Ministry of Lands and Natural Resources has pledged to have a comprehensive stakeholder engagement process to refine the terms of the Ewoyaa Lithium mining lease, assuring the public that the final agreement will be structured to secure the maximum possible benefit for the people of Ewoyaa and Ghana at large.

According to the Media Relations Officer at the Lands and Natural Resources Ministry, Mr. Paa Kwesi Schandorf, the move is a direct response to a spectrum of concerns raised by Civil Society Organisations (CSOs), the Parliament of Ghana, and local communities regarding the fiscal terms and long-term value of the country’s first lithium mine.

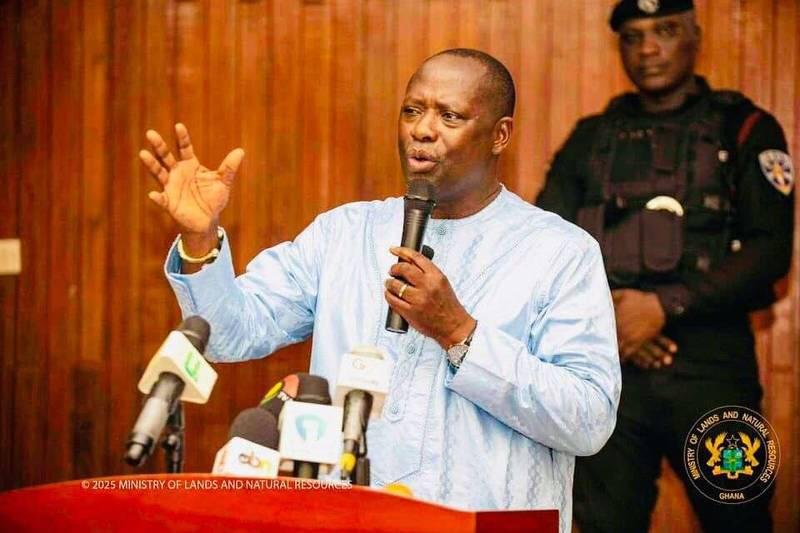

“But I have to put on record, as an assurance from the Sector Minister, the focus of this entire deal is to ensure that the Ghanaian people, at the end of the day, are not shortchanged. That the people of Ewoyaa become the prime beneficiaries of the projects. That it benefits them. They get to derive maximum benefits.”

Mr. Paa Kwesi Schandorf

At the heart of the Ministry’s new approach is a proposal to replace the contentious fixed royalty rate with a dynamic “sliding scale” mechanism.

Mr. Paa Kwesi Schandorf noted that the move is designed to create a resilient and equitable framework that adapts to the notoriously volatile global lithium market.

The new pathway aims to ensure the project’s operational continuity during periods of low prices while guaranteeing that the state captures a significantly larger share of revenue when prices peak, thus protecting both the investor’s viability and the national interest.

A Project Stalled by Market Volatility and Legal Ambiguity

The Ewoyaa Lithium Project, operated by Atlantic Lithium Limited, initially gained traction with a proposed agreement that included a 10% royalty rate payable to the state. This figure was significantly higher than the standard rates in Ghana’s mining sector and was agreed to by the company.

However, the deal was not ratified by the 8th Parliament, which expressed desires for “better terms” for the country.

The situation was complicated by a dramatic downturn in the global lithium market. Mr. Schandorf explained that when the lease was first signed in October 2023, lithium prices were buoyant at around $3,000 per tonne, but they subsequently plummeted to as low as $600-$700 per tonne in early 2024.

This price collapse rendered the initial 10% royalty rate commercially unviable for the investor, leading to a stall in the project’s progression towards production subsequently bring about the 50% reduction i.e from 10% to 5% royalty rates .

“The investor really does not have the capacity to run the concession… because global prices have reduced significantly,” Mr. Schandorf noted, emphasizing that proceeding under the old terms would have hampered production and potentially led to losses.

Further complicating the matter is the legal framework governing royalties. While the Minerals and Mining (Amendment) Act, 2010 (Act 794) fixed royalties at 5%, a subsequent amendment in 2015 (Act 900) granted the Minister discretion to prescribe rates. However, the 10% rate prescribed earlier lacked a published legislative instrument to give it solid legal force, creating a contentious ambiguity that the new proposal seeks to resolve permanently.

Sliding Scale Solution: Crafting a Responsive Fiscal Regime

The Ministry’s proposal for a sliding scale is a strategic pivot away from a rigid fiscal structure that fails to account for market realities.

This model directly addresses the core reason for the project’s delay: the risk posed by price volatility.

“Because it keeps going up and down, let us have a working arrangement that will not affect the profitability,” Mr. Schandorf stated, outlining the government’s rationale.

A sliding scale ensures that during market downturns, the royalty rate decreases to a predetermined floor, allowing the mining operation to continue, thereby securing jobs and maintaining some level of state revenue.

Conversely, as prices recover and surge, the royalty rate automatically increases, allowing the state to capture a larger share of the windfall profits.

This dynamic framework is intended to resolve the debate over whether the royalty rate should be 5% or 10%. Instead of a single number, the new instrument will define a range of rates tied to specific global price benchmarks for lithium.

A New Chapter of Inclusivity and Transparency

Recognizing that the success of the sliding scale hinges on its design and public trust, the Ministry initiated a robust consultative process.

This marks a commitment to transparency and inclusivity, aiming to build a broad consensus before the new legislative instrument is finalized and presented to Parliament for ratification. “What we want to do now is to engage the views and opinions of all the relevant stakeholders, CSOs included,” Mr. Schandorf affirmed.

He revealed that in the coming weeks, the Minister for Lands and Natural Resources will hold a series of meetings with key groups.

These engagements will include the Lands and Natural Resources Committee of Parliament, which has already had extensive preliminary conversations, as well as critical Civil Society Organisations (CSOs) in the extractive sector, journalists, the Minority in Parliament, and traditional leaders from the Ewoyaa community.

The objective is to gather diverse expert input to ensure the sliding scale is well-constructed and “tightened very well” to prevent unfavorable outcomes.

This collaborative approach is designed to ensure that when the Ewoyaa lithium deal is finally ratified, it stands as a model for future resource agreements, one that is resilient, equitable, and transparently developed to guarantee that Ghana’s natural wealth translates into tangible prosperity for its citizens.

READ ALSO: Fidelity Bank Pushes ESG, GreenTech and Youth Innovation as Ghana’s New Growth Pillars