The Ghana Securities Industry Association (GSIA) has disclosed its decision to commit to a “fair” domestic debt exchange program where a joint effort will be made with government to overcome economic challenges.

GSIA communicated this decision after government’s announcement on the extension of the domestic debt exchange program to Tuesday, January 31, 2023. As the government scrambles to find a solution to the country’s worsening economic condition, GSIA promised its support provided government ensures transparency in the implementation of the program.

Announcing the extension of the exchange program, the Office of the Finance Minister revealed that building consensus is key to a successful economic recovery for Ghana, hence resulting in the postponement of the stated deadline.

“Pending further stakeholder engagement with institutional and individual investors who were recently invited to join the debt exchange programme, government has extended the expiration date of the domestic debt exchange program to 31 January, 2023.”

Finance Minister, Ken Ofori-Atta

Reacting to the development in the statement made by the Finance Minster, the Governing Council of GSIA welcomed the Ministry’s decision.

“This is critical to ensure equity and fair treatment of all Individual Bondholders and will further make the exchange program more progressive.”

The Ghana Securities Industry Association (GSIA)

According to GSIA, the Ministry’s position to use this period to further engage with stakeholders, especially individual bondholders to mitigate any adverse impacts is heart-warming, given that “we also reiterated that the commercial terms of the amended offer fell below our expectation,” they said.

GSIA further beseeched government to revise its position in relation to its classification of persons known as individual bondholders.

“We take this opportunity to remind the Ministry of our unwavering position that the Individual Bondholders should include persons who hold bonds directly and those who hold bonds indirectly, that is individuals having shares/units in Collective Investment Schemes that have invested in government bonds and persons on whose behalf bonds are held for in Trust Accounts, a position also espoused by the Ghana Individual Bondholders’ Forum.”

The Ghana Securities Industry Association (GSIA)

DDEP Stands To Loose Its Credibility Due To Date Extension- Analysts

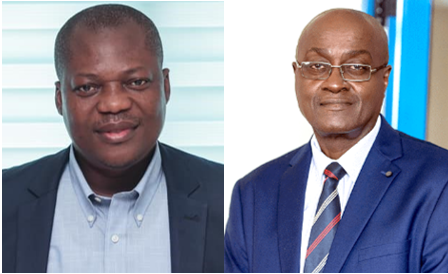

Despite efforts made by financial regulators, institutions and associations including GSIA for the extension of the DDEP, Dr. Richmond Atuahene, a banking consultant and Professor John Gatsi, the Dean of University of Cape Coast Business School, stipulated that the extension of the exchange program to the last day of this month could raise questions over the program’s credibility.

While describing the latest extension, the third in a series, as no surprise, Dr. Atuahene warned that the government is in danger of losing the integrity of its initiative (DDEP) due to the extensions and evident lack of broad consultation.

That notwithstanding, the banking consultant also blamed the controversies surrounding the programme on the finance ministry’s ill-advised decision to exempt certain classes of investors from the DDEP, explaining that it has emboldened the previously included parties to believe they have been disadvantaged.

“Look at the example of Jamaica, which was able to successfully roll out its debt exchange programme. We can’t expect one group to buy in when it sees that others have been excluded.”

Dr. Richmond Atuahene

Likewise, Professor Gatsi argued that the extensions should not focus on getting people to sign on but a period for the government to do the needful such as coming up with a new structure for the programme.

Citing an example, the professor noted that the government could use the period to restructure the modalities, as this is the only way to guarantee a significant enough buy-in for the programme to be successful.

“Government cannot resolve the problem by wiping out the middle class, by hurting people who use their coupon payments for medication, housing and education.”

Professor John Gatsi

Whilst conveying optimism that the new extension period is enough time to get increased participation, Prof. Gatsi urged government to be conscious of its actions as that could have a long lasting negative impact on investors confidence.

“I believe people want to help but it must be in a manner that will let them see that it is worth it. That is how the structure should be. We need it in a manner that does not entirely kill the confidence of investors in government instruments.”

Professor John Gatsi

Read Also : Ghanaian Individual Bondholders Vehemently React As Today Marks Deadline For Signing Up To Government’s DDEP