Iran has sharply increased oil exports amid rising tensions with Israel, raising fears of disruption through the Strait of Hormuz.

Data from vessel-tracking firm TankerTrackers.com revealed that Iran’s oil exports surged by 44% since June 13—the day Israeli strikes reportedly targeted Iranian nuclear facilities and military installations.

Iran has shipped an average of 2.33 million barrels per day (bpd) in the days following the attack, up significantly from the 12-month average leading to June 12.

The move appears strategic: Tehran is leveraging geopolitical uncertainty to move as much crude as possible before potential disruptions to its infrastructure or export routes.

“They’re trying to get out as many barrels as they can, but with safety as their number one priority.”

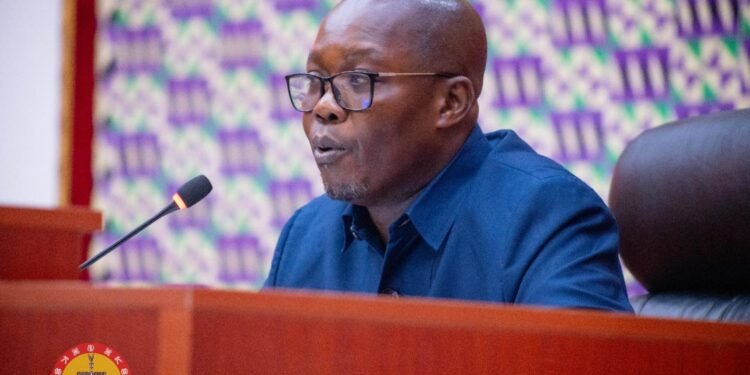

Samir Madani, co-founder of TankerTrackers

This surge in Iranian oil exports comes despite fears that worsening Middle East tensions could destabilize global energy markets, especially if oil infrastructure is caught in the crossfire.

So far, no major Iranian export infrastructure has been hit, and oil is continuing to flow steadily from Kharg Island, Iran’s primary crude export terminal.

Kharg Island, located in the Persian Gulf, handles roughly 90% of Iran’s crude oil exports. All shipments from this terminal must pass through the Strait of Hormuz, the world’s most critical oil chokepoint. Approximately 30% of global seaborne oil trade transits this narrow passage daily.

While the current escalation has not directly targeted this lifeline, analysts are warning that any significant escalation could jeopardize global energy flows.

“As the conflict doesn’t seem to abate, oil supply from the Middle East could become vulnerable if the two sides decide to attack vital energy infrastructure in the region.”

RBC Capital Markets

Although the closure of the Strait of Hormuz remains a worst-case scenario, its implications would be catastrophic for global oil markets.

Analysts from ING, led by Warren Patterson and Ewa Manthey, estimate that such a disruption could drive oil prices to $120 per barrel.

Iran’s High-Stakes Strategy

Iran’s move to aggressively export oil during this volatile period is being interpreted as both a pre-emptive economic measure and a geopolitical signal.

With existing U.S. sanctions limiting Iran’s formal exports, the country often relies on discreet sales, including off-the-radar shipments to Asia.

By accelerating its oil outflows now, Iran could be seeking to shore up revenues in case the conflict worsens or further international sanctions are imposed.

Furthermore, the timing suggests a clear understanding of market psychology. As global oil prices inch higher—Brent crude is trading near $77 per barrel—Iran appears to be cashing in on both volume and price.

The global oil market remains on high alert. While prices have not spiked to crisis levels yet, sentiment is clearly on edge. Even rumors of infrastructure strikes or a blockade of Hormuz could send futures soaring.

Governments and market analysts are closely monitoring not just Iran’s export behavior but also Israel’s potential next move.

Any indication that critical infrastructure—such as Kharg Island or pipelines in Iraq and Saudi Arabia—could be targeted may lead to emergency stock releases or diplomatic interventions.

Iran’s rapid ramp-up in oil exports underscores the complex intersection of energy, security, and geopolitics. As long as vital infrastructure remains intact and oil continues to flow through the Strait of Hormuz, markets may avoid the worst. But the risks are growing.

With Iran clearly racing against time and uncertainty, global stakeholders are left hoping that diplomacy can cool the Middle East tensions before oil becomes the next frontline.

READ ALSO: Cedi to Remain Stable Against Major Currencies- Finance Minister Assures Ghanaians