Ghana’s 2026 Budget, presented just last week, is already facing intense scrutiny following a new International Monetary Fund (IMF) report that exposes a significant gap between the country’s tax revenue and its true potential.

The revelation has triggered an intense debate among economists and policymakers on the effectiveness of current tax policies and whether the budget’s projections are realistic in the face of long-standing structural constraints. With Ghana’s tax-to-GDP ratio standing at 13 percent, far below regional benchmarks, experts warn that the country may struggle to achieve its fiscal goals if urgent reforms are not implemented.

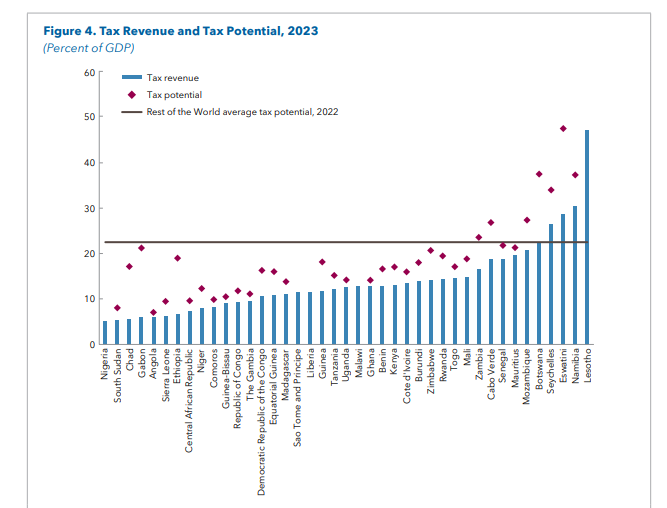

According to the IMF report on Tax Expenditures in Sub-Saharan Africa, Ghana is performing far below its tax potential both in the region and globally. The Fund highlighted that the tax gap, which represents the difference between actual tax collection and what could be raised, exceeds five percentage points of GDP in about one-third of Sub-Saharan African countries. Ghana belongs in that category.

The report noted that “the cross-country heterogeneity in the estimated tax potential reflects differences in the level of economic development, the degree of informality, trade openness, and public sector effectiveness and corruption.” It added that Sub-Saharan Africa’s estimated tax potential is significantly lower than the rest of the world due to long-standing structural issues.

For Ghana, the IMF’s findings signal a major challenge; the nation has not only failed to mobilize adequate domestic revenue but has also allowed inefficiencies and poorly designed tax exemptions to widen its fiscal gap.

The 2026 Budget and IMF Reality

The timing of the IMF report could not be more consequential. Ghana’s 2026 Budget is heavily dependent on improving domestic revenue mobilisation to reduce reliance on external borrowing and to meet expenditure commitments. However, the IMF insists that the country must take deep reforms to achieve that ambition.

The Fund alluded that “scaling back costly and often poorly targeted tax expenditures could contribute to narrowing the tax gap by strengthening revenue performance and improving the efficiency of the overall tax system.” This directly challenges elements of Ghana’s tax strategy which has historically allowed broad exemptions to certain sectors and companies.

With limited external financing options and rising pressure to stabilize the macroeconomy, the government’s 2026 plans may not be fully attainable unless these structural weaknesses are addressed.

Declining Revenue Mobilisation Trends

The IMF also cautioned that although revenue mobilisation in Sub-Saharan Africa has improved over the past two decades, progress has slowed recently. The median revenue-to-GDP ratio rose from 13 percent in 2000 to 16 percent in 2019, only to fall back to about 14 percent in 2022 due to the COVID-19 pandemic.

As of 2022, 18 countries in the region have surpassed the 13 percent revenue threshold required to accelerate growth and development. Ghana is barely at that benchmark with its current 13 percent tax-to-GDP ratio, raising questions about its ability to finance development projects, reduce debt, and sustain long-term growth.

The slowdown in regional revenue growth mirrors Ghana’s own struggles. Despite numerous tax reforms, the country continues to grapple with informality, enforcement gaps, weak compliance, and inefficient tax administration.

The 2026 Budget outlines plans to expand the tax base and VAT reforms, enhance digital revenue tracking, and increase compliance. However, analysts warn that without addressing deeper structural challenges identified by the IMF, such measures may not deliver the expected results.

These challenges include corruption, a large informal sector, limited tax education, and inconsistent enforcement of tax laws. Compounding the issue is the misuse of tax expenditures, which the IMF argues drains government revenue without proportionate economic benefits.

The IMF emphasised that Sub-Saharan African countries, including Ghana, must “look inward for under-explored areas of tax policy” as a way to boost domestic revenue and build resilience.

Urgency for Policy Overhaul Intensifies

The stark contrast between the ambitions of the 2026 Budget and the weaknesses exposed by the IMF underscores the need for bold policy reforms. Experts suggest that Ghana must review its tax exemptions regime, strengthen revenue institutions, tackle corruption within tax systems, and deploy innovative methods to capture the informal economy.

With rising development needs and limited fiscal space, Ghana has little room for error. The IMF findings serve as a wake-up call that incremental adjustments will not be enough. What is required is a comprehensive tax policy overhaul that aligns with the country’s growth aspirations.

As Ghana steps into a new fiscal year guided by the 2026 Budget, the IMF’s revelation of a massive tax gap casts a long shadow over the nation’s economic plans. The government faces the dual challenge of meeting ambitious revenue targets while overhauling a flawed tax framework that has held back progress for years. Whether Ghana can rise to the occasion will determine not just the success of the 2026 Budget but also the country’s long-term financial stability and development trajectory.

READ ALSO:Police Service Joins ADB’s Transformation Wave After IGP’s Glowing Endorsement