The Domestic Money Bank Report for the first 4 months, between January and April, of 2025 revealed that Non-Performing Loans (NPLs) amounted to GH¢ 654.2 million. This amount of bad debt, though huge, is a decline from previous year’s figure.

According to the Bank of Ghana (BOG) report, compared to same period from January to April 2024, an improvement has been made. The NPL in 2024 that was written-off amounted to GH¢ 863.4 million. The previous two years recorded as high as GH¢ 1.087 billion within same period.

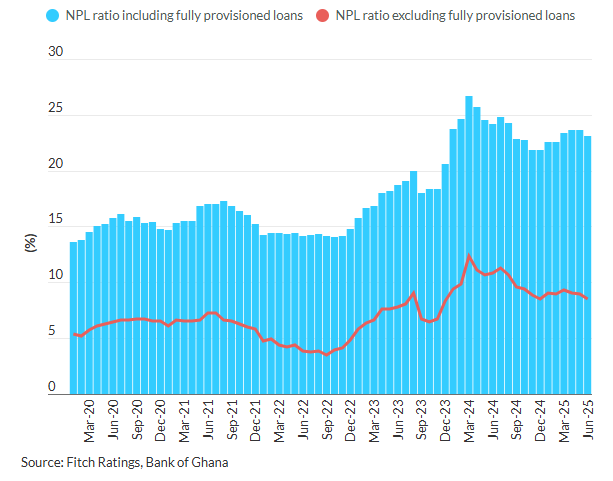

Credit risk by financial institutions has always been on the high side. According to the report, credit risk exposure reduced in 2025 as revealed by the decline NPL ratio from 25.7% in April 2024 to 23.6% in April 2025 showing an improvement in the asset quality of financial institutions.

However, NPLs ratio declined from July 2024 (28.8%) to 21.8% in December 2024, and then increased from January 2025 (21.8%) to 23.6% in May. Though significant improvements have been made this year (a GH¢ 209.2 million less), the NPL still remain high.

Understanding NPL

NPLs arise when the creditor defaults in scheduled payment usually between 90 to 180 days, depending on the loan type. When the creditor resumes payment, it becomes a reperforming loan.

NPL ratio is used to measure the health and stability of financial institutions within the banking sector. In determining the quality of loan portfolio, the NPL ratio reveals the proportion of loans or credit defaulted as against total loans given out. The ratio indicates the banking sector’s risk assessment, credit quality, capital requirements, market sentiment, and industry comparison.

According to Fitch Rating, only 4 out of 23 banks have their NPL ratio below 10% at end of first half of 2025. “Vast majority of banks should be able to reduce their NPLs ratios below 15%, including through write-offs, by end-2026,” they added. 6 banks, their research forecasted, will be challenged in bringing their NPL ratio below 15% by end of 2026 due to high problem loans and limited capital buffers to write off such loans.

BOG regulations to reduce NPLs

The BOG on August 13, 2025 issued a notice to industry players through its secretary, Sandra Thompson (Ms.) to address the recurring surge in NPLs. According to her, policy on problem assets have been reviewed and prudential guideline has been re-emphasized to mitigate risk to the industry’s profitability, liquidity and solvency as well as threats to the stability of the financial system.

All Regulated Financial Institutions (RFIs) are mandated by the BOG to maintain a robust credit risk management framework; observe the prudential limit on NPLs; write off all fully provisioned loans and loans with no realistic prospects of recovery; restructure NPLs to qualifying borrowers; and timely realize collaterals on written-off facilities.

Additional BOG regulations to curb this menace is included in Act 930 and Act 774. Also, list of defaulters is to be submitted monthly by the RFI to the Financial Stability Department of BOG and all Credit Reference Bureaus in Ghana. These defaulters will not be granted additional credit facilities.

BOG further explained that wilful defaulters will not have access to loan facilities for the time period between write-off date and full settlement. Being on this list for more than once in 10 years destroys any chance of acquiring credit for 5 years.

Strict adherence to these regulations can guarantee progress in the effort being made to reduce NPLs. All banks, specialised deposit-taking institutions, non-bank financial institutions and the general public are noticed of the BOGs efforts and commitment to reducing NPLs to its minimum.

“Ghanaian banks’ non-performing loan (NPL) ratios are likely to decrease significantly in the next few years to comply with new Bank of Ghana (BOG) regulations effective from end-2026. Fitch Ratings expects the improvement will mostly be achieved through an acceleration in write-offs and stronger operating conditions.”

Fitch Ratings-London-15 September 2025

According to Fitch Ratings, BOG’s announced in August 2025 requires an NPL below 10% prudential limit by financial institutions to achieve target. “Banks with NPL ratios exceeding 15% will immediately be restricted from paying dividends and bonuses, while those with ratios between 10% and 15% will be subject to restrictions after two consecutive years of failing to restore compliance with the limit,” they pointed out.

What NPL means to Ghana’s economy

In order to further reduce the NPL, the new regulations by the BOG should be strictly adhered to by the financial institutions. Some of the causes of high NPL, which needs to be addressed include macroeconomic instability (high inflation and interest rates, volatile exchange rate), the government’s delay payment (energy debts, contractors among other), reduced economic growth, variations of banking sector crises.

Other causes include tolerant credit and inadequate risk management processes, poor credit monitoring, under trained staff, and poor corporate governance and management. There is also identification and tracking issues, funds diversions, and weak recovery laws.

However, the progress being made by the BOG and the Ministry of Finance in the macroeconomic indicators, which has led to the reduction in NPL if continued will see a more significant reduction in the NPL.

Read Also: Forson, Asiama Lead Ghana’s Economic Diplomacy Offensive at 2025 IMF/World Bank Annual Meetings