The Chamber of Oil Marketing Companies (COMAC) has urged government to intensify efforts to stabilise the Ghanaian cedi, warning that persistent currency volatility continues to undermine fuel pricing and consumer relief at the pumps.

COMAC’s Board Chairman, Gabriel Kumi, highlighted the currency’s weakness as the most significant driver of petroleum price fluctuations.

According to him, while the government has made progress in curbing earlier sharp depreciation, more robust measures are required to sustain stability and protect consumers from further price hikes.

“The depreciation of the cedi contributes to a very large extent towards the increment we have seen in recent years on the price of the product but comparatively it is still good.”

Gabriel Kumi, COMAC’s Board Chairman

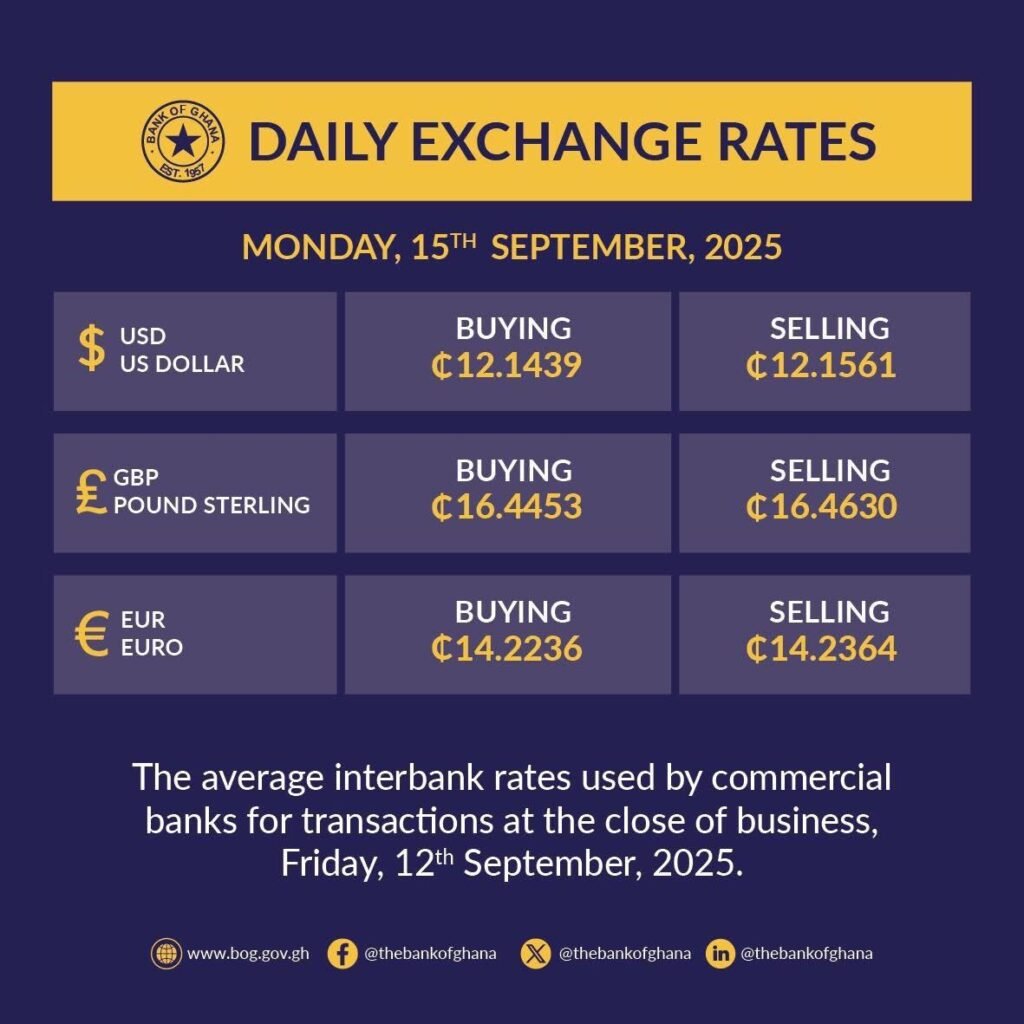

He acknowledged that the government had managed to bring the exchange rate down from about GHS17 to GHS12 to the dollar, describing the move as commendable. However, he stressed that sustaining the gains is crucial to shielding fuel prices from external shocks.

“What this current government needs to do is to make sure that they put a tap on the cedi so that it doesn’t go up any further.

“If the cedi goes up, we at COMAC have very little control over the pump price. Our goal is to ensure that the price of the product continues to remain low.”

Gabriel Kumi, COMAC’s Board Chairman

Currency Woes Threaten Pump Price Relief

The call from COMAC comes at a time when fuel consumers are facing renewed anxiety over possible price increases in the coming weeks.

After months of relative stability, the cedi has shown fresh signs of weakness against major trading currencies, particularly the U.S. dollar, raising fears that pump prices may soon climb again.

COMAC’s Chief Executive Officer, Dr. Riverson Oppong, confirmed these concerns, warning that fuel prices are likely to rise in the second pricing window of September.

He attributed the anticipated increases primarily to the depreciation of the cedi, which erodes the ability of oil marketing companies to maintain stable prices.

“The pricing outlook is out, and we have seen some increase.

“We are still waiting for the floor price to determine what variables are changing. But from the outlook, you can see the cedi has depreciated a bit, which will obviously affect the pricing.”

Dr. Riverson Oppong, COMAC’s Chief Executive Officer

Beyond the immediate challenge of fuel price volatility, Dr. Oppong urged government to adopt forward-looking and comprehensive policies aimed at strengthening the energy sector’s resilience.

He noted that a well-structured energy sector could not only sustain itself but also contribute meaningfully to Ghana’s broader economic development.

“It is a bit dicey, and we are looking forward to having very solid and comprehensive policies that will ensure the energy sector is paying for itself, paying its dues, and even contributing to the economy of this country.”

Dr. Riverson Oppong, COMAC’s Chief Executive Officer

Industry watchers argue that while global oil prices play a role in determining local fuel costs, the impact of currency depreciation is particularly acute in Ghana, given the high levels of import dependence in the petroleum supply chain.

Every sharp movement in the exchange rate directly translates into higher costs for importers and eventually higher prices at the pump.

Balancing Act for Policymakers

The debate over stabilising the cedi has become central to economic policymaking, especially as utility providers and energy-related firms press for tariff hikes in response to mounting operational costs.

For COMAC, the priority remains clear: stabilising the cedi to prevent unnecessary burdens on consumers and businesses.

With fuel prices poised to edge upwards once again, COMAC’s appeal highlights the urgency of sustainable currency management and policy reforms to shield Ghanaians from the ripple effects of global energy volatility and domestic macroeconomic weaknesses.

The coming weeks will be crucial, as both government and regulators weigh competing demands from consumers, industry players, and international markets.

What remains clear is that for the petroleum downstream sector, stabilising the cedi is not just an economic imperative, but a necessary safeguard for fuel security and price stability.

READ ALSO: Market Cheers as Ghana’s Treasury Auction Breaks Four-Week Drought with 15.8% Oversubscription