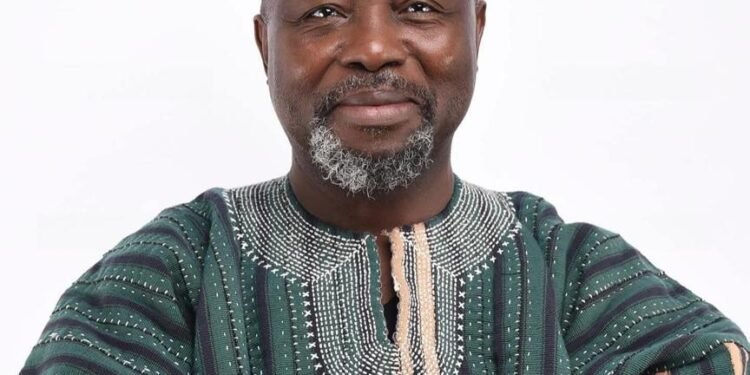

Ghana’s financial institutions, according to an Investment Banker, Dr. Bernard Tetteh-Dumanya, cannot be solely blamed for their over-exposure to government debt securities, which resulted in significant losses during the execution of the domestic debt exchange programme.

The Investment Banker attributed the situation to regulatory frameworks, such as the requirement for Pension Funds to invest more than 70% of their funds in government debt securities.

Speaking during a conversation, Dr. Tetteh-Dumanya disclosed that the current economic environment in the country was “unhealthy” for the financial system.

The assertion made by Dr. Tetteh-Dumanya is particularly relevant given the negative impact experienced by Ghana’s financial institutions during the government’s domestic debt restructuring program. The program was initiated to reduce the government’s debt to a sustainable level, as a precondition for qualifying for a $3 billion bailout program from the International Monetary Fund (IMF).

The domestic debt exchange program is aimed to swap high-yield domestic bonds for longer-term, lower-yielding bonds. However, Dr. Tetteh-Dumanya noted that the program’s implementation was fraught with challenges, including lack of investor confidence, market volatility, and political instability, adding that: “The resultant losses suffered by financial institutions were significant, with some estimating the losses to be in the hundreds of millions of dollars.”

Despite the challenges, Dr. Tetteh-Dumanya divulged that the crisis was with the government and not the banks and other financial institutions. He linked the current environment to the poisoning of the banks and other financial institutions, stating that once the environment improved, the financial system would function effectively.

Government Urged To Limit Its Dependency On The Financial Sector And Debt Securities

While governments often rely on the financial sector to finance their activities, he said, over-reliance on government debt securities can pose significant risks to financial stability.

The assertion made by Dr. Tetteh-Dumanya underscores the need for regulatory reforms in Ghana’s financial sector. The concentration of risk associated with investing heavily in government debt securities must be addressed to safeguard financial stability.

The regulatory frameworks within which Ghana’s financial institutions operate have been a source of concern for some time. For instance, the Pension Funds Act requires Pension Funds to invest a significant portion of their funds in Government debt securities, effectively creating a captive market for government bonds. This has resulted in a concentration of risk for financial institutions, particularly during times of economic uncertainty.

According to Dr. Tetteh-Dumanya, it is worth noting that the over-exposure to Government debt securities is not unique to Ghana. Many other developing countries face similar challenges, with financial institutions investing heavily in government debt securities due to regulatory frameworks and lack of alternative investment options.

Going forward, Dr. Tetteh-Dumanya communicated that there is a need for more prudent debt management practices to mitigate the risks associated with over-exposure to government debt securities.