First National Bank (FNB) Ghana, one of the commercial banks in Ghana, at the end of December 2022 recorded a 23.6% growth in total assets value.

According to the summary financial statement for the year ended 31st December, 2022, the bank within the review period witnessed its assets value rise from GHS 2.48bn to GHS 3.06bn indicating some GHS 586m increase in assets value.

Growth in assets value of the bank was driven by increments in the South African-owned bank’s cash and cash equivalents from GHS 649m in 2021 to GHS 1.05bn in 2022, further supported by an increase in loans and advances to customers which stood at GHS 981m at end-2022.

Liabilities, as indicated by the bank’s report, were driven mainly by deposits from customers (GHS 1.92bn) – which stood at GHS 2.82bn, an increase from the previous year’s figure of GHS 1.93bn.

Growth in deposits by customers indicate increased capacity by the bank to increase loans to customers as well as potential increase in interest-income from loans.

Despite the growth in assets, impairments costs on financial assets held by the bank on the back of the domestic debt restructuring programme amounted to GHS 263m. (Impairment resulting from domestic debt exchange amounted to GHS214m).

The debt exchange programme largely affected the bank’s profitability leading to a net loss of GHS 340m in 2022.

Within the review period, Capital Adequacy Ratio (CAR) of First National Bank declined to 19.82% from 36.62%.

Despite the decline, the bank’s CAR still remains well above the BoG’s minimum CAR requirement of 10%.

Loan asset quality of First National Bank for the period under review deteriorated with non- performing loans ratio of the bank falling from 3.49% in 2021 to 7.09% in 2022.

FBN Bank Records GHS 61.6m Net Profit; Posts 56% CAR At End-2022

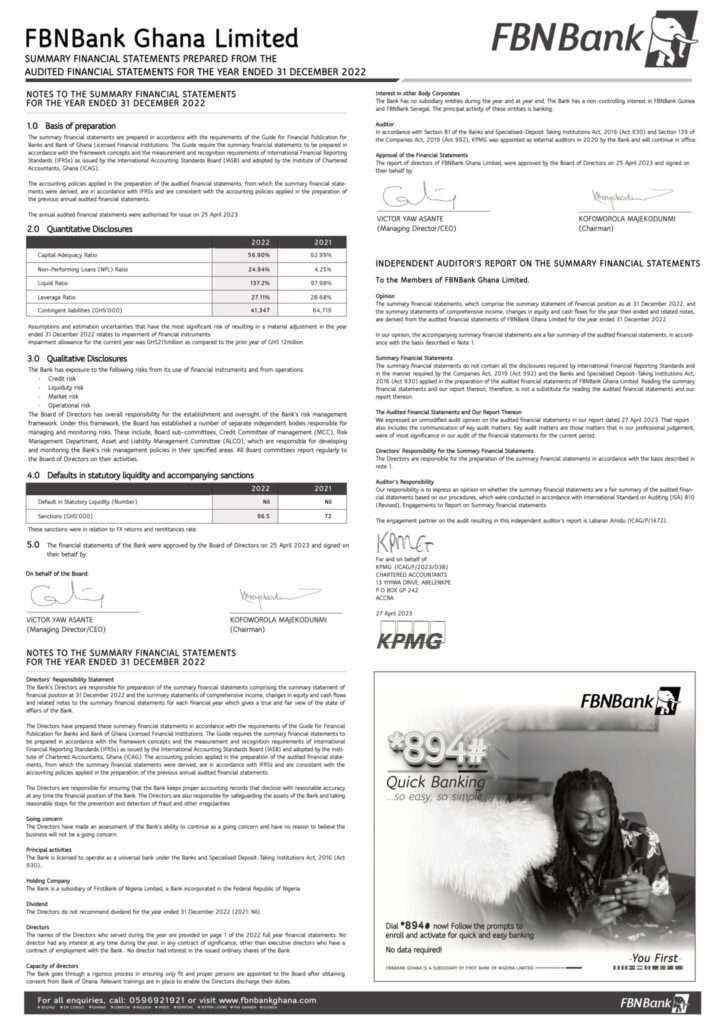

Meanwhile, First Bank of Nigeria (FBN) Ghana for the year 2022 recorded a net profit of GHS 61.6m.

The GHS 61.6m profit recorded in 2022 is a significant achievement by FBN given the fact that most banks in the country for the review period recorded net losses as result of the domestic debt exchange programme undertaken by government.

Also, impairment costs on financial assets held by the bank within the review period rose to GHS 215m from the previous year’s figure of GHS 14.3m on the back of the domestic debt exchange programme.

The recorded net profit for 2022 is however lower than the GHS 73.5m profit recorded in 2021.

Total liabilities of the bank also grew to GHS 2.18bn from GHS 1.32bn on the account of increments in customer deposits which stood at GHS 1.2bn at end-2022.

Capital Adequacy Ratio (CAR) of FBN declined from 62.9% in 2021 to 56.9% in 2022, despite the decline the bank’s CAR still remains significantly above the BoG’s 10% minimum CAR requirement.

Loan asset quality of FBN within the review period deteriorated significantly with the bank’s non-performing loans ratio rising to 24.9% from 4.25%.

Assets value of the bank within the review period grew from GHS 1.91bn in 2021 to GHS 2.83bn in 2022 driven mainly by increments in the bank’s cash and cash equivalents (GHS 621m) and investment securities (GHS 1.5bn).

Read also: World Bank Grants $200 Million Loan For Ghana Digital Acceleration Project