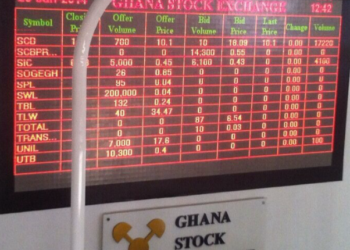

The Ghana Stock Exchange (GSE) kicked off the week with a vibrant mix of gains and losses, creating what many market observers are calling a day of “fireworks”.

Trading activity saw some equities blazing upward while others plunged, painting a dynamic picture of investor sentiment and market forces at play.

Clydestone Ghana emerged as the biggest gainer in Monday’s trading session, recording a massive 11.11% appreciation in its share price. The stock closed at GHS 0.10 per share, lifting investor confidence in the company and sparking curiosity about what’s driving renewed interest in the fintech and payment solutions provider.

Though the volume of Clydestone shares traded was not the highest on the day, the price appreciation sent strong signals to the market. For many investors, this move may be seen as speculative positioning or a reflection of underlying value not previously captured.

Clydestone was not alone in the green territory. Fan Milk Ghana followed with a 1.65% gain, a positive movement that may reflect improving sales performance or anticipation of stronger half-year results. Societe Generale Ghana edged up 0.51%, and GCB Bank, one of Ghana’s largest indigenous banks, posted a modest 0.21% gain.

These gains, although marginal compared to Clydestone’s leap, contributed to a mixed market sentiment, with pockets of optimism balanced against broader caution.

TotalEnergies Leads Decliners

On the losing end, TotalEnergies Marketing Ghana took a sharp blow, with its share price plunging 9.95% to close at GHS 29.94 per share. The energy giant’s dramatic decline made it the worst-performing stock of the session. The reason for the drop wasn’t immediately clear, but it could reflect short-term investor profit-taking or uncertainty surrounding oil market trends and operating margins.

Other notable losers included SIC Insurance Company, which declined 0.88%, and Access Bank Ghana, down by a marginal 0.06%. The overall downward pressure from these stocks weighed on the main index.

GSE Composite Index Dips Despite Weekly and YTD Gains

Despite the stellar performance of a few stocks, the GSE Composite Index (GSE-CI) slipped by 28.42 points (-0.43%) to close at 6,644.69. However, the broader outlook remains positive. The index has recorded a 1-week gain of 3.22%, a 4-week gain of 6.34%, and an impressive year-to-date (YTD) gain of 35.92%.

This suggests that while short-term volatility persists, the market has maintained solid upward momentum in 2025, driven largely by strong performance in the banking and telecommunications sectors.

The GSE Financial Stocks Index (GSE-FSI), which tracks performance of listed financial institutions, also posted a 0.03% uptick to close at 3,413.27 points. Though the 1-week performance was slightly negative (-0.03%), the index posted a 4-week gain of 1.1% and a strong YTD gain of 43.37%.

This reflects sustained investor confidence in Ghana’s financial services sector, which has remained resilient amid macroeconomic uncertainties.

Trading Volume and Turnover Plunge

While the market was alive with price movement, trading activity saw a sharp decline in volume and turnover. A total of 9,418,351 shares worth GHS 32,477,375.00 exchanged hands. This marked a 64% decline in volume and a 68% drop in turnover compared to the previous trading day on Friday, July 25.

Despite the slowdown, MTN Ghana remained the most traded stock by volume, accounting for 9.14 million shares, further reinforcing its dominance on the exchange. Other active stocks included CalBank (108,203 shares), TotalEnergies (82,559 shares), and SIC Insurance (29,388 shares).

The market capitalization of the GSE stood at a solid GHS 141.8 billion, underscoring the depth and liquidity of Ghana’s equity market. While daily fluctuations may cause volatility, the overall size of the market reflects a healthy and investible environment.

Outlook: Volatility Ahead, but Optimism Endures

As the week unfolds, market participants are likely to keep a close eye on earnings releases, macroeconomic updates, and global commodity prices. The day’s fireworks—both positive and negative—signal a market that is alive with activity and ripe for opportunities, but not without risk.

In the words of one market analyst, “This is what makes the GSE exciting: it moves with the rhythm of economic and investor sentiment. Every trading day tells a new story.”

READ ALSO: BoG Governor Flags Key Inflation Risks Amid Strong Fiscal Gains