Ghana’s upstream petroleum sector is set for a major turnaround as the Government announces more than US$3.5 billion in new investment commitments secured in 2025.

The disclosure was made by the Minister for Finance, Dr Cassiel Ato Forson, during the presentation of the 2026 Budget Statement and Economic Policy to Parliament. He described the commitments as one of the clearest signs that investor confidence is returning to the oil and gas industry after several years of declining output.

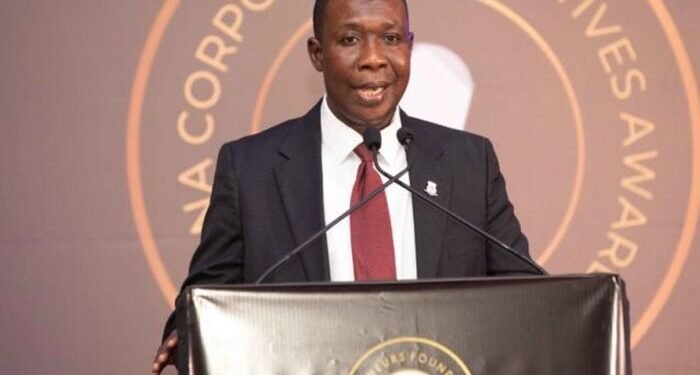

“The Government’s investor-friendly reforms have already secured over US$3.5 billion in new investment commitments in 2025.”

Dr Cassiel Ato Forson, Minister for Finance

The Minister explained that the industry has suffered a prolonged period of reduced production, with annual crude output falling from 71.4 million barrels in 2019 to an estimated 36 million barrels in 2025.

He noted that this represented almost a fifty percent decline within six years, a trend he described as worrying for an economy that depends on petroleum revenues for fiscal stability.

He explained that the turnaround reflects a deliberate effort by the administration of President John Dramani Mahama to rebuild the sector through reforms, improved regulation and sustained engagement with global energy companies.

Major Capital Commitments for Jubilee, TEN and OCTP

The largest share of the new commitments is targeted at the Jubilee and TEN fields, where operators have agreed to an extensive drilling programme.

Dr Forson stated that the Government has secured “a US$2 billion framework agreement for the Jubilee and TEN fields to drill 20 new wells.” This marks the most significant investment in the two fields in several years and is expected to lift medium-term output.

He added that a further “US$1.5 billion Memorandum of Intent with Offshore Cape Three Points partners to expand operations” has been concluded.

The additional funding is expected to support broader field development, improved gas integration and enhanced recovery techniques.

Both agreements, according to the Minister, reflect a renewed commitment by major operators to expand long-term production in Ghana.

Global Oil Majors Return to Ghana’s Upstream Space

The Minister also revealed that the improved operating environment has begun attracting the attention of major global companies.

He noted that “this new investor-friendly environment has also drawn the interest of oil and gas majors such as Shell.”

Though early in the engagement process, he said the presence of such large firms signals a positive shift in global perception of Ghana’s petroleum potential.

The entry of additional companies is expected to bring capital, technical expertise and modern technologies which the Minister believes will be crucial to reviving exploration, improving recovery rates and expanding the country’s resource base.

Government Moves to Reverse Production Declines

Dr Forson emphasised that the production downturn of recent years has prompted the Government to adopt a more aggressive posture in petroleum sector governance.

He said that “President John Dramani Mahama’s administration has taken decisive action to reverse this trend.” The new investments, regulatory reviews and field development plans form part of the effort to bring Ghana back onto a growth path in the upstream market.

The Minister highlighted that the Ghana National Petroleum Corporation will play a more direct operational role in the coming years.

He stated that “the Ghana National Petroleum Corporation will commence drilling for oil on the offshore Voltain Basin in October 2026.” According to him, early assessments show promising prospects that could expand Ghana’s hydrocarbon footprint if exploration proves successful.

A key part of the reform agenda is a comprehensive review of the upstream regulatory and fiscal framework.

Dr Forson said an assessment is underway “to make Ghana’s petroleum regime more competitive, transparent and stable.” The review is expected to address concerns raised by investors about clarity in contract terms, tax treatment, licensing arrangements and long-term regulatory certainty.

Government officials believe that the reforms will strengthen Ghana’s position as a preferred destination for upstream investment, especially at a time when global competition for capital is intense.

A Turning Point for the Petroleum Sector

The announcement of more than US$3.5 billion in new commitments marks a significant milestone in Ghana’s efforts to stabilise and revive its petroleum industry.

The fresh capital injection, combined with a renewed regulatory framework and exploration plans in the Voltain Basin, positions the country for a recovery in output over the next several years.

If the planned drilling programmes proceed as scheduled and new fields expand production, Ghana could see medium-term volumes rise well above current projections.

For Government, such an outcome would help ease fiscal pressures, create jobs and enhance the country’s broader energy security.

The Budget presentation suggests that after years of stagnation, Ghana’s upstream sector may be entering a new phase of growth driven by policy reforms and renewed global interest.

READ ALSO: IC Research Predicts a Further Decline in Inflation to 6.5% for November