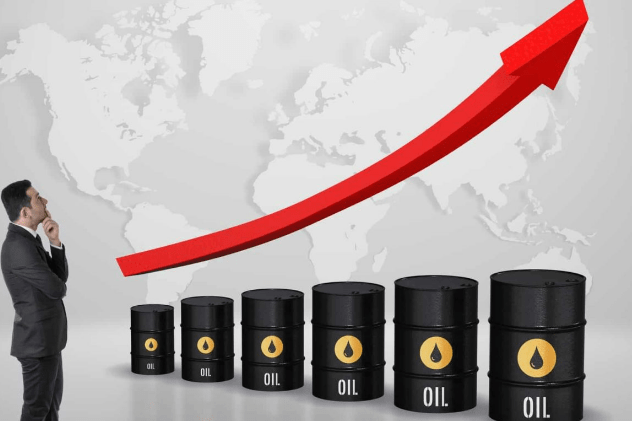

Global oil markets are on high alert as crude prices surged sharply following a dramatic escalation of military tensions between Israel and Iran.

Brent crude has surged more than 7% to $74.40 per barrel, while West Texas Intermediate (WTI) jumped over 8% to $73.15 in early Friday trading. Analysts warn that if hostilities intensify or impact regional oil flows, potentially derailing global inflation control efforts.

“Oil could spike toward $80 if Middle East tensions escalate and supply risks materialize.

“However, rising OPEC+ output may cap gains and revive oversupply concerns into autumn.”

Charu Chanana, Chief Market Strategist at Saxo Markets

The rapid rise in prices reflects mounting fears that the confrontation could disrupt oil flows from the Middle East—a region responsible for nearly one-third of global oil production.

The worst-case scenario, according to market observers, is a potential closure of the Strait of Hormuz, a key chokepoint for global oil trade.

Around 20% of the world’s petroleum passes through this narrow waterway, and any disruption would send shockwaves through energy markets.

“A closure of the Strait or disruption to Iran’s 2.1 million barrels per day in exports could have serious implications for global oil supply and inflation expectations.”

Charu Chanana, Chief Market Strategist at Saxo Markets

Iran has pledged a “harsh response” after Israel launched strikes on Iranian targets, including uranium enrichment facilities, missile production centers, and senior military officials.

According to Reuters, over 100 Iranian drones were launched at Israel in retaliation. The Iranian Revolutionary Guards Corps confirmed that its headquarters had been hit, with reports that its top commander, Hossein Salami, was killed.

Analysts Warn of Weekend Volatility

Crude markets are bracing for what could be a turbulent weekend. Rystad Energy’s Mukesh Sahdev highlighted the gravity of the situation, stating that “Iran’s potential retaliation and blockage of the Straits of Hormuz can threaten crude oil supplies.”

However, Sahdev and others believe a full-scale regional war remains unlikely.

“Given the stated U.S. goal of negotiation, it is unlikely that the conflict will escalate into a full-blown war.”

Rystad Energy’s Mukesh Sahdev

Robert Rennie, Head of Commodity Research at Westpac, echoed that sentiment but emphasized that the risk of short-term volatility remains.

“Israel’s targeting of military facilities and commanders suggests the strikes are more pre-emptive than the start of a sustained conflict. But the key to watch is Iran’s response.

“Risks going into the weekend are very high, and a push above the January highs for crude is very possible.”

Robert Rennie, Head of Commodity Research at Westpac

The United States, a traditional backer of Israel, has moved swiftly to clarify its position. Secretary of State Marco Rubio a press statement stated that the U.S. was not involved in the Israeli strikes and emphasized Washington’s focus on regional stability.

“We are not involved in strikes against Iran and our top priority is protecting American forces in the region.

“Israel advised us that they believe this action was necessary for its self-defense.”

Secretary of State Marco Rubio

While former President Trump had expressed dissatisfaction with the pace of U.S.-Iran negotiations earlier in the week, the Biden administration appears to be pursuing a cautious diplomatic path.

Until this point, oil markets had been guided by fundamentals—OPEC+ output decisions, Chinese demand data, and global economic recovery indicators. But as geopolitics once again takes center stage, traders are rapidly recalibrating.

Brent and WTI had hovered near multi-month lows just days earlier due to concerns about oversupply and sluggish demand growth. But with the Middle East on edge, supply security is now the dominant concern.

Market participants will closely monitor Iran’s next moves, including any threats to maritime security in the Gulf.

READ ALSO: Cedi to Remain Stable Against Major Currencies- Finance Minister Assures Ghanaians