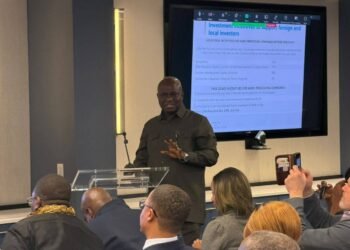

Dr. Ransford Annetey Abbey, Chief Executive Officer of the Ghana Cocoa Board (COCOBOD), has disclosed that a rollover of over 333,000 tonnes of cocoa from the 2023/24 season was sold at just $2,600 per tonne by the previous Cocobod administration.

This, he noted significantly depressed the declared Free On Board (FOB) price for the 2024/2025 season, resulting in lower earnings for cocoa farmers and partly responsible for the marginal increase in cedi value for the 2025/26 season.

According to Dr. Abbey, this massive rollover was concealed from the public, Parliament, and even many top officials within COCOBOD. The revelation, he said, has become central to understanding why, despite record global cocoa prices in 2024, Ghanaian cocoa farmers were offered a producer price that fell well below expectations.

“At the heart of pricing and what we are able to pay the farmer lies something significant that most of us didn’t know about. The Cocoa Board sold 333,767 tonnes of cocoa at $2,600 per tonne in the 2023/2024 season, collected the money, signed the contracts—but failed to deliver because there was no cocoa.”

Dr. Ransford Annetey Abbey, Chief Executive Officer of the Ghana Cocoa Board (COCOBOD)

The undisclosed backlog, he said, was later rolled into the 2024/2025 season, forcing COCOBOD to use newly harvested cocoa—sold on the global market at prices between $8,000 and $10,000 per tonne—to honor old contracts signed at a much lower price.

“While the farmer was producing for you and the price was, let’s say, on average around $8,000 or $8,500, you were using that cocoa to service cocoa that you sold for $2,600 and could not deliver” .

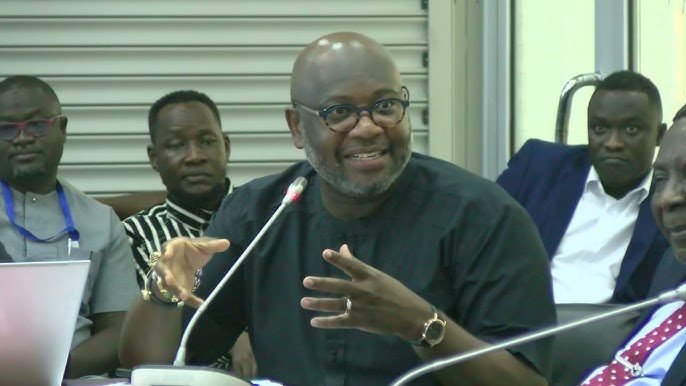

Dr. Ransford Annetey Abbey, Chief Executive Officer of the Ghana Cocoa Board (COCOBOD)

This situation, Dr. Abbey noted, is what led COCOBOD to declare an FOB of $4,850 for the 2024/2025 season—substantially lower than the actual market prices at the time.

From this FOB value, the farmer received $3,100, which represented 63.9 percent. “Mind you, cocoa prices were higher then than today. Yet the FOB that COCOBOD and the government declared was only $4,850. That’s the outcome of the rollover,” he emphasized.

Lack of Transparency

He criticized the lack of transparency in the previous administration’s handling of the issue. “The issue of the rollover wasn’t made public. The Parliamentary Committee on Agriculture and Cocoa didn’t know. The Finance Committee didn’t know. Even many people at COCOBOD didn’t know,” he said.

Dr. Abbey detailed the mechanism by which the FOB price is calculated, stating that a weighted average is normally applied when multiple price contracts exist. “If you’re expecting, let’s say, 600,000 tonnes of cocoa, and part of it will go for $2,600 and the rest for, say, $7,000 or $8,000, you strike a weighted average. That becomes your FOB,” he explained.

The scale of the impact, he added, is not trivial. For the 2024/2025 season, COCOBOD managed to clear around 230,000 tonnes of the rollover stock, but over 100,000 tonnes still remain outstanding. This leftover volume, he said, will again affect the new season’s pricing and be responsible for the earnings for farmers in the 2025/2026 season.

“This was hidden from everybody. And that’s what made the declared FOB artificially low,” Dr. Abbey said, adding that the COCOBOD press release announcing the 2024/2025 producer price did not include the declared FOB value of $4,850. “But in the current minister’s release for this year, you will find the $7,200 FOB figure clearly stated. Why was that not done last year?” he queried.

Responding to critics who argue that rollovers are not new and occurred under previous administrations, Dr. Abbey drew a sharp distinction in scale and financial outcome.

He cited a rollover incident in 2016/2017 of about 50,000 tonnes, but pointed out that the contracts then were priced higher than the cocoa used to fulfill them, resulting in a net financial gain for COCOBOD. “In that case, we made a gain. This time, we lost big. Do the math. It’s huge,” he stressed.

Serious Regulatory Lapse

Dr. Abbey also disclosed a serious lapse in regulatory compliance, revealing that COCOBOD failed to submit financial reports to the State Interests and Governance Authority (SIGA) for six consecutive quarters—equivalent to one and a half years. “They provided operational reports, but not the financials,” he said. “What was anybody hiding?”

The lack of disclosure meant that members of Parliament and key oversight institutions were kept in the dark about critical developments in the cocoa sector, including what Dr. Abbey described as a central factor influencing Ghana’s earnings from cocoa and the welfare of farmers.

“This information was at the heart of what the farmer was going to earn. At the heart of how this industry was going to thrive. And yet it was never disclosed by the then administration”.

Dr. Ransford Annetey Abbey, Chief Executive Officer of the Ghana Cocoa Board (COCOBOD)

The CEO of COCOBOD further noted that the issue did not feature explicitly in the transitional briefing handed to the new government.

“Speaking to those in the transition team, they say this matter didn’t come up directly. I’m told it was hidden in aggregated figures from 2017 onwards. But something of this gravity ought to have been treated as a standalone item.”

Dr. Ransford Annetey Abbey, Chief Executive Officer of the Ghana Cocoa Board (COCOBOD)

As Ghanaian cocoa farmers continue to demand fair pricing amid volatile international markets, Dr. Abbey’s revelations are likely to trigger calls for a thorough audit of COCOBOD’s recent financial and operational decisions.

The disclosure raises pressing questions about how Ghana’s largest agricultural export commodity was managed and whether the interests of farmers were sacrificed in the name of political expediency.

READ ALSO: Mahama Unveils Bold Health Reforms at Africa Health Sovereignty Summit