that, let alone claim publicity for it.”

Richard Murphy, Tax Expert.

Other experts also claimed that, they find no merits that the agreement could serve both nations. The agreement, they claimed, may be a diplomatic show off to demonstrate that, the tiny nation of San Marino is a world player.

READ ALSO: Don’t Intervene In Niger, Mali, Burkina Faso Cautions Western Military Powers