Ghana has reached another significant milestone in its ongoing debt restructuring programme, sealing a bilateral debt agreement with the Kingdom of Spain.

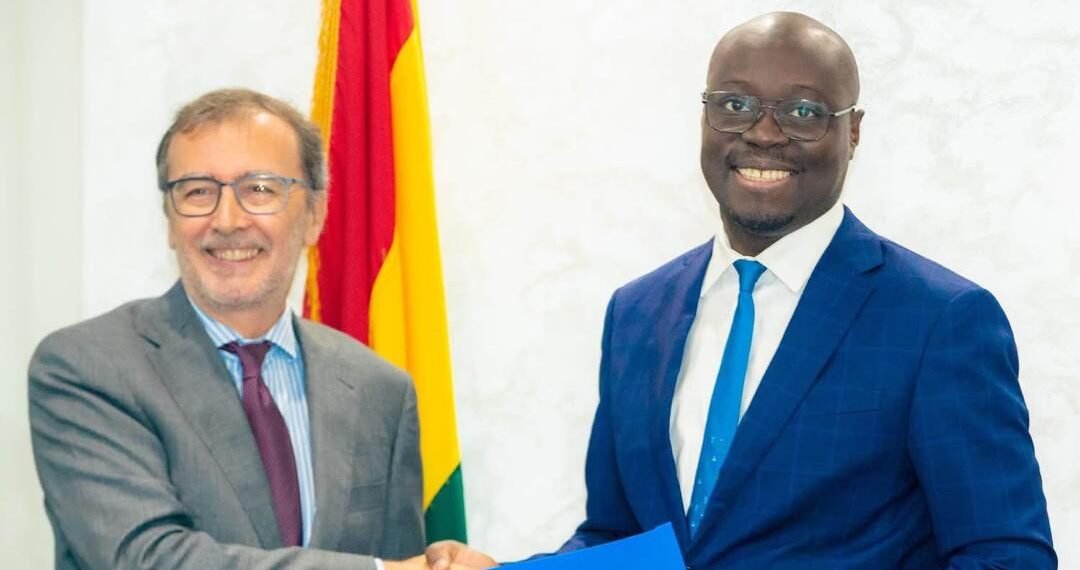

The deal, signed by Ghana’s Minister for Finance, Dr. Cassiel Ato Forson, and Spain’s Ambassador to Ghana, H.E. Ángel Lossada Torres-Quevedo, represents the fourth bilateral agreement concluded under Ghana’s post-crisis debt restructuring plan.

Dr. Forson described the development as “another important milestone” in the country’s quest to restore fiscal stability and long-term debt sustainability, noting that the government’s goal is to bring the entire process to a close by the end of 2025.

“On behalf of the Republic of Ghana, I signed a Bilateral Debt Restructuring Agreement with the Kingdom of Spain. This signing marks another important milestone in Ghana’s debt restructuring journey.

“To date, we have concluded five bilateral restructuring agreements with France, Finland, the United Kingdom, China EXIM Bank, and now Spain.”

Ghana’s Minister for Finance, Dr. Cassiel Ato Forson

The Finance Minister underscored the government’s determination to complete all outstanding negotiations within the year, emphasizing that the process has been one of deep reflection and learning for the nation.

Ghana’s debt restructuring efforts form part of a broader economic recovery agenda initiated after years of mounting debt pressures and fiscal imbalances that led to the country’s engagement with the International Monetary Fund (IMF) under the Extended Credit Facility (ECF) programme.

The bilateral agreements are a critical component of Ghana’s efforts to meet the terms of the IMF-supported debt sustainability framework, which seeks to reduce the country’s debt-to-GDP ratio and restore investor confidence.

Need for Fiscal Discipline

According to Dr. Forson, Ghana’s experience with debt distress has brought to light the need for disciplined economic management and stronger institutional safeguards to prevent a recurrence.

“As a country, we have learnt valuable lessons from this experience. We are determined to maintain sound fiscal discipline and never again allow ourselves to reach such unsustainable levels of debt.”

Ghana’s Minister for Finance, Dr. Cassiel Ato Forson

He reiterated his confidence in Ghana’s economic recovery programme, noting that the measures being implemented—ranging from expenditure control and domestic revenue mobilization to reforms in public financial management—will ensure a more resilient and stable macroeconomic environment.

“I remain confident that the measures we are implementing will safeguard our recovery and strengthen Ghana’s resilience,” he affirmed. The Minister expressed deep gratitude to the Kingdom of Spain for its cooperation and patience throughout the negotiations, describing the bilateral engagement as a testament to the strong partnership between the two countries.

Spain’s Commitment to Ghana’s Recovery

Spain’s Ambassador to Ghana, H.E. Ángel Lossada Torres-Quevedo, on his part, reaffirmed his government’s commitment to supporting Ghana’s economic recovery and strengthening bilateral relations.

The agreement, he noted, represents not only an act of economic cooperation but also a reaffirmation of Spain’s confidence in Ghana’s long-term growth potential and commitment to reform.

Ghana’s debt restructuring process has been both complex and consequential, involving multiple creditor groups—including bilateral, multilateral, and commercial partners. The government’s negotiation strategy has aimed to balance fiscal sustainability with continued social and developmental spending.

The signing with Spain follows earlier successful agreements with France, Finland, the United Kingdom, and China EXIM Bank—each representing critical partners within the framework of Ghana’s Official Creditor Committee (OCC), co-chaired by France and China.

The OCC’s approval of Ghana’s debt treatment under the G20 Common Framework in early 2024 opened the door for the country to finalize bilateral deals and unlock disbursements under the IMF programme.

The Fund had earlier emphasized that successful completion of these agreements was key to maintaining debt sustainability projections and ensuring continued support for Ghana’s economic reforms.

With inflation trending downward, the cedi showing relative stability, and fiscal performance improving, analysts believe Ghana’s progress with bilateral creditors sends a strong signal to both domestic and external investors.

The move could also pave the way for renewed discussions with private bondholders as part of the second phase of debt restructuring. The agreement with Spain adds to Ghana’s growing list of successful restructuring deals and marks a turning point in its post-crisis economic recovery.

By bringing the process closer to completion, the government aims to restore confidence in Ghana’s fiscal management while reinforcing its commitment to transparency, accountability, and prudent borrowing.

As Ghana looks ahead, the Finance Minister’s optimism suggests that the country is gradually emerging from its debt challenges, positioning itself for sustainable growth anchored on fiscal responsibility and improved governance.

The bilateral partnerships forged through this process—particularly with Spain and other creditors—signal renewed international confidence in Ghana’s economic future.

READ ALSO: Mahama Moves to Curb Misuse of Public Funds, Plans Meeting with AG and CJ