For the fourth consecutive week, the Government of Ghana has failed to meet its treasury bills (T-bills) target, reinforcing growing investor skepticism about the state’s short-term debt instruments.

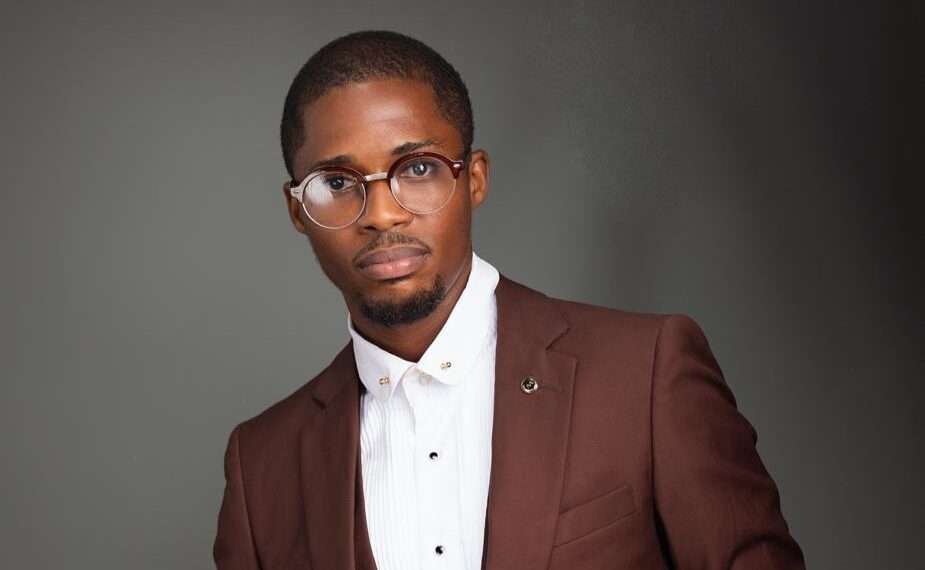

The persistent shortfall—this time a 24% miss—has once again triggered concerns over government liquidity and investor sentiment. Speaking exclusively to Vaultz News, market analyst and CEO of Pipliquidator Fx, Mr. Kwabena Nyarko, minced no words, saying: “The market is voting with its wallet.”

According to auction results released by the Bank of Ghana (BoG), the government targeted GH¢4.551 billion but only managed to raise GH¢3.379 billion—and accepted an even lower amount of GH¢2.952 billion. Meanwhile, investors continue to flock toward Bank of Ghana bills, which are currently offering returns of around 27%, well above the prevailing inflation rate of 18.4%.

Mr. Nyarko was blunt in his assessment: “What we are seeing is a rational flight to better yields and more perceived security. The BoG bills are far more attractive right now, and frankly, they’re overshadowing government treasury instruments.”

Breakdown of the Auction Results

The breakdown of investor participation further underscores the preference for short-term commitments. A whopping 71.55% of the total bids—GH¢2.418 billion—came from the 91-day bill. The government accepted GH¢2.191 billion of that.

The 182-day bill attracted just GH¢716.29 million in bids, with an uptake of GH¢603.74 million. Meanwhile, the 364-day bill fared even worse, with only GH¢236 million tendered and GH¢157.76 million accepted.

“These numbers tell a story. Investors are not just rejecting long-term risk; they are strategically parking funds in shorter, more liquid instruments until market conditions improve.”

Mr. Kwabena Nyarko

Declining Yields Add to Investor Hesitation

Further complicating the outlook is the marginal decline in yields. The 91-day bill dropped slightly by a basis point to 14.69%, the 182-day bill held steady at 15.25%, and the 364-day bill slipped from 15.74% to 15.69%.

To Mr. Nyarko, this signals a dangerous disconnect.

“We have a situation where demand is falling and yet yields are also trending down. That’s not sustainable. It suggests the government is trying to manage borrowing costs, but it’s doing so at the expense of market appetite.”

Mr. Kwabena Nyarko

Eroding Confidence in Government Borrowing Strategy

Investor behavior, Mr. Nyarko noted, reflects not just a preference for higher yields but also a loss of confidence in the government’s short-term borrowing strategy. He believes the Treasury’s repeated inability to meet targets could reflect deeper macroeconomic uncertainty.

“Investors are not naïve. They read the macro signals—rising debt levels, external pressures, and now BoG’s crowding-out effect with better rates. If the government does not realign its instruments and pricing strategy, these weekly shortfalls will become the new normal.”

Mr. Kwabena Nyarko

Commenting on steps the government could take to restore investor confidence, Mr. Nyarko emphasized the need for realistic pricing and more transparent fiscal communication.

“There must be a shift in policy mindset. The government cannot price below what the market deems acceptable and expect full participation. If BoG bills are at 27% and you’re offering 14%, you’re already out of the game. It’s basic economics.”

Mr. Kwabena Nyarko

Longer-Term Impact Of Continuous Shortfalls

He also warned of the longer-term impact of continuous shortfalls, “Persistent auction failures signal fiscal distress. This can ripple into exchange rate instability and potentially reignite inflationary pressure if not handled with foresight.”

According to Mr. Nyarko, consistent underperformance sends a troubling message to both domestic and foreign investors about the state’s ability to attract capital through conventional means.

“If investors begin to doubt the government’s capacity to meet even short-term financing needs, it can trigger a ripple effect across other segments of the financial market.”

Mr. Kwabena Nyarko

Mr. Nyarko stressed that these shortfalls could eventually put upward pressure on interest rates, as the government might be forced to offer higher yields to lure back investors. This could increase the cost of borrowing and worsen the fiscal deficit. “You can’t keep missing targets and expect the cost of capital to remain low. At some point, the market will demand a premium for the perceived risk,” he explained.

In his view, this could complicate the government’s efforts to manage inflation and stabilize the cedi, especially if domestic investors begin favoring foreign-denominated assets with better returns.

Furthermore, he pointed out that continued auction failures might push the government to rely more heavily on central bank financing—commonly known as monetary financing—which could have inflationary consequences. “When shortfalls persist, the temptation is always there to fall back on the central bank. But that path risks undermining monetary discipline and fueling inflation,” Mr. Nyarko warned.

He called for a balanced approach that involves realistic pricing, improved investor engagement, and better coordination between fiscal and monetary authorities to ensure sustainable debt financing.

In this volatile economic environment, investor decisions are increasingly influenced by yield disparities and institutional trust. As Mr. Nyarko aptly summed it up, “The market is speaking clearly—it wants better returns and more trust in fiscal management. Until the Treasury listens, we should expect more of the same.”

The question now is whether the government will recalibrate its strategy or continue to watch investors walk away—one bid at a time.

READ ALSO: Ghana Has Over Two Months of Fuel Reserves — NPA Boss