The Managing Director of Stanbic Bank Ghana and the President of the Ghana Association of Bankers, Mr. Alhassan Andani, has intimated that in spite of all the sectors contracting in the phase of COVID, agriculture has experienced a persistent growth.

Speaking on Pm express, Mr. Andani stated that, with all the monetary loosening that we are seeing, if we were ploughing that into local production and local consumption, the fear of crossing inflation would not arise,” he opined.

According to him, if money were loosening by giving people local currency and importing goods with foreign currencies, then inflation would be at its peak.

During the scourge that affected the banking sectors and other sectors, agriculture in Ghana has grown above 2 percent. Mr. Andani iterated that, the development in the agriculture sector is informing us to think locally, meet all our critical needs locally and export instead of importing goods into the country.

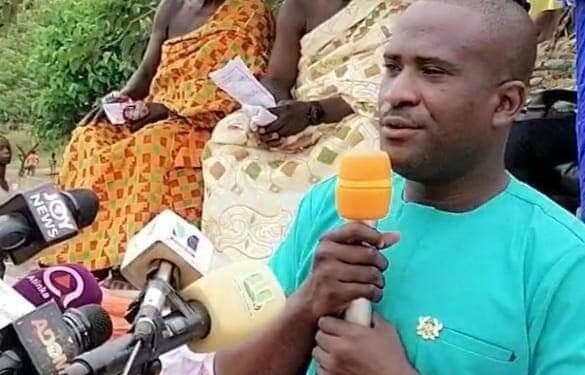

Without mincing words, the newly enstooled Chief, Mr. Alhassan Andani, stated that most of the African country’s economy is too dependent on import trade.

“Literary, look around, everything that we have here is imported from Europe or China. Which currency are you using to do that, where are you getting the foreign currency to do that? So, for me, COVID has actually come to give us a pull back to say, who says we are not producing hand sanitizers; we have got sanitizers being produced with local alcohol, with a little aloe vera, people are producing it. I have seen local companies produce wipes, which were imported previously from China. So, it is just a wakeup call not only for Ghana, but indeed the rest of the world.”

Also, the Managing Director of Stanbic Bank intimated that, the banking industry was already pursuing a gradual evolution in the sector however, “COVID just gave every everybody a jolt for us to sit, and actually look into what this future world is like or will be like.

Mr. Andani revealed that prior to COVID, there were modifications in the mode of production, logistics and value chain, creating an economic shift in China, Europe, USA, India and Africa. It only took COVID to propel the sector to take the plunge in the new future of technology.

However, he stressed that the new future of technology in the banking sector was not created by COVID but rather, brought it to light, and the severity of it exposed by the scourge.

Touching on the dissatisfaction expressed by customers concerning banks support to be minimal, the President of the Ghana’s Association of Bankers iterated that its core mandate is to “always to be the safest repository for your deposits, and our core job is also been to facilitate payments, whether it is domestic or international payment. Our core job is to create credits and to advice businesses. This hasn’t changed,” he remarked.

Refuting claims that support from banks are minimal in the COVID era, he stated that the services provided by the banks have not changed but rather, have been modified to provide faster service because of the digital bridges built between clients and the financial services.

“Credit for example, is a bet on the future and the bet is civil. So, you have a client who has a business vision and is thinking in a particular light. Then, you have a bank who is holding client deposit, and our primary responsibility is to protect these depositors and ensure that, either our capital or depositors funds used to create loans, are safe, and also, we can get it back. So, between that and what the client’s expectations are, we have expanded credit and the credit from the financial sector in Ghana has expanded, even since COVID.

“So, people will think we just shut down; we didn’t shut down. There were critical industries; your telcos and other service providers were still keeping the economy running and we continued to support them. There are some manufacturing firms, they can’t turn on, turn off. So, they have to keep workers, they have to keep raw materials, they have to keep receivables and all that needed to be funded and even as they were not off loading into the market. We needed to sort off extend working capital, reposition their loans. COVID took whole year off, so if you had a repayment arrangement, we had to change that. So, all that support continued to come.”

Speaking on pricing on the cost of credit, Mr. Andani has expressed delight that since COVID, interest rates have globally declined within the banking sector between 400 to 500 bases point. He revealed that the Bank of Ghana pulled down the policy rate from 16 percent to 14 percent.

According to him, Ghana government’s 90-day treasury bill which was between 14 to 15 percent is sitting around the 13 percent.

He indicated that, the cost of credit though in double digits, has mirrored the macro-situation.