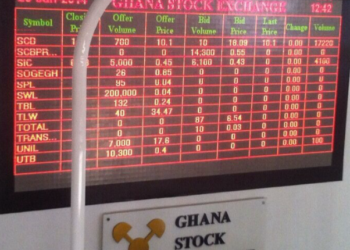

The Ghana Stock Exchange (GSE) began the trading week on a powerful note, as market capitalization surged past the GHS150 billion mark for the first time, closing at GHS151.1 billion.

This historic leap, which added over GHS2 million in value in a single session, was propelled by a massive 194% jump in trading volume and a 167% surge in turnover compared to the previous trading day.

The crossing of the GHS150 billion threshold represents a psychological and technical milestone for the GSE, signaling renewed investor confidence and growing market activity. The market capitalization increase was largely underpinned by price gains in some heavyweights, including Ecobank Ghana and MTN Ghana, as well as an exceptional performance from Trust Bank Gambia.

This achievement comes on the back of sustained bullish momentum over the past month, which has seen the benchmark indices post double-digit gains.

Standout Performers of the Day

Trust Bank Gambia emerged as the star performer of the session, posting a remarkable 10% share price appreciation to close at GHS1.10 per share. This surge underscored strong investor demand and optimism in the financial sector’s performance.

Ecobank Ghana also gained 1.14%, closing higher and contributing to the market’s upward push. MTN Ghana, the most traded equity of the day, saw a modest 0.51% gain but dominated trading volumes with an eye-catching 7.41 million shares changing hands.

Republic Bank Ghana, Ecobank Transnational, and SIC Insurance Company also recorded significant trading activity, though without substantial price movements.

Despite the strong market sentiment, not all equities closed higher. The Accra bourse recorded one loser in a sea of gains. The NewGold ETF slipped by 0.88%, making it the only equity to lose value during the session. Analysts suggest that the drop was more a function of global commodity price adjustments than local investor sentiment, as gold prices have faced short-term pressures in recent trading sessions.

Indices Reflect Ongoing Bull Run

The GSE Composite Index (GSE-CI) climbed 25.53 points, or 0.35%, to close at 7,411.94. This increase extended its 1-week gain to 5.8%, its 4-week gain to 15.17%, and its remarkable year-to-date gain to 51.62%.

The GSE Financial Stocks Index (GSE-FSI) also posted a modest 0.17% rise to reach 3,414.69 points. While the FSI has experienced slight weekly and monthly declines of 0.4% and 0.42% respectively, it still boasts an impressive year-to-date gain of 43.43%.

Market analysts believe that the continued rally is being supported by a combination of strong corporate earnings, renewed foreign investor interest, and improving macroeconomic indicators, including stabilizing inflation and exchange rates.

Trading Volume and Turnover Skyrocket

In total, 7,843,831 shares valued at GHS30,023,919.68 were traded on the day. This represents a 194% improvement in volume and a 167% improvement in turnover compared to the previous session.

The surge in trading activity is being interpreted as a sign of increasing liquidity in the market. This could be further fueled by institutional investors repositioning their portfolios in anticipation of upcoming corporate announcements and interim dividend declarations.

Investor optimism is clearly reflected in the current rally, with traders seizing opportunities in both blue-chip and mid-tier stocks. Market watchers point out that the bullish momentum could continue if macroeconomic stability persists and companies maintain positive earnings trajectories.

Furthermore, the performance of financial and telecom equities continues to serve as a key driver for the GSE, with these sectors accounting for the majority of market capitalization and trading volumes.

Outlook for the Week Ahead

With the market breaking significant capitalization and index barriers, all eyes will be on whether the rally can sustain its momentum through the rest of the week. The combination of robust trading volumes, rising prices, and strong investor sentiment suggests there could be further gains, particularly if global markets remain stable.

However, analysts also caution that after such a strong run, the market may see some profit-taking, which could create short-term dips. Still, the long-term trend appears bullish, supported by improving fundamentals in both the corporate and economic environment.

The Ghana Stock Exchange’s performance on the first week day has not only captured investor attention locally but also positioned the bourse as one of the most dynamic markets in the region. With market capitalization above GHS151 billion and trading volumes soaring, the GSE’s momentum could well set the stage for a historic year in Ghana’s capital markets.

READ ALSO: Trump Announces Decision To Deploy US National Guard In Washington, DC