The Ghanaian banking sector is witnessing a profound technological shift as artificial intelligence (AI), particularly Generative AI (GenAI), gains rapid adoption across institutions.

According to the 2025 Ghana Banking Survey by PwC, GenAI has become one of the most transformative forces in the industry, enabling banks to enhance operational efficiency, improve customer experience, and strengthen financial inclusion.

The report highlighted a robust year for the banking industry, with total deposits soaring by 32.2%, from GH₵201.73 billion in 2023 to GH₵266.73 billion in 2024. This growth not only reflects the sector’s resilience amid economic headwinds but also its readiness to embrace cutting-edge tools that drive digital transformation.

Market Leaders Retain Strong Grip

Among the major players, Ecobank Ghana PLC (EBG), GCB Bank PLC (GCB), and Stanbic Bank Ghana (SBG) retained dominance by leveraging expansive branch networks alongside bold digital strategies. Together, EBG and GCB captured 27.3% of the market share in deposits, up from 25.1% the previous year. Their ability to mobilize deposits demonstrates both high customer trust and the effectiveness of tailored financial products designed for SMEs and salaried professionals.

Stanbic Bank, on the other hand, cemented its position as a digital innovator, rolling out AI-driven banking solutions that combine human expertise with technology. These three institutions are setting the pace for the rest of the industry, balancing traditional strengths with new digital tools.

PwC’s findings show that nearly seven in ten banking executives (68%) confirmed adopting GenAI tools in 2024. This surge reflects a strong appetite for automation, particularly in customer-facing services and back-office operations. Banks are now deploying AI-powered chatbots to provide instant, personalized customer interactions, while platforms like ChatGPT are being integrated to boost internal productivity and streamline service delivery.

For customers, this means faster response times, tailored product recommendations, and a seamless digital banking experience. For banks, it translates into reduced operational costs, better fraud detection, and sharper decision-making capabilities.

PwC Experts Outline the Roadmap

Speaking on the implications of this transformation, Vish Ashiagbor, Country Senior Partner at PwC Ghana, emphasized that successful GenAI adoption hinges on building trust. “For the banking industry to successfully adopt GenAI, it first needs to build trust in AI-driven digital transformation in Ghana, which requires responsible AI policies and secure environments,” he noted. Ashiagbor pointed to ethical data use, robust governance, and strong risk management as prerequisites for sustainable AI integration.

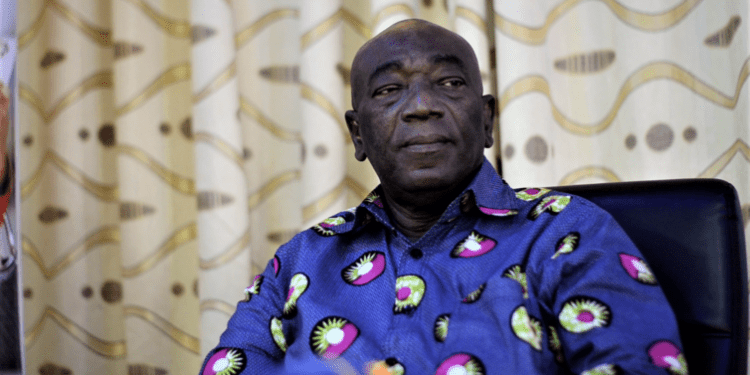

Kingsford Arthur, PwC Ghana’s Financial Services Leader, echoed this view, stressing the need for balance.

“For banks in Ghana, the way forward is to find the right balance—using automation while keeping the human touch, modernizing infrastructure without sacrificing compliance, and encouraging innovation while ensuring data integrity.”

Kingsford Arthur

Emerging Players Catch Up

While Ecobank, GCB, and Stanbic dominate the conversation, emerging players like Zenith Bank Ghana and Access Bank Ghana are also carving niches through agile, customer-focused strategies. By investing in digital solutions and adopting AI at a smaller but strategic scale, these banks are gaining traction in competitive segments, particularly among young, tech-savvy customers.

Their rise signals that AI adoption is not limited to market leaders but is spreading across the industry, creating a level playing field where innovation and customer-centricity define success.

The PwC survey underlines that the Ghanaian banking sector is at a critical juncture. With deposit mobilization rising sharply and AI adoption accelerating, banks must now focus on long-term sustainability. This involves not only technological investments but also customer education, regulatory compliance, and trust-building initiatives.

For SMEs and individuals, the shift is equally promising. With AI-driven insights, banks can design products tailored to business needs, enhance credit assessment, and expand financial access. As Ghana continues its digitalization journey, the banking sector is poised to play a pivotal role in shaping a modern, inclusive financial ecosystem.

READ ALSO: ADB Honors National Best Farmer 2024 with GH¢1m Cash Prize