According to a more fulsome analysis released by the Congressional Budget Office (CBO), US President, Donald Trump’s tax and budget bill would increase deficits by $2.8 trillion over the next decade after including other economic effects.

The report, produced by the nonpartisan CBO and the Joint Committee on Taxation, factors in expected debt service costs and finds that the bill would increase interest rates and boost interest payments on the baseline projection of federal debt by $441 billion.

The report used dynamic analysis by estimating the budgetary impact of the tax bill by considering how changes in the economy might affect revenues and spending.

This is in contrast to static scoring, which presumes all other economic factors stay constant.

The CBO released its static scoring analysis earlier this month, estimating that Trump’s bill would unleash trillions in tax cuts and slash spending, but also increase deficits by $2.4 trillion over the decade and leave some 10.9 million more people without health insurance.

The analysis comes at a crucial moment as Trump is pushing Congress, where Republicans have majority control, to send the final product to his desk to become law by the Fourth of July.

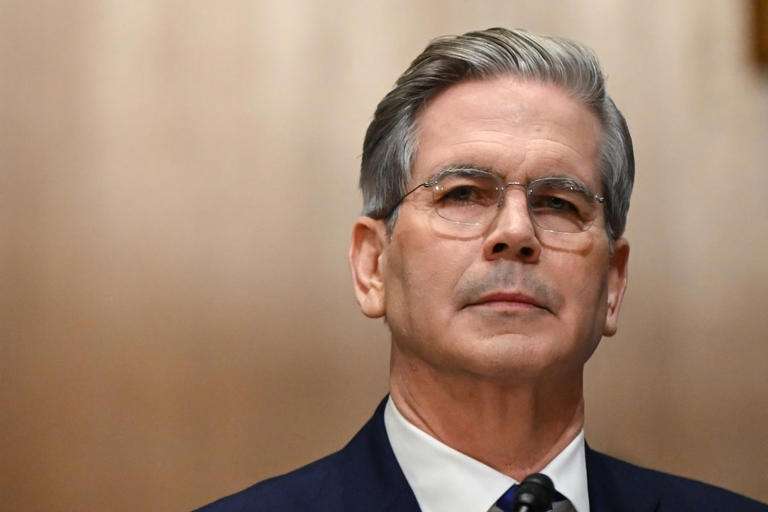

US Treasury Secretary, Scott Bessent and other Republicans have sought to discredit the CBO, saying the organization isn’t giving enough credit to the economic growth the bill will create.

Republicans on the Senate Finance Committee unveiled a proposal on Monday, June 16, 2025, for deeper Medicaid cuts, including new work requirements for parents of teens, as a way to offset the costs of making Trump’s tax breaks more permanent in draft legislation unveiled for his self-described big, beautiful bill.

The first House proposal on the new Medicaid work requirement exempted parents with dependents.

However, the Senate’s version broadened the requirement to include parents of children older than 14, as part of their effort to combat waste in the program and push personal responsibility.

The proposals from Republicans keep in place the current $10,000 deduction of state and local taxes, called SALT, drawing quick blowback from Republican lawmakers from New York and other high-tax states, who fought for a $40,000 cap in the House-passed bill. Senators insisted negotiations continue.

Marc Goldwein, Senior Vice President and Senior Policy Director for the Committee for a Responsible Federal Budget, stated on social media that considering the new dynamic analysis, “It’s not only not paying for all of itself, it’s not paying for any of itself.”

Tax Cuts Bill To Deliver Permanence And Certainty

Meanwhile, US Treasury Secretary, Scott Bessent asserted that the Senate Republican proposal for the tax cuts bill “will deliver the permanence and certainty both individual taxpayers and businesses alike are looking for, driving growth and unleashing the American economy.”

He said in a news release, “We look forward to continuing to work with the Senate and the House to further refine this bill and get it to President Trump’s desk.”

Last month, the International Monetary Fund (IMF) lowered its projection for the country’s global gross domestic product (GDP) growth to 2.8 percent growth in 2025, down from a forecast of 3.3 percent in January. Low predictions come despite Trump’s 90 day pause on “reciprocal” tariffs, with the exception of China.

Bessent urged the IMF to train its attention on China amid the US’s fallout with the world’s second largest economy.

The CBO separately released another analysis on the tax bill last week, including a look at how the measure would affect households based on income distribution.

It estimates the bill would cost the poorest Americans roughly $1,600 a year while increasing the income of the wealthiest households by an average of $12,000 annually.