US Treasury Secretary, Janet Yellen has intimated that private financing, and not just government spending, will be needed to tackle the “existential threat” of climate change.

Addressing a virtual conference organized by the Institute of International Finance, Yellen noted;that the overall cost of achieving net-zero carbon emissions by 2050 could run to $2.5 trillion over 10 years for the US. This estimate, she said, is in line with the 2015 Paris Agreement that the US has rejoined.

“It’s going to be tremendously important for the financial services industry to marshal and allocate capital that’s needed;to make the transition toward net-zero emissions. Massive investments are likely to be;needed and the bulk has to be private.”

The Treasury Secretary also highlighted the need to strengthen financial risk disclosures so investors can accurately gauge risks and opportunities. She stressed on the need to make the disclosures more reliable, consistent and comparable across markets and countries.

Rich countries promised in 2009 that by 2020 they’d;collectively give $100 billion annually to climate finance, but have fallen far short. As the world’s No. 2 emitter of greenhouse-gas emissions, the US especially has come under pressure to honour its promise.

Yellen pledged that the US will help developing countries that are especially vulnerable to threats from climate change. However, she stopped short of making any specific financial promises on that front.

Analysts have also noted that Yellen didn’t also offer any specific new pledge of additional US government funding to help developing nations adapt to a warming planet or build clean-energy projects.

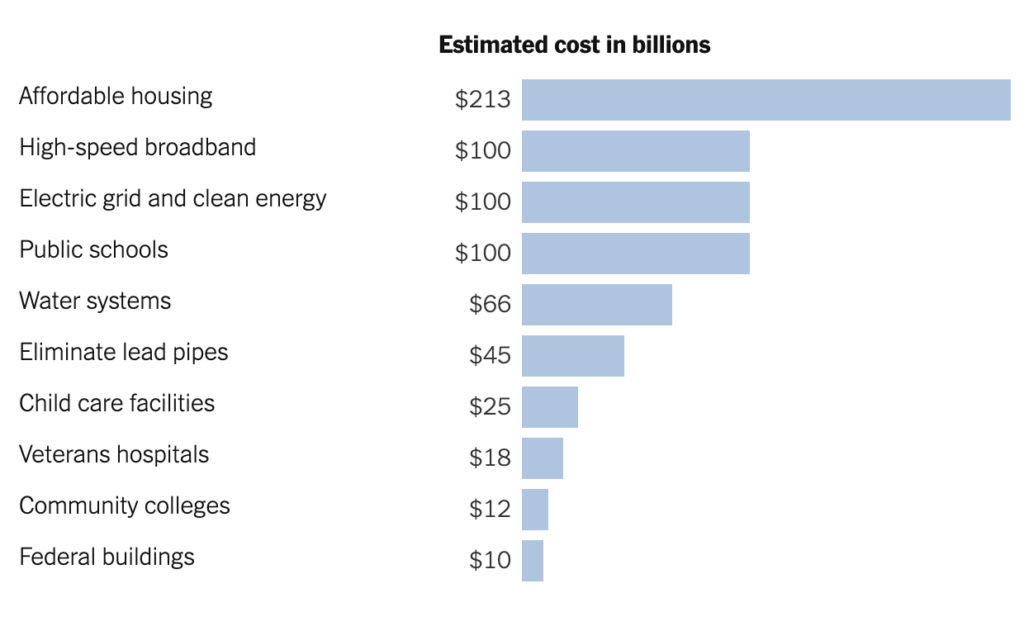

Most significant public investment in America

Yellen’s comments come as President Joe Biden is set to meet with the leaders of 40 nations, corporate executives and union leaders in a two-day virtual summit on the climate change on 22-23rd April.

The Treasury Secretary declared;in her speech that the infrastructure-focused economic proposal that Biden;unveiled last month, including money to address climate change, “will be the most significant public investment in America since the 1960s,;dramatically reducing US emissions;by;greening the electricity and transportation sectors”.

She also revealed that the treasury is;involved;in a number of initiatives aimed at removing hurdles. These initiatives, she said, includes efforts to improve financial reporting and increasing the reliability of climate-related disclosures.

The Financial Stability Oversight Council (FSOC), a multi-agency body of regulators chaired by Yellen, will be the Treasury’s principal tool in attempting to minimize financial-sector risks associated with climate change, she said.

“It’s FSOC’s job to understand these risks, to coordinate across U.S. regulatory agencies in assessing the risks and, if necessary and appropriate, acting to mitigate risks to overall U.S. financial stability”.

Yellen added that US officials will also work with the multilateral Financial Stability Board and other international bodies to make reporting requirements consistent and comparable across borders.

She also endorsed a “solid framework” for climate-related disclosures from an FSB task force chaired by Michael R. Bloomberg, founder and majority owner of Bloomberg LP.

Read Also: Failure to execute measures against ‘galamsey’, nations problem in dealing with it