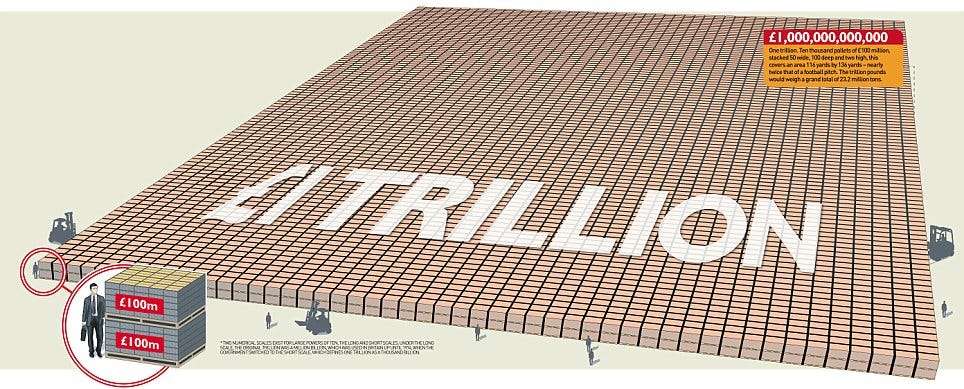

The United Kingdom needs a massive investment drive to secure £1 trillion in fresh capital over the next decade.

According to a report by the City taskforce, led by former Legal & General boss Sir Nigel Wilson, this substantial sum is necessary if the government hopes to achieve an annual economic growth rate of at least 3%.

The Capital Markets of Tomorrow report emphasized the need to attract around £100bn in investment per year across various sectors. It estimates that the housing market requires £20bn to £30bn, the energy sector needs £50bn, and £8bn is essential for water projects.

Furthermore, the report calls for £20bn-£30bn in venture capital to support companies transitioning from startup to sustainable growth phases.

The taskforce highlighted the importance of making the UK a competitive market for investment. While numerous initiatives have already been launched to enhance British infrastructure and stimulate growth, the report stresses that more innovative opportunities and incentives for investors are crucial. “The global pitch needs to be leveled,” the report asserts.

Investment for Energy, Housing, Water Needs Boost

Sir Nigel Wilson highlighted the availability of global capital, pointing out that “there has never been such a large amount of money globally available and seeking investment opportunities.”

This pool of potential funding includes domestic sources, international investors, sovereign wealth funds, retail investment, and private equity. Wilson further mentioned that the UK has access to £6tn of long-term capital within its pension and insurance sectors, ensuring that ample capital is on hand for growth.

A key suggestion in the report is the creation of new investment funds through the Long-Term Investment for Tech and Life Sciences (Lifts) initiative, aiming to attract private cash into UK markets.

It also recommends ensuring that the £60bn to £70bn in annual tax breaks for pension funds are directed in ways that spur investment in British businesses. Another significant recommendation is the reintroduction of tax credits on dividends from UK companies, a scheme that was discontinued in 1997.

Beyond institutional investment, the report calls for cultural changes to encourage individuals to take more risks with their finances. It advocates for removing stamp duty on share purchases and offering incentives for people with large cash savings to shift toward investment.

The report suggests a streamlined UK Individual Savings Account (ISA) to allow tax-free investments in British stocks. However, reports indicated that Chancellor Rachel Reeves might abandon the ISA project before the October 30 budget announcement.

The Capital Markets of Tomorrow report was compiled for the UK Capital Markets Industry Taskforce (CMIT), a prominent group led by Dame Julia Hoggett, CEO of the London Stock Exchange, along with senior leaders from Schroders, GSK, Phoenix Group, and venture capital firm Lakestar.

“We have a great base in the UK on which to build,” Hoggett stated, citing the country’s world-leading universities and highly respected financial services sector. “But the opportunities need to be seized.”

Since its establishment in 2022, CMIT has been advocating for regulatory reforms to boost investment in UK businesses, arguing that the current landscape leaves the nation behind the United States in capital markets development and economic growth.

Additionally, the group has raised concerns about an increasing number of companies opting to list on overseas exchanges rather than the London Stock Exchange, which is attributed to more favorable conditions abroad.

A Treasury spokesperson acknowledged the challenges ahead, commenting: “The chancellor has been clear that difficult decisions lie ahead on spending, welfare, and tax to fix the foundations of our economy.” The spokesperson added that more details would be outlined in the forthcoming budget, including efforts to reinvigorate the capital markets.

As the UK seeks to reinvigorate its economy, the pressure mounts on both the public and private sectors to attract the necessary investments and reverse the tide of companies heading overseas for better prospects.

READ ALSO: EC’s Refusal of Live PVR Meeting Coverage Sparks Transparency Concerns