The Deputy Governor of the Bank of Ghana, Matilda Asante Asiedu, has commended the nation’s tremendous strides in digital finance, revealing that digital transactions in 2024 exceeded GH¢3 trillion, signaling a new era of financial modernization and accessibility for all Ghanaians.

Speaking at the MOBEX Africa Tech Expo & Innovation Conference 2025 in Accra, Mrs. Asiedu Asante reaffirmed BoG’s unwavering commitment to strengthening the country’s digital payment infrastructure and expanding financial inclusion through cutting-edge innovation and progressive regulation. She emphasized that the Bank’s strategy is anchored on deepening interoperability, advancing the eCedi pilot, and maintaining public confidence in digital financial services.

Reflecting on Ghana’s journey toward a digital economy, the Deputy Governor highlighted the remarkable evolution in the use of mobile money and digital payments over the past decade. She noted that Ghana has moved from 4.9 million mobile money users in 2015 to over 24 million users in 2025, demonstrating the growing confidence of citizens in digital financial systems.

“Digital payments have become the backbone of our financial system, connecting individuals and businesses nationwide,” Mrs. Asiedu Asante stated. “Today, millions of Ghanaians can save, pay bills, trade, and access credit using digital platforms, something that was unimaginable just a few years ago.”

This transformation, she explained, has not only simplified financial transactions but has also enhanced economic participation among previously underserved groups, including rural dwellers, women entrepreneurs, and small-scale traders. Digital payments have become a powerful tool for financial inclusion, driving growth, efficiency, and convenience across all sectors of the economy.

BoG’s Three-Pillar Digital Agenda

According to the Deputy Governor, the Bank of Ghana’s digital agenda is guided by three strategic pillars aimed at fostering innovation while protecting the interests of consumers.

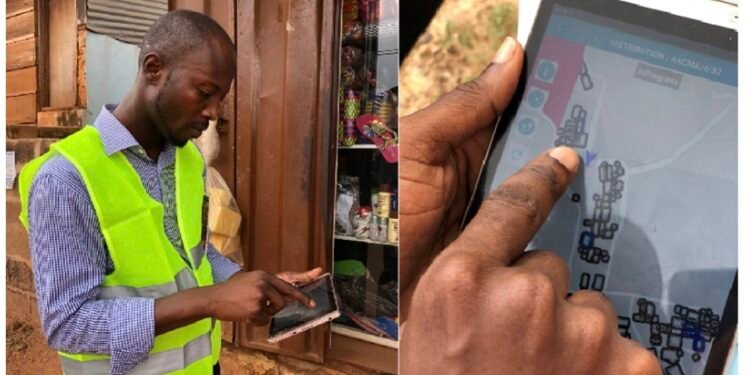

Strengthening Payment Infrastructure and Interoperability: BoG is investing in robust instant payment systems that ensure seamless and efficient digital transactions across multiple platforms. By enhancing interoperability between banks, fintechs, and mobile money operators, the central bank aims to create a unified financial ecosystem that enables users to transact conveniently without barriers.

Expanding the eCedi Pilot for Greater Inclusion: The Bank’s pioneering eCedi initiative, Ghana’s Central Bank Digital Currency (CBDC) pilot, is being expanded to reach more communities, including those in offline environments. The eCedi seeks to make digital transactions accessible to everyone, regardless of their connectivity status, ensuring that no Ghanaian is left behind in the digital economy.

Deepening Trust through Progressive Regulation: BoG is reinforcing regulatory frameworks to safeguard consumer interests while encouraging technological innovation. Mrs. Asiedu Asante emphasized that building trust is crucial to sustaining digital adoption. “Innovation and inclusion must go hand in hand. Technology should empower, not exclude,” she stressed.

Mrs. Asiedu Asante commended MOBEX Africa for its decade-long contribution to promoting technology and innovation across the continent. The event has grown into one of Africa’s most influential platforms for dialogue on emerging technologies, digital transformation, and inclusive growth.

“As we mark ten years of MOBEX Africa, we celebrate the power of collaboration between regulators, innovators, and entrepreneurs in shaping a more inclusive digital economy. This partnership between the public and private sectors is key to unlocking Africa’s digital potential.”

Mrs. Asiedu Asante

The 2025 edition of the MOBEX Africa Tech Expo & Innovation Conference brought together policymakers, innovators, investors, and tech leaders to explore the intersection of technology and financial inclusion. The discussions centered on how digital tools can be leveraged to expand access to finance, improve efficiency, and strengthen economic resilience across the continent.

Ghana’s Rise as a Digital Finance Leader in Africa

With the pace of innovation and the Bank of Ghana’s proactive leadership, Ghana is fast emerging as a digital finance hub in Africa. The country’s advanced interoperability system, widespread adoption of mobile money, and ongoing eCedi pilot have positioned it as a model for other African nations pursuing digital transformation.

According to the Deputy Governor, BoG’s initiatives are designed to create a more resilient, inclusive, and dynamic financial ecosystem that supports entrepreneurship, trade, and economic growth. By integrating digital technology into financial services, Ghana is not only modernizing its economy but also empowering citizens to participate meaningfully in the digital age.

She reiterated that the central bank remains committed to driving forward-thinking policies that encourage innovation while ensuring that the financial system remains stable and secure. “Our vision is to build a digital economy that serves everyone—an economy where access to finance is not a privilege but a right,” she declared.

As digital adoption continues to grow, the Deputy Governor highlighted the importance of public trust, cybersecurity, and data protection. BoG is therefore strengthening its regulatory oversight to ensure that financial institutions and fintech companies adhere to the highest standards of data security and consumer protection.

READ ALSO: Madagascar Swears In Colonel Michael Randrianirina As President