The Managing Director of the Agricultural Development Bank (ADB) PLC, Edward Ato Sarpong, has commended Akuapem Rural Bank PLC for its remarkable commitment to empowering women through credit financing, describing it as a significant driver of financial inclusion in Ghana.

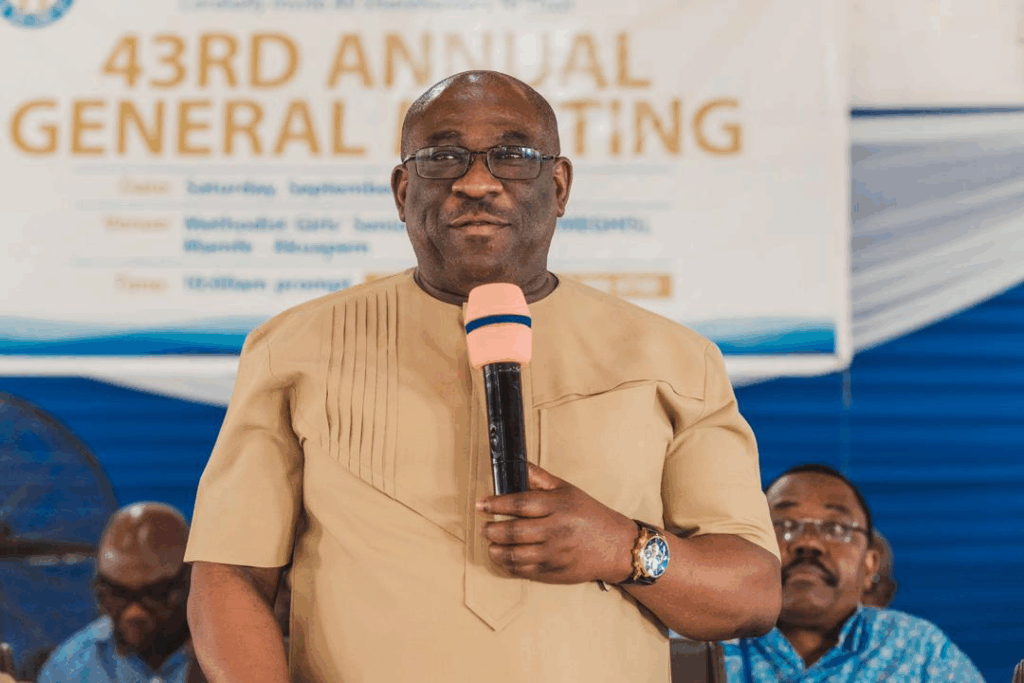

Speaking as Guest of Honour at the bank’s 43rd Annual General Meeting (AGM), Mr. Sarpong highlighted the institution’s Credit with Education (CwE) programme as a model of sustainable banking that directly impacts households and communities.

According to him, the programme is making a measurable difference by targeting women, a group often excluded from mainstream financing. “This achievement is not only commendable but also aligns with the Sustainable Development Goal of poverty alleviation,” he noted.

GH¢60m Loans to Women in 2024

Figures released at the AGM revealed that Akuapem Rural Bank disbursed GH¢60.33 million in loans to women in 2024 alone. This represented 49.93 per cent of total loan disbursements and benefitted 5,267 women across the bank’s operational areas. The achievement marked a 23 per cent increase over the previous year and was accompanied by an impressively low non-performing loan (NPL) ratio of 0.13 per cent.

Mr. Sarpong praised the strategic approach of channeling nearly half of the bank’s loan portfolio toward women-led businesses and households, pointing out that women often reinvest earnings in family welfare, education, and community development.

The ADB MD encouraged Akuapem Rural Bank to deepen its investments in the Credit with Education programme, emphasizing the need for enhanced risk management systems and greater incorporation of technology to expand outreach.

“The integration of technology into your credit programmes will enable you to scale up, improve monitoring, and ensure that more women and communities benefit.”

Mr. Sarpong

He further highlighted that the initiative stands out as a replicable model for other rural and commercial banks across the country. By focusing on women, the bank is not only supporting entrepreneurship but also addressing structural inequalities in access to finance.

Record-Breaking Financial Performance

The 43rd AGM also highlighted the strong overall performance of Akuapem Rural Bank in 2024. Post-tax profits surged by 186 per cent, rising from GH¢1.35 million in 2023 to GH¢3.85 million in 2024. Total assets grew from GH¢156 million in 2023 to GH¢208 million in 2024, reflecting the bank’s strengthening position in Ghana’s rural banking landscape.

The Board Chairman, Dr. Ernest Obuobisa-Darko, attributed this growth to robust deposit mobilization, loan expansion, and rising investments. Deposits increased by 30.77 per cent, from GH¢137.1 million in 2023 to GH¢179.3 million in 2024, while loans grew by 29.01 per cent and investments by 33.15 per cent.

“These strong performances across our key indicators underscore the hard work of management and staff, as well as the confidence shareholders and customers continue to place in Akuapem Rural Bank.”

Dr. Ernest Obuobisa-Darko

Good Governance and Shareholder Confidence

Mr. Sarpong commended the governance structures of the Rural Bank, attributing much of its success to strong leadership and effective oversight from the board. He urged shareholders to continue backing the current leadership team to sustain growth. “The quality of your board is evident in the results achieved, and I encourage shareholders to keep faith in this governance structure to achieve greater milestones,” he said.

The meeting brought together shareholders, board members, management, and invited guests, all of whom celebrated the bank’s achievements. Stakeholders expressed optimism that the bank’s strategy of combining financial growth with inclusive programmes such as Credit with Education would ensure its continued relevance and competitiveness in the sector.

The performance of Akuapem Rural Bank aligns with Ghana’s broader push for financial inclusion and poverty alleviation. By focusing on women, who make up a significant proportion of the informal sector, the bank is directly contributing to national development objectives and the global Sustainable Development Goals (SDGs).

Experts note that empowering women with credit not only drives financial inclusion but also reduces poverty and stimulates grassroots economic growth. The CwE programme, with its impressive loan disbursement figures and negligible default rates, serves as a shining example of how rural banking can transform lives and communities.

With its strong 2024 performance, Akuapem Rural Bank is poised for continued growth in the years ahead. The challenge, however, remains to sustain this momentum while deepening outreach to underserved populations. Incorporating digital tools, strengthening internal controls, and expanding partnerships with development institutions will be critical to scaling impact.

READ ALSO: Ghana Stock Exchange Maintains 4-Week Upward Momentum