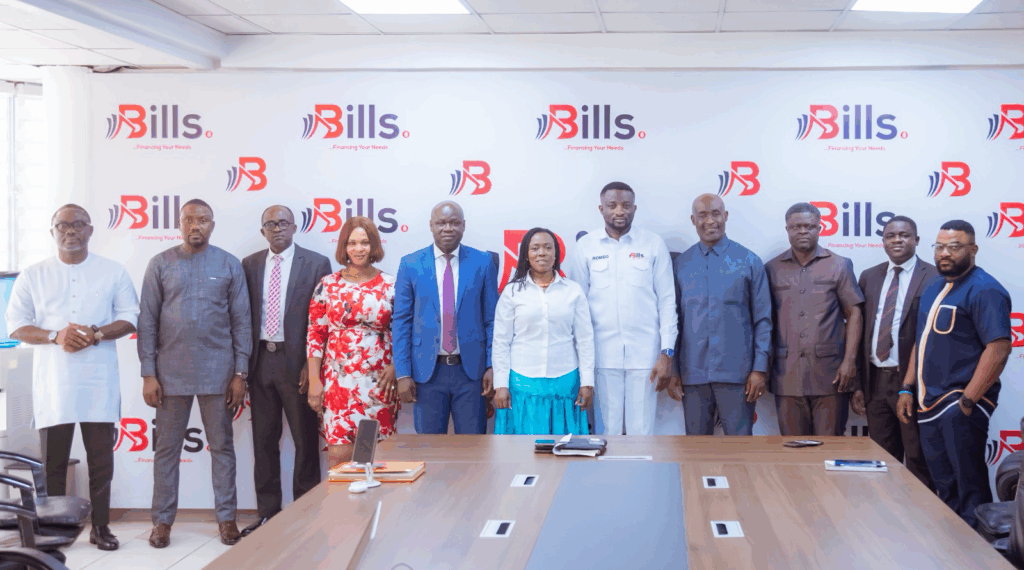

The Ghana National Chamber of Commerce & Industry (GNCCI) has engaged Bills Micro-Credit Limited in a strategic partnership aimed at enhancing financial access, literacy, and support for local businesses.

The delegation, led by GNCCI President Mr. Stephane Abbas Miezan, included CEO Mr. Mark Badu-Aboagye and First Vice President Dr. Emelia Asiakwa. They were warmly received by Mr. Romeo-Richlove Elorm Seshie, CEO of Bills Micro-Credit.

The visit marks a significant moment in private sector cooperation, where finance and policy advocacy converge to provide tangible support for entrepreneurs across the country.

The GNCCI, with over 10,000 members and eight regional branches, is a leading advocate for private sector growth in Ghana. During the engagement, Mr. Abbas Miezan emphasized the Chamber’s continued commitment to providing enterprise development services, facilitating market access, and championing business-friendly policies.

“We are happy to share insights into our ongoing work in business development, market access, and enterprise support, as we do for all members. Partnering with and onboarding Bills Micro-Credit will be great due to the significant role you play in the financial services sector.”

Mr. Abbas Miezan

The leadership of GNCCI highlighted the importance of building partnerships that not only drive policy dialogue but also offer real solutions in the form of capital access and technical support to MSMEs.

A Natural Synergy

Mr. Romeo-Richlove Elorm Seshie, CEO of Bills Micro-Credit, expressed optimism about the collaboration, emphasizing the alignment between the two institutions’ missions. While GNCCI represents the voice of business and pushes for a conducive policy environment, Bills Micro-Credit offers tailored financial services designed for the unique needs of MSMEs.

“This kind of partnership is what Ghana’s SME ecosystem needs—one that brings together advocacy, finance, and hands-on support to drive real results,” Mr. Seshie affirmed. He reiterated Bills Micro-Credit’s readiness to co-create impactful programs with GNCCI that will address long-standing gaps in business support, especially in underserved communities.

The discussions between the two institutions centered on several key themes that could form the backbone of their collaboration. These include:

- Enhanced access to finance: Making credit more accessible, especially to small and informal businesses that often lack collateral or financial history.

- Financial literacy training: Providing MSMEs with the knowledge and tools to manage their finances responsibly and build resilient businesses.

- Capacity building programs: Equipping entrepreneurs with business management skills, including record-keeping, customer engagement, and product development.

- Policy advocacy support: Amplifying the voices of MSMEs in policy dialogue to ensure that the business environment reflects their realities and challenges.

Such a multi-pronged approach aligns with Ghana’s broader economic goals of deepening financial inclusion and promoting indigenous enterprise development.

A Tour of Operational Excellence

As part of the visit, the GNCCI leadership team was given a guided tour of the Bills Micro-Credit offices to gain deeper insight into the company’s operations, client service delivery model, and technology-driven loan processing systems.

Bills Micro-Credit Limited is a licensed, non-bank financial institution known for its fast, flexible, and accessible financial solutions. With a growing national presence and over 2,000 employees, the company is a key player in promoting financial inclusion in Ghana.

Through mobile-based services, branch networks, and customer-centric policies, Bills Micro-Credit ensures that credit reaches those who need it most—particularly women, youth, and informal sector businesses that are typically excluded from traditional financial institutions.

Building a Stronger MSME Ecosystem Together

The potential collaboration between GNCCI and Bills Micro-Credit signals a new chapter in the quest to build a robust and inclusive MSME ecosystem in Ghana. By leveraging the strengths of both institutions—policy advocacy and financial empowerment—the partnership promises to deliver long-term impact.

As both institutions prepare to finalize modalities for joint programs, the broader business community eagerly anticipates innovative solutions that will reshape the MSME sector, improve livelihoods, and stimulate inclusive economic growth.

In a country where MSMEs form the backbone of the economy, such partnerships are not just timely—they are essential.

READ ALSO: Inflation Hits 45-Month Low