Ghana’s reliance on imported corn is set to surge dramatically in the 2025/26 marketing year, with projections indicating a 67 percent increase in import volumes.

According to the U.S. Department of Agriculture’s (USDA) Grain and Feed Annual 2025 Report, Ghana will bring in an estimated 500,000 metric tonnes of corn, compared to the previous year’s 300,000 metric tonnes. The development underscores the government’s continued suspension of restrictions on corn imports, a measure introduced by the previous administration to ease supply pressures and stabilize prices.

The decision to maintain open borders for corn imports has been met with mixed reactions. Policymakers argue that the measure is necessary to protect consumers and agribusinesses from steep price hikes, especially during lean production seasons. In February 2025, corn prices peaked at GHȼ380 ($24.52) per 50kg bag, raising alarms about food inflation. The influx of imported supplies has since helped cool prices, providing short-term relief to households and feed processors that depend heavily on maize.

However, concerns are mounting that such policies may undermine Ghana’s domestic production base. Farmers across key maize-growing areas, particularly in the Afram Plains, have reported a glut of maize that remains unsold. This situation has triggered fears of market distortions, where local harvests are crowded out by cheaper imports.

Farmers Struggle with Market Glut

While consumers may be celebrating lower prices, farmers face an increasingly uncertain future. Reports from the Afram Plains show that many maize producers are struggling to sell their harvests due to the sudden influx of imports. Local traders, overwhelmed by oversupply, have scaled back purchases, leaving farmers burdened with storage and financial challenges.

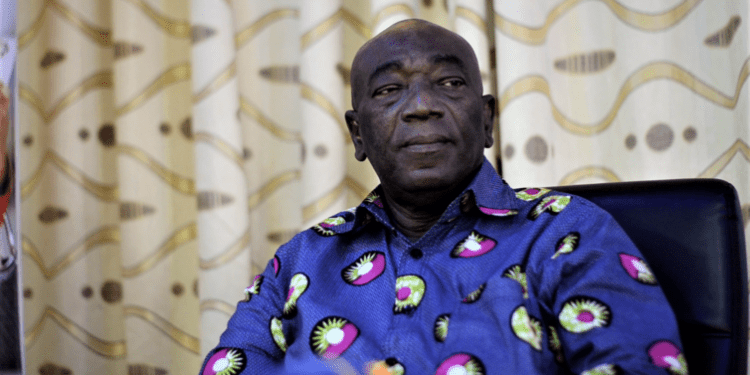

Anthony Morrison, CEO of the Chamber of Agribusiness Ghana, has cautioned that the government must develop a long-term strategy to balance imports with domestic production. “We may have to look at a long-term strategy, not just beating down the production costs,” he stressed. According to Morrison, sustainable policies must safeguard both consumers and farmers to prevent systemic disruptions in the maize value chain.

The surge in corn imports can be traced back to the devastating dry spells of 2024, which crippled domestic maize production. The reduced output left the country vulnerable, forcing policymakers to rely on external sources to meet demand. That year, the administration implemented tax exemptions and introduced private sector incentives to facilitate large-scale corn imports, which rose nearly 18-fold compared to the previous year.

Though such interventions helped avert a food crisis, they also marked a turning point in Ghana’s dependency on foreign supplies. The USDA report suggests that unless domestic production is boosted through irrigation, mechanization, and research into drought-resistant seed varieties, Ghana could continue to face cycles of shortages followed by import surges.

The Consumer-Farmer Divide

The policy dilemma highlights a widening divide between consumer needs and farmer welfare. On one hand, consumers and agribusinesses benefit from stable prices and readily available corn for food and feed processing. On the other hand, farmers bear the brunt of policies that make it difficult for them to compete with imported supplies. Without targeted support such as subsidies, guaranteed purchase schemes, and market expansion initiatives, many smallholder farmers may be forced out of maize cultivation altogether.

Agricultural stakeholders are urging the government to adopt a more balanced approach. They argue that while imports may be necessary in times of crisis, an over-reliance on foreign supplies could weaken local food security in the long term. “We need a clear framework that ensures imports complement local production, not replace it,” Morrison noted.

Experts believe that a combination of improved extension services, affordable inputs, irrigation infrastructure, and access to regional markets could enable Ghanaian farmers to thrive despite the competition. Without such measures, the projected 67 percent rise in imports could leave lasting scars on the domestic maize industry.

READ ALSO: Bullish Wave Lifts GSE Composite Index to 7,339 Points with Zero Decliners