Ghana’s sovereign petroleum wealth funds, the Ghana Stabilisation Fund (GSF) and the Ghana Heritage Fund (GHF), ended the first half of 2025 with a combined value of $1.42 billion, according to the latest semi-annual report published by the Bank of Ghana.

The figures reflect the country’s continued effort to manage its oil revenues with fiscal prudence and intergenerational equity in mind, as required by the Petroleum Revenue Management Act (PRMA).

The report, covering the first six months of the year, revealed that total inflows into the two funds reached $63.5 million.

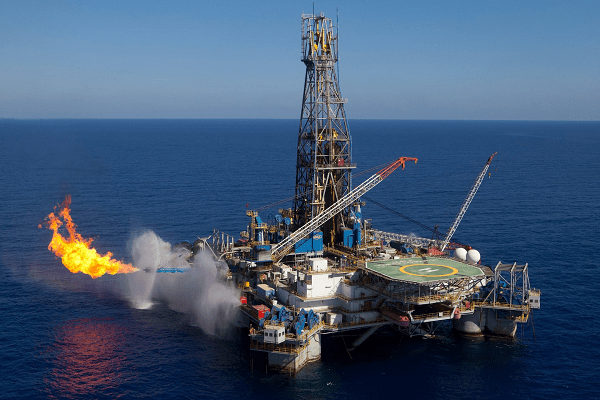

These receipts stemmed from three crude oil liftings executed during the period, two from the Jubilee Field and one from the Sankofa Gye Nyame (SGN) Field.

From these allocations, the Ghana Stabilisation Fund received $44.5 million while the Ghana Heritage Fund was allocated $19.1 million.

However, the two funds have experienced divergent trajectories. The Stabilisation Fund, which is used to cushion shortfalls in national oil revenue during economic downturns, saw its balance fall from $196.92 million at the beginning of the year to $122.91 million by the end of June.

This drop signals active utilisation of the fund, possibly in response to shortfalls or pre-approved budgetary pressures.

On the other hand, the Heritage Fund, a long-term investment vehicle intended to serve future generations, has seen steady growth with no recorded withdrawals.

Its balance rose from $1.26 billion at the start of 2025 to $1.30 billion by mid-year, a reflection of both its accumulation from recent inflows and positive investment performance.

The source of these revenues, Ghana’s crude oil export sales, generated gross receipts of approximately $218.6 million in the first half. The government lifted oil under the 81st and 82nd cargoes from the Jubilee Field, as well as the 17th cargo from the SGN Field.

These barrels were sold to a mix of long-standing off-takers, including Tullow Ghana, Kosmos Energy, ENI Ghana, and Vitol.

Petroleum Revenues Boost Ghana

Additional income was realised from statutory sources such as corporate income tax, surface rentals, and interest earnings.

According to the Bank of Ghana, these revenues, “totaling over $71 million—came primarily from petroleum contractors including Tullow, Kosmos, ENI Ghana, and PetroSA.”

The Petroleum Holding Fund (PHF), the central account for all petroleum revenue inflows, also earned approximately $1.3 million in interest during the review period.

The publication of this data aligns with Section 28 of the Petroleum Revenue Management Act, which mandates biannual reporting on the performance and utilisation of petroleum revenues.

Transparency and public accountability remain central to the legislative framework governing oil income in Ghana.

Fiscal analysts have often pointed to this legal architecture as a key reason Ghana’s oil wealth has avoided the pitfalls of mismanagement seen in other resource-rich nations.

Looking ahead to the second half of 2025, projections suggest additional inflows to the Ghana Petroleum Funds. These will come from oil liftings executed in the first half of the year, but for which revenues were received later and are scheduled for disbursement in the months ahead.

Given the timing of some receipts and global oil price dynamics, there may be moderate upward movement in the fund balances by the end of the year, barring any major fiscal drawdowns.

Industry observers note that while the Heritage Fund’s growth is encouraging, the declining balance of the Stabilisation Fund could reignite conversations around prudent spending, especially in an election cycle.

As Ghana continues to rely on oil revenues to support its development agenda, the performance of the Petroleum Funds will remain a barometer of fiscal responsibility and long-term planning.

For now, the semi-annual report reinforces the critical role that transparency and adherence to legal frameworks play in protecting Ghana’s natural resource wealth.

READ ALSO: Bright Simons Critiques Ghana’s Sports Infrastructure: Misplaced Priorities and State Enchantment