Recent forecast on Ghana’s debt to rise to about 80 percent of Gross Domestic Product by Moody’s ratings Agency may be fast approaching than anticipated.

Ghana’s debt to GDP rose significantly from 64 percent in 2019 to 71 percent, representing a public debt stock of GHS273.8 billion in September 2020 due to the government’s increased borrowings in 2020 in response to the health and economic impact of the Covid-19 pandemic on the country.

Considering the pattern of forecasts by the Ratings Agency especially over the past year, its predictions have largely been near-accurate. For instance, when it predicted that the country’s debt stock was going to inch up from 64 percent in 2019 to close at 70 percent in 2020. Hence, in part, the recent forecast by the Ratings Agency cannot be written off as unlikely to occur.

In its recent MPC press statement released on February 1, 2021, the Bank of Ghana indicated that the stock of public debt rose to GHS286.9 billion, representing 74.4 percent of GDP at the end of November, 2020. It is yet surprising that, the Central Bank failed to publish the public debt stock of the country at December 2020, having ended the first month of 2021. Thus, there is a high likelihood that the debt stock would register a further increase for December 2020.

This notwithstanding, the extent of the rise in the country’s debt/GDP ratio depends in part on the government’s capacity to increase domestic revenue mobilization, and ensure a drastic reduction in its fiscal deficit this year, as well as preserving exchange rate stability.

With renewed waves of the Covid-19 pandemic, it has become the more difficult for domestic revenue mobilization to pick up, as the imposition of bans and restrictions on some economic activities have been announced especially, in the hospitality industry. Thus, it is anticipated that domestic revenue mobilization is likely to remain low.

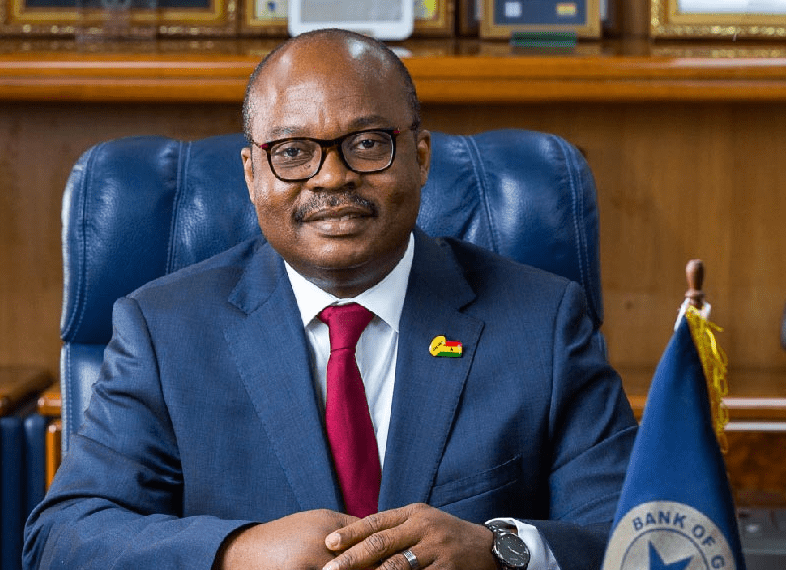

Although, the Governor of the Central Bank of Ghana, in a speech delivered at the University of Ghana Alumni Lectures last year, called for the return to an improved fiscal economy in the medium term by the imposition of tougher fiscal measures, he finds that such is unlikely to happen due to the renewed waves of the coronavirus pandemic.

“The prospects of a sharp fiscal correction in 2021 now looks unlikely amidst the second wave of the pandemic which will be requiring additional spending to provide testing, vaccines, etc. To put debt on a sustainable path and to ensure sustainability in policies, some new revenue measures and expenditure rationalization efforts will have to be pursued within the context of the medium term fiscal framework to allow for the generation of primary surpluses.”

On the back of maintaining exchange rate stability in order to reduce the burden of debt payment, the research arm of Databank has projected that the Ghana cedi will end this year at GHS6.18 to the dollar. The research arm of the Bank notes, albeit, this depreciation will be 3.02 percent lower than that recorded last year. So, at least, the cedi on this count, would moderate the debt burden in terms of debt servicing as well as interest payments maturing this year.

Ghana’s debt level is becoming acute and as suggested by the Governor of the Central Bank, it has become critical that new revenue measures and expenditure rationalization efforts be pursued to set the economy back on a sustainable path.

READ ALSO: Moody’s 80% debt projections for 2021 not realistic – Prof. Quartey