The Bulk Oil Storage and Transportation Limited Company (BOST) has more than doubled its net profit margin in 2022 financial year, with the profit jumping from GH₵161 million in 2021 to hit GH₵342 million in 2022.

This was disclosed by the Board Chair, Ekow Hackman, at BOST’s second Annual General Meeting (AGM) held in Accra, noting that the company has made a 360-degree turn in its fortunes.

Ekow Hackman noted that the transformation that BOST has undergone over the past three years is truly remarkable. “The company has been turned from a heavily-indebted one to a highly profitable one. In 2022, BOST increased its net profit by 112% to GH₵342 million from GHS161 million in 2021”, he reported.

This performance, Mr Hackman noted, should be viewed in the context of a miserable run of losses which has been recorded for more than a decade until 2021. He explained saying “central to our transformation has been the restoration of our business model, which involves the effective utilization of our strategically located fuel depots connected by a network of pipelines and barges”.

“The revival of these assets has enabled us to deliver fuel products securely and cost-effectively to consumers across the country. Through the dedicated efforts of our management and workforce, we have significantly increased the revenue-generating assets of the company to 97% from a trough of 34% in 2017. We are committed to ensuring that 100% of our assets are generating revenue by the end of 2023.”

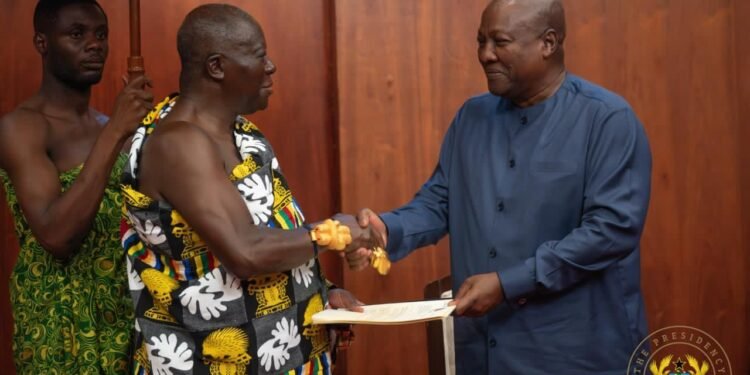

Ekow Hackman

Mr Hackman cited other measures such as the increase in the BOST margin from 7 pesewas to 9 pesewas in December 2022, provided the company with the necessary resources to repair and maintain BOST’s facilities.

At the AGM, Energy Minister Matthew Opoku Prempeh, on his part, said BOST’s success story must be a model to other SOEs. “The progress made by BOST exemplifies the path we should continue to follow, and we encourage you to increase the momentum to sustain this performance and strive for even greater heights,” urged Dr Prempeh.

“BOST’s success contributes to the fiscal policies of the government and supports our national growth and development agenda. It is my expectation that other state-owned enterprises will learn from the BOST story and replicate this performance. This, I believe, will ensure that government can effectively execute its flagship programs using revenues generated by its SOES.”

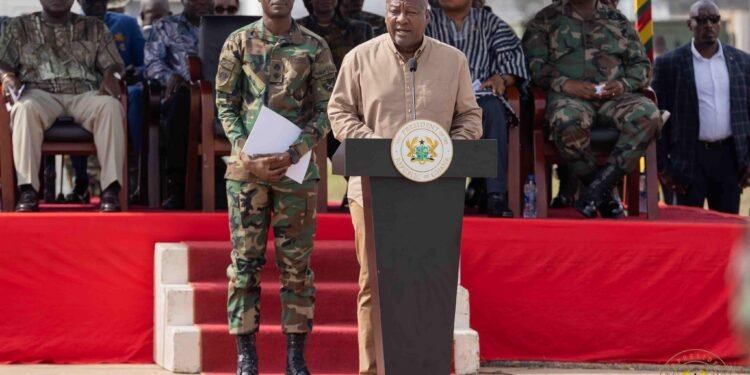

Opoku Prempeh

Dr Bawumia Challenges SOEs to Review their Activities

Vice President, Dr Mahamudu Bawumia, meanwhile, also challenged SOEs to aggressively review their activities in order to fulfil the aspirations for which they were established and also contribute their quota to national development.

Dr Bawumia noted that a well-focused and well-managed SOE is crucial to sustained national development, and it is important that the Managements and Boards of such entities live up to expectation.

“I would like to congratulate the Board, Management and staff for ensuring their stewardship and prudent Management of resources on behalf of the Government and people of Ghana. This should be the blueprint for SOEs to enable them to contribute to the execution of government policies.”

Dr Mahamudu Bawumia

Established in 1993, BOST operated mainly as a monopoly in the petroleum products storage and sales business until 2004 when the Government liberalised the sector by introducing privately owned Bulk Distribution Companies (BDCs).

At some point in its history, despite its wide geographical presence across the country, with assets such as storage facilities, pipelines and marine infrastructure, BOST could not fulfil its mandate due to a number of reasons, including the freezing for almost a decade of the BOST margin, intended for developing, operating and maintaining the company’s storage and transmission infrastructure. This resulted in the lack of investment in the maintenance and upgrading of the infrastructure.

Furthermore, inadequate management systems and corporate governance led to significant operational losses recorded by the company.

The records indicated that as of 2017, BOST was saddled with trade liabilities of USD 624 million, legacy loans of GHS 284 million, BDC claims of USD 37million, CAPEX liability of USD 109 million and GRA tax liability of GHS 47 million.

READ ALSO: Men Are Not The Prize – Kafui Danku