Nigeria’s oil and gas industry may soon witness a major shake-up as two of the nation’s most prominent global investors, Hakeem Belo-Osagie and Bayo Ogunlesi, enter advanced discussions to inject massive capital into a refinery project that could rival the $20 billion Dangote Refinery.

President Bola Ahmed Tinubu revealed the development following a high-level meeting with the investors in Lagos, describing it as a “transformational opportunity” for Nigeria’s energy future.

In a statement after the meeting, President Tinubu praised Belo-Osagie and Ogunlesi as “credible Nigerians” with global influence, financial strength, and proven track records across key sectors.

“We agreed on the urgency of unlocking large-scale investments in upstream oil and gas and critical infrastructure to drive Nigeria’s long-term growth.

“Nigeria remains open for business and ready to partner with credible global investors to deliver energy security and modern infrastructure for our people.”

President Bola Ahmed Tinubu

The move signals what could be the beginning of a new wave of large-scale private investments designed to reduce the country’s dependence on imported refined products and boost domestic capacity.

The discussions come at a crucial moment for Nigeria’s energy sector, which is grappling with high import dependency despite having some of the largest crude reserves in Africa.

While the Dangote Refinery, Africa’s largest industrial complex was expected to end decades of fuel importation, operational disruptions and regulatory bottlenecks have slowed its full-scale production rollout.

Industry observers say Tinubu’s announcement is a strategic step to diversify Nigeria’s refining base and ensure that no single entity dominates the downstream sector.

Government Reforms Encouraging Investor Confidence

President Tinubu has consistently championed structural reforms aimed at creating a more conducive environment for investors.

His administration’s energy policies have focused on deregulation, fiscal incentives, and transparency in licensing and pricing regimes all designed to attract both domestic and international capital into the sector.

“We are determined to make Nigeria Africa’s premier investment destination.

“Our reforms are opening new frontiers for sustainable financing, global capital inflows, and transformative projects that will power our future.”

President Bola Ahmed Tinubu

The president’s renewed focus on investor partnerships follows the government’s broader drive to achieve energy self-sufficiency by 2030.

Officials say the government is keen to facilitate public-private collaborations that will expand refining capacity, improve energy access, and stimulate job creation.

Refining Ambitions Beyond Dangote

Sources close to the discussions suggest that the proposed refinery, backed by Belo-Osagie and Ogunlesi, could rival or complement the scale of the Dangote Refinery in terms of capacity and export potential.

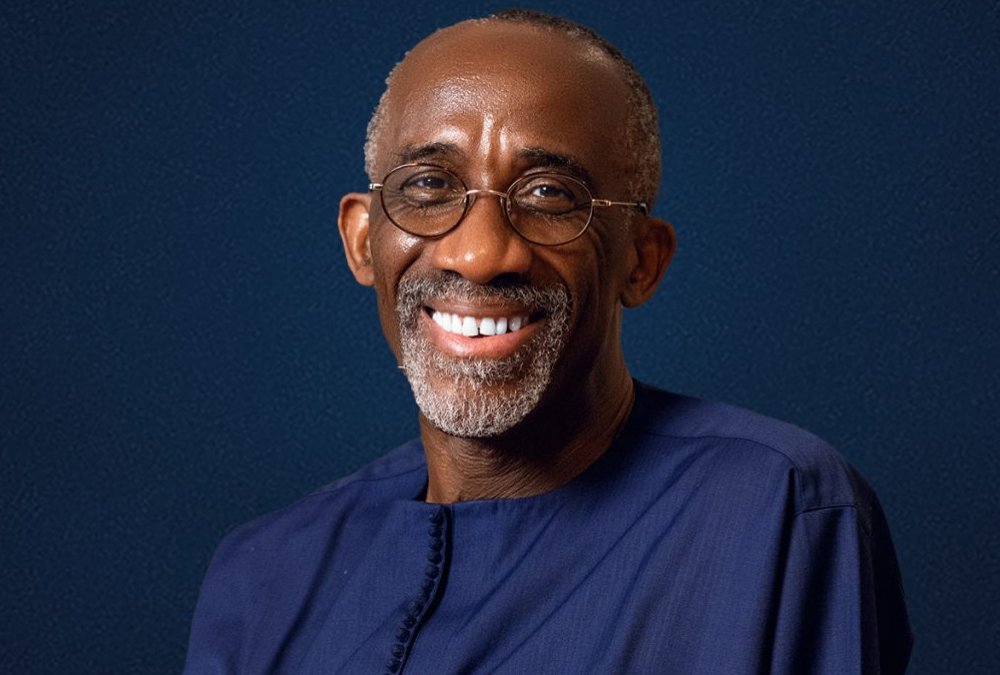

Belo-Osagie, a seasoned entrepreneur and founder of Metis Capital Partners, is renowned for his strategic investments across telecommunications, energy, and finance.

His leadership experience as former chairman of the United Bank for Africa (UBA) and his deep understanding of emerging markets position him as a key figure in Nigeria’s next phase of industrial transformation.

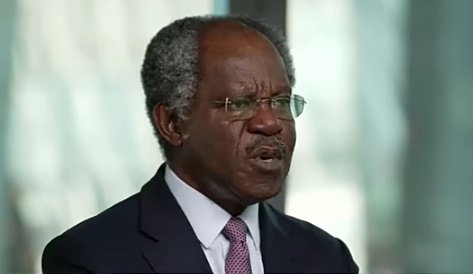

Ogunlesi, on the other hand, brings unmatched global experience in managing large-scale infrastructure assets.

As the lead director at BlackRock and chairman of GIP, he has been instrumental in funding airports, energy plants, and transportation systems across Europe, North America, and Africa.

Timing and Market Opportunity

The timing of this potential investment is significant. The Dangote Refinery, which began partial operations earlier this year, recently faced a temporary shutdown following industrial action by the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN).

The disruption raised concerns about operational stability and reliability, exposing vulnerabilities in Nigeria’s downstream energy chain.

These developments have created an opening for new players with the capacity and discipline to sustain large-scale refining operations.

For President Tinubu, the partnership discussions underscore his administration’s commitment to fostering investor confidence and accelerating industrial transformation.

This represents a potential step toward energy independence and economic diversification.

As the world’s energy landscape evolves, the involvement of Nigerian billionaires like Belo-Osagie and Ogunlesi could mark the dawn of a new era, one where African capital and expertise drive Africa’s own energy future.

READ ALSO: BoG’s $1.15bn FX Injection Sparks Clash with IMF and World Bank Over Cedi Stabilization