Recent data from the Bank of Ghana show that the various indicators of the banking sector started 2021 with sterling performances. This comes against the backdrop of a constant assurance of the Bank of Ghana that the banking sector is robust and resilient.

However, the performance of the various indicators show that the sector is yet to fully recover from the damages inflicted by COVID-19. This is because some of the indicators that showed signs of a rebound in the second half of last year have dipped marginally.

Worst performing indicators so far in 2021

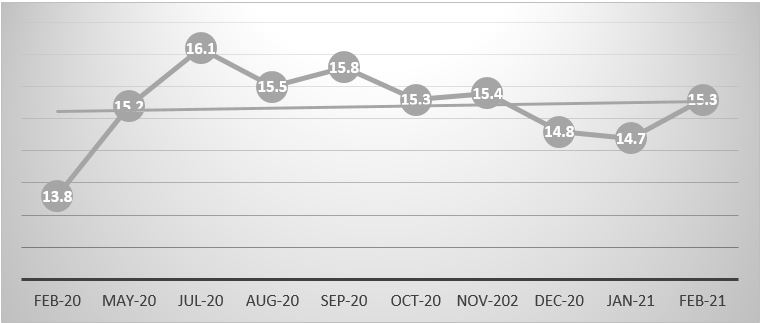

Non-performing loans

One of the indicators of a resilient banking sector is the quality of assets. Asset quality normally reflects the magnitude of existing and potential credit risk associated with the loans. The Non-Performing Loan (NPL) ratio is one of the measures of asset quality. The NPL ratio expresses the amount of non-performing loans as a percentage of the total amount of outstanding loans the bank holds.

The recent data from the Bank of Ghana show that NPL has gone up marginally in February 2021. NPLs rose marginally to 15.3% in February 2021 from 14.7% in January. The current NPL ratio is still above pre-COVID levels of 13.8% in February 2020. The BOG attributed the rise to the general pandemic-induced repayment challenges. Also, the central bank cited some bank-specific loan recovery challenges as another factor that resulted in the rise in NPLs.

Chart 1: Non-performing Loans (percentage)

Management Efficiency

Management Efficiency measured by Total Cost to Gross Income Ratio has deteriorated in the first two months of the year. The rise in the ratio from 75.4% in January 2021 to 77.2% in February 2021 represents a lower efficiency in the sector.

Chart 2: Total Cost to Gross Income Ratio

The deterioration in consumer and business confidence may have had a toll on the sector. The BOG attributed that to heightened uncertainty of a possible lockdown following the upsurge in COVID-19 cases earlier this year. The banking sector is, however, on the right track, reflecting a rebound of the Ghanaian economy.

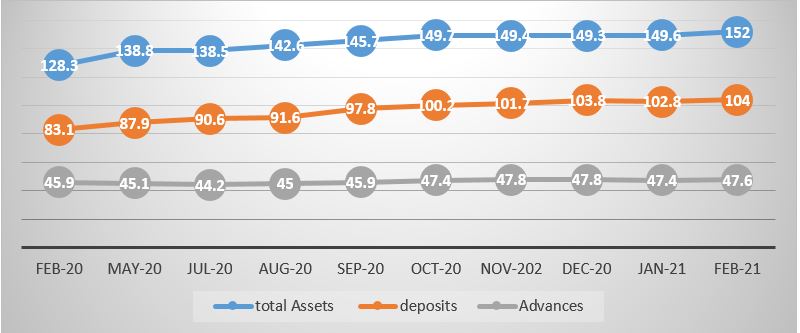

Overall banking sector performance

However, the BOG stated that the overall performance of the banking sector remained strong through End-February 2021. There was robust growth in total assets, deposits, and investments in February 2021. Available data show that all these indicators are well above their pre-COVID-19 levels.

Chart 3: Total Assets, Deposits, and Advances (GH¢’ billion)

Total assets increased to GH¢152.0 billion at End-February 2021 from GH¢128.3 billion recorded in the corresponding month of 2020. This represents a year-on-year growth of 18.5%. The BOG attributed this to a rise in investments in government securities by 45.9% to GH¢67.9 billion.

Similarly, total deposits recorded a year-on-year growth of 25.1% in February 2021. This was as a result of an increase in deposits to GH¢104.0 billion in February, up from GH¢83.1 billion a year ago. The BOG attributed this to the COVID-19 fiscal stimulus, payments to contractors, SDI depositors, and clients of SEC-licensed fund managers. Likewise, total Advances increased by 3.6% year-on-year to GH¢47.6 billion in February 2021, up from GH¢45.9 billion in February 2020.

“Overall, the impact of the pandemic on the industry’s performance seems moderate as banks remained liquid, profitable and well-capitalized”.

Bank of Ghana

Financial Soundness Indicators

Likewise, the financial soundness indicators remained positive underpinned by robust solvency, liquidity, and profitability indicators. The industry’s Capital Adequacy Ratio was 20.2% at End-February 2021. According to the BOG, this is well above the regulatory minimum threshold. Meanwhile, Core liquid assets to short-term liabilities was 26.5% in February 2021 compared with 31.3% a year ago.

Furthermore, the BOG indicated that Net interest income for the first two months of 2021 grew by 10.9% to GH¢2.0 billion. This is lower than the 25.9% recorded a year ago. Moreover, Net fees and commissions grew by 13.7% to GH¢435.4 million in February 2021. This is also lower than the 18.4% growth recorded during the same period last year. According to the BOG, this perfectly reflected the observed dip in growth in loans and trade finance-related businesses.

Also, operating income rose by 8.7% in the first two months of the year. However, the BOG stated that this is lower than the corresponding growth of 23.6%, recorded last year. BOG explained that this was supported by cost control measures which resulted in operating expenses declining by 0.3%.

This is in contrast to the 18.6% increase for the same period in 2020. Loan loss provisions, however, grew sharply by 62.2%, significantly higher than the 6.5% a year ago. This, according to the BOG, is a reflection of continued elevated credit risks. Moreover, profit before tax, increased to GH¢1.1 billion over the first two months of 2021. This is slightly higher than the GH¢1.0 billion recorded in the same period last year.

READ ALSO: The economy is on a rebound with a sustained momentum – BOG