Indigenous mining and engineering powerhouse Engineers & Planners (E&P) has taken full control of the Black Volta and Sankofa gold concessions in Ghana’s Upper West Region, following the acquisition of Azumah Resources Ghana Ltd and Upwest Resources Ghana Ltd.

The landmark transaction, officially registered with the Registrar of Companies and approved by the Minerals Commission, ends nearly two decades of dormancy marked by under-investment, legal disputes, and financial hurdles that had kept the promising concessions idle.

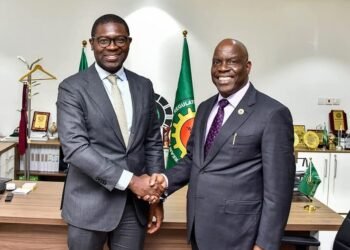

Chief Executive Officer Ibrahim Mahama hailed the deal as a watershed moment in Ghana’s extractive industry.

“This is a proud moment for E&P and for Ghana. Our commitment is to ensure that these projects, which have been dormant for too long, finally deliver real value to our country and its people.

“We will work transparently with regulators and stakeholders to build mines that create shared prosperity.”

Chief Executive Officer Ibrahim Mahama

The takeover transfers all issued shares of the concessions’ Ghanaian beneficial owner to E&P, positioning the company at the forefront of Ghana’s gold mining future.

Originally granted in 1992, the Black Volta and Sankofa concessions have long been viewed as potentially lucrative assets.

However, legal disputes, shifting investor priorities, and persistent capital shortfalls meant little progress on actual mine development.

For host communities in the Upper West Region, the delays translated into dashed hopes for jobs, infrastructure, and local economic growth. For Ghana, it meant the loss of billions in potential revenue.

Now, with global gold prices surging above $3,000 per ounce, E&P says it is ready to fast-track development.

Backed by its financial muscle and technical expertise, the company plans to push the projects into production after decades of inertia.

A three-pronged strategy

E&P has outlined a clear roadmap for reviving the long-stalled concessions. According to an executive, the company will first conduct a comprehensive audit of all historical loans in collaboration with the Ghana Revenue Authority (GRA).

The executive explained, “We will honour all genuine obligations, but they must be properly accounted for and taxed,” stressing that transparency would be central to the new chapter.

Once debts are verified and settled, E&P intends to deploy secured funding towards immediate mine construction, signaling that the company is ready to move beyond acquisition into execution.

More than a corporate transaction, the takeover marks a symbolic reassertion of local ownership in Ghana’s mining sector, which has historically been dominated by foreign multinationals.

For years, the concessions were held by offshore entities that failed to mobilize the necessary capital. Now, a homegrown firm with a proven track record in mining services has assumed direct ownership.

Founded in 1997, Engineers & Planners has built a reputation as one of West Africa’s leading mining and civil engineering contractors.

The company has worked with global majors on large-scale projects across the sub-region, but this acquisition represents its boldest step yet into direct resource ownership.

Benefits for host communities

E&P has pledged that beyond production, the Black Volta and Sankofa projects will bring broad socio-economic benefits to the Upper West Region.

The company also promised investments in infrastructure, education, and healthcare to ensure that local communities directly benefit from the resources beneath their soil.

With regulatory approvals in place and control firmly secured, E&P is preparing to roll out an intensive development programme for the concessions.

If successful, the company could set a precedent for Ghanaian-led mining ventures that combine profitability with national benefit.

As Ghana debates mining reforms and strategies to increase local participation in its resource economy, E&P’s acquisition of the Black Volta and Sankofa concessions will be closely watched. The stakes are high not just for the company, but for the future direction of Ghana’s mining sector.

READ ALSO: Investors Snub T-Bills As Government Struggles to Raise GH¢6.7bn, Settles for GH¢3.2bn