In a development that comes as a relief to Ghanaian motorists, several Oil Marketing Companies (OMCs) have begun reducing fuel prices at the pump, effective this morning, June 16, 2025.

The reductions are largely attributed to the sustained appreciation of the Ghana cedi and the temporary suspension of the controversial GH¢1 Energy Sector Levy, offering consumers some relief in the face of global crude market volatility.

Star Oil is now selling a litre of petrol at GH¢10.99, though the price of diesel remains unchanged at GH¢12.49. Some independent retailers have gone even further, quoting petrol prices as low as GH¢10.99 per litre, raising hopes that competition could drive further price cuts in the coming days.

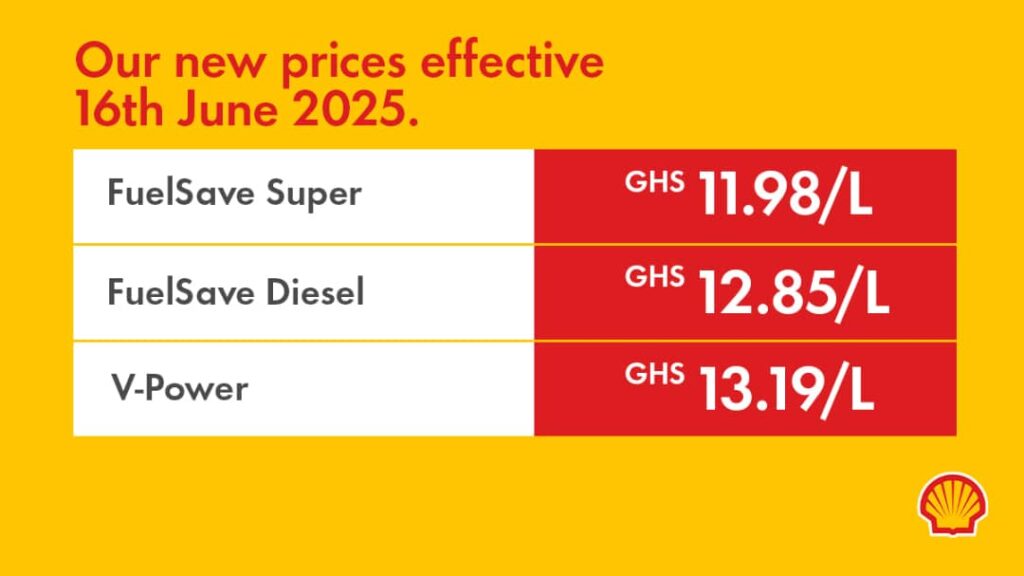

Another major player, Shell Ghana, has also reduced its prices significantly. The company is now selling petrol at GH¢11.98 per litre, down from GH¢12.98 as of June 3. Diesel is retailing at GH¢12.85, a marginal decrease from the previous GH¢12.89.

“These price adjustments reflect the strong performance of the cedi in recent weeks and the government’s decision to delay the implementation of the GH¢1 levy.

“Without these factors, prices could have gone up significantly due to the global crude oil situation.”

Dr. Riverson Oppong, CEO of the Chamber of Oil Marketing Companies (COMAC)

From May 27 to June 12, 2025, the Ghana cedi posted notable gains against the U.S. dollar, easing import costs for petroleum products. This trend has provided temporary stability in ex-pump prices, which might otherwise have been pushed higher by global supply tensions.

Moreover, the government’s decision to postpone the implementation of the Energy Sector Shortfall and Debt Repayment Levy (ESSDRL) on June 16 gave OMCs the necessary breathing room to adjust without inflating retail prices.

Global Oil Pressures Loom

Despite the local reprieve, industry watchers are warning of looming risks. Crude oil prices have surged on the international market amid escalating conflict in the Middle East, particularly the intensifying Israel-Iran confrontation.

Indeed, the Chamber of Oil Marketing Companies cautioned that unless crude prices cool off in the coming weeks, Ghanaians may face a new wave of fuel price hikes starting July 1, 2025.

The Ministry of Energy and Green Transition has hinted at the possibility of new mitigation measures to cushion consumers from future increases. These may include exchange rate interventions, tax policy reviews, or targeted subsidies.

“We are monitoring global trends and preparing options to protect Ghanaian consumers and maintain macroeconomic stability.

“Fuel pricing has implications across the economy — from transportation to food prices — and we are committed to proactive management.”

Richmond Rockson, Public Relations Officer at the Ministry of Energy and Green Transition

While the reduction in petrol prices provides short-term relief for consumers and businesses, the volatility of global oil prices and regional geopolitical tensions present a mixed outlook.

The strength of the Ghanaian cedi and further government intervention will be key in determining whether current pump prices can be sustained or even lowered further in the coming weeks.

For now, motorists are encouraged to take advantage of the lower prices and stay informed about developments as they unfold.

READ ALSO: Cedi to Remain Stable Against Major Currencies- Finance Minister Assures Ghanaians